TMT Selected News

LOCAL NEWS

Indosat’s Leap from Telco to TechCo: Vikram Sinha’s AI-Driven Transformation

At NVIDIA GTC 2025, IOH CEO Vikram Sinha made it clear: the company will not follow technology—it will shape it, sovereignly (fully independent) and strategically, from within Indonesia at the heart of SE Asia. Indosat is evolving from a legacy telco into a sovereign, AI-native TechCo and a national enabler placing Indonesia firmly on the global map as not just an AI adopter, but an AI creator.

“Where others see data traffic,” Vikram notes, “we see 120 million dreams in motion.”

At the center of this shift is the AI Factory, launched in partnership with NVIDIA and Accenture. designed to empower 100mn+ Indonesians and accelerate AI-driven progress through:

- Development of Indonesia’s first local language AI model, in collaboration with GoTo

- Provision of GPU-as-a-Service and tailored vertical AI solutions for enterprises and government

- A commitment to train 1mn digital talents by 2027, building deep local capability

- Rollout of Sahabat AI, a Bahasa-speaking assistant simplifying citizen access to public services

Rewiring the human core of a 57-year-old telco is the biggest transformation: Shifting from a connectivity provider to an outcome-driven AI company demands a cultural reinvention retraining its workforce at scale. (SosMed, Vikram Sinha)

Shopee will stop offering J&T Express standard and economy deliveries in Indonesia from April

This decision could hit J&T’s revenues significantly, given Shopee was one of its biggest logistics partners, potentially reducing parcel volumes sharply. Competitors like JNE, SiCepat, Anteraja, Pos Indonesia, and Shopee’s own Shopee Xpress (SPX) may take advantage and expand their market shares. J&T Express, handling about 4mn daily packages in Indonesia (its 2nd-largest market after China), might respond by strengthening partnerships with other ecommerce platforms, making strategic acquisitions, or investing in infrastructure using over $450m from its recent IPO. J&T Cargo (for larger parcels up to 600kg) will still operate on Shopee. (TechinAsia)

Comment: Shopee hasn't officially stated the reason for dropping J&T Express's services. However, it's likely part of Shopee's broader strategy to promote its own logistics arm, Shopee Xpress (SPX). Mgmt. highlighted SPX’s benefits in terms of faster deliveries, geographic reach, and lower costs. By shifting away from J&T, Shopee might be aiming to increase operational control, reduce logistics costs, and improve service consistency.

Grab Indonesia launches new feature for easier bill payments

Grab Indonesia has launched Bayarin, a feature that lets users pay digital bills for others through a single payment link, making it the first Request to Pay (RTP) service in Indonesia. Bayarin supports payments for various bills, including mobile top-ups, electricity (both prepaid and postpaid), BPJS health insurance, internet and cable TV subscriptions, property taxes, and other utilities. Users can send payment requests through messaging platforms like WhatsApp. (TechInAsia)

Grab seeks up to US$2bn loan for potential takeover of GoTo

Grab Holdings is in discussions to secure a US$2bn bridge loan to support its potential acquisition of Indonesian rival GoTo Group, sources revealed. The 12-month loan, still in early negotiation stages, signals progress in what could be one of Southeast Asia’s largest tech mergers, valued at over US$7bn. Grab, backed by Uber, is conducting due diligence while exploring deal structures and additional financing options, including bonds or equity. The transaction comes amid a surge in M&A activity in Asia, with firms like Blackstone and Advent International also raising significant funds for acquisitions. (TheBusinessTimes)

Telkomsel & Gojek Offer RoaMAX Package and GoCar Discounts in Singapore

Telkomsel and Gojek are strengthening their synergy to provide a more seamless and integrated travel experience for customers visiting Singapore. Through the RoaMAX Singapore Package, customers can enjoy high-speed roaming services at affordable rates, along with GoCar vouchers for easier mobility in both Indonesia and Singapore. Customers who activate the RoaMAX Singapore Package will receive GoCar vouchers worth up to SGD20 for rides across Singapore, including trips to and from Changi Airport, as well as vouchers worth up to Rp400,000 for airport transfers in Indonesia. The vouchers apply to all GoCar ride types, including GoCar Comfort, which offers newer and more comfortable vehicles, and GoCar Luxe, which provides a premium fleet. (Bisnis)

MyRepublic Reaches 1 Million Active Subscribers

MyRepublic has achieved a major milestone by surpassing one million active subscribers. As a key technology and infrastructure partner, Berca Hardayaperkasa has played a crucial role in developing MyRepublic Indonesia's fiber optic network. This solution enables MyRepublic to manage, distribute, connect, and expand internet access across various cities in Indonesia. Additionally, Berca Hardayaperkasa provides integrated solutions, including Content Delivery Network (CDN), storage, notebooks, and network infrastructure, to enhance MyRepublic's network performance in both central hubs and major cities. (Detik)

Indonesia’s Digital Voucher Market Accelerates, Driven by Gen Z Adoption and Strategic Brand Promotions

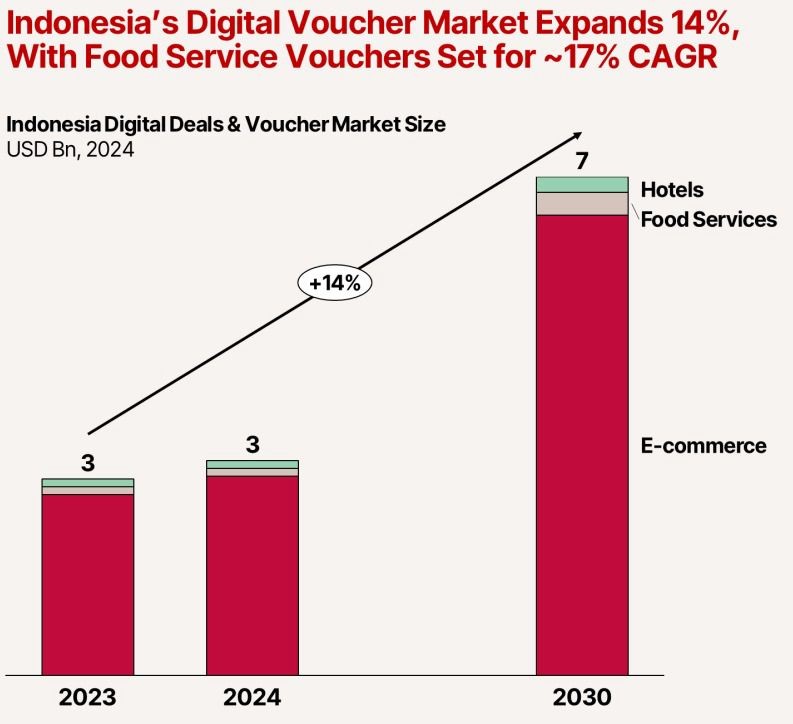

Indonesia’s digital deals and voucher market is gaining strong momentum, growing at a projected 14% CAGR to reach USD 7bn by 2030. This growth is led by e-commerce, food services, and hotel vouchers, with food service vouchers alone expected to post ~17% CAGR.

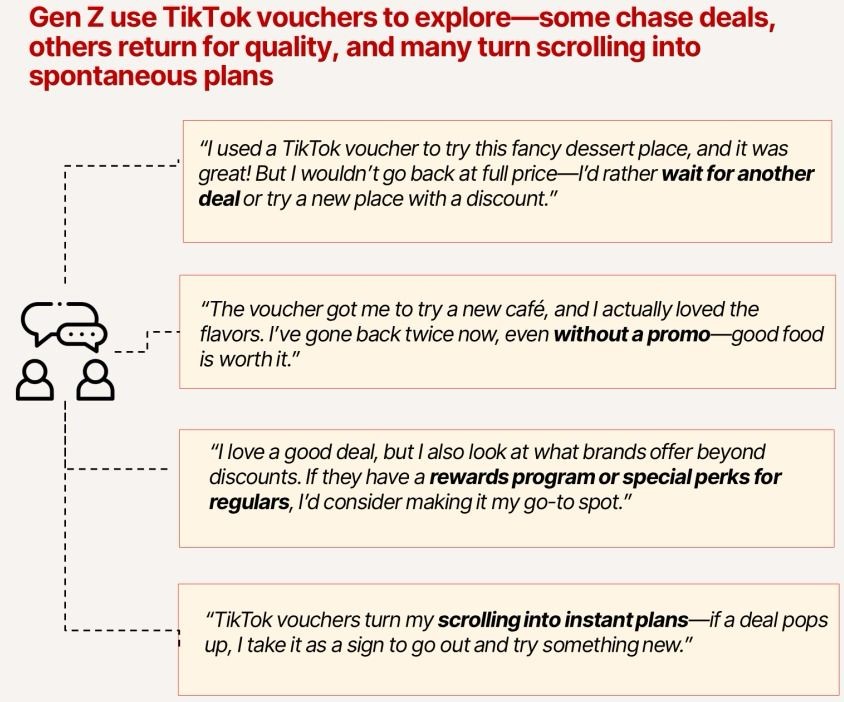

- Vouchers — offering average discounts of 7–15% — are becoming embedded in daily spending, especially among Gen Z. TikTok-led voucher discovery is encouraging spontaneous consumption and new product trials, with many returning for quality or loyalty perks even after the promo ends.

- For brands, this shift underscores the need for always-on promotions, layered with loyalty programs and differentiated offers to sustain engagement. Platforms enabling seamless discovery and redemption are reshaping consumer behavior and how businesses compete.

- Firms that integrate vouchers as a strategic channel — not just a discounting tool — will be best positioned to capture Indonesia’s expanding digital economy. (Redseer SE Asia)

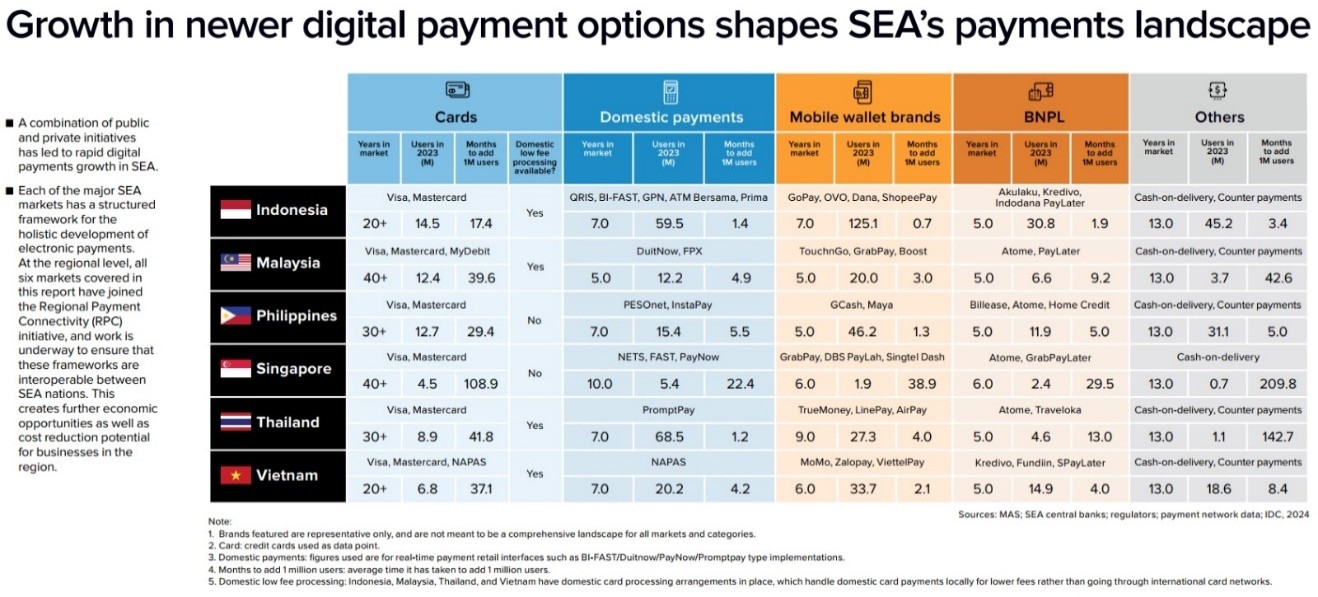

SEA Ecommerce & Payments Outlook - IDC publication

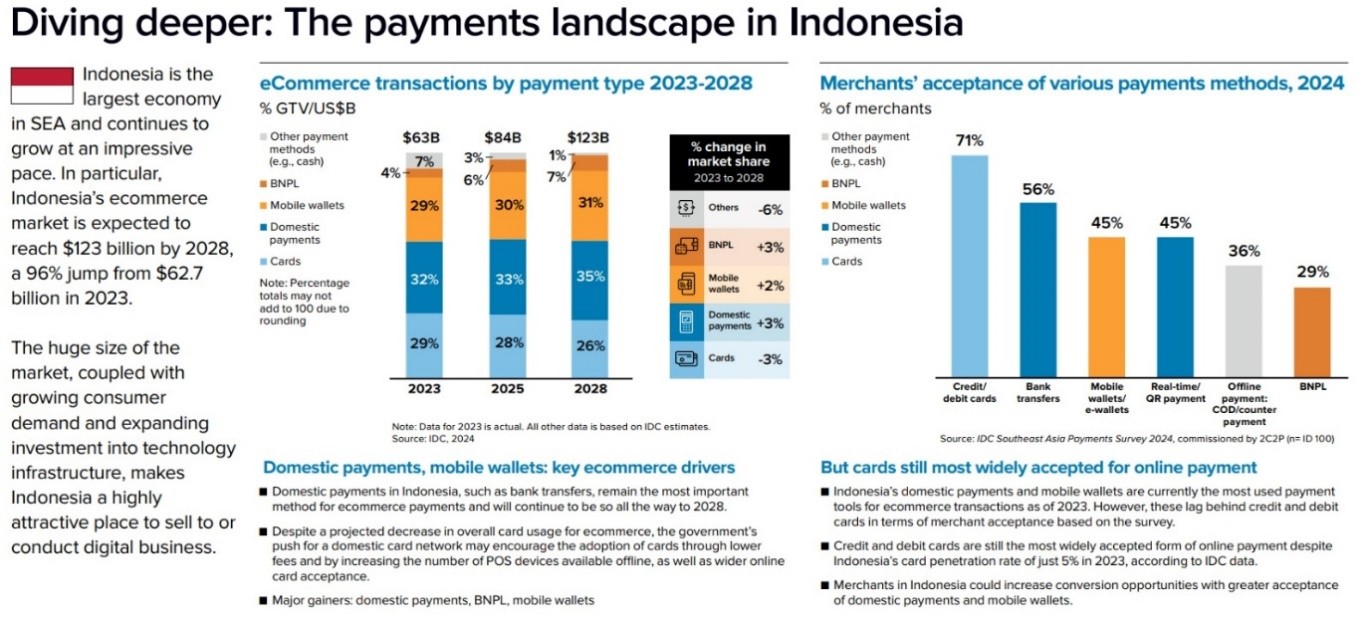

SEA ecommerce hit US$138bn in 2023, led by 🇮🇩 Indonesia US$63bn. On track to US$325bn by 2028.

- Digital payments = 94% by 2028

- Mobile wallet users: 254M → 364M

- BNPL growing 15% CAGR → 145M users

- Cross-border ecommerce = $14.6B by 2028 (+2.8x)

- Indonesia focus:

- Mobile wallets: 125M → 178M

- BNPL users: 31M → 80M

- QRIS, BI-FAST: 59M users, fast adoption

- COD shrinking to 6% of all payments

- Cross-border sales: US$4.2bn by 2028 (+2.7x) from US$1.2bn, avg. txn value $155

62% of SEA merchants already sell cross-border — avg. basket size is 21% higher than local

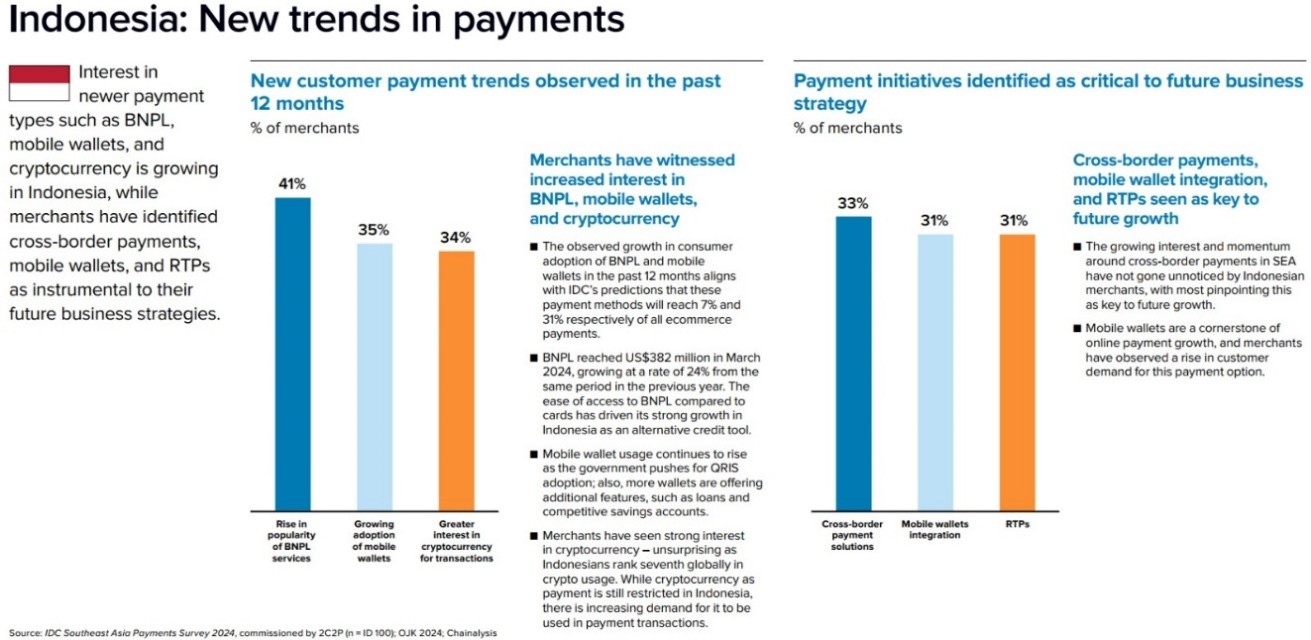

Top priorities for ID merchants:

- BNPL uptake (41%)

- Mobile wallet integration (35%)

- Cross-border enablement & RTPs (31%) such as QRIS, BI-FAST, GPN

Takeaway: Cross-border is a high-margin growth lever. Merchants must be cross-border ready and digitally native to compete in SEA's next chapter.

OTHER FOREIGN TRENDS

Joe Tsai warns of potential AI infrastructure bubble; too many data centres?

Alibaba chairman Joe Tsai flagged growing concern over speculative AI-linked investments—especially in data centre builds. He pointed to eye-popping figures like OpenAI–SoftBank’s $500B Stargate Project in the US, warning some centres are being developed without confirmed customers. Current AI infrastructure spending may be outpacing real demand. He suggested that while AI is transformative, not all mega-projects are necessary—and could reflect early signs of a bubble.

- Meanwhile, Alibaba is going “all-in on AI,” committing $52B over the next 3 years into cloud and AI infra—China’s largest private sector computing investment to date. But Tsai emphasized a more grounded, open-source-based approach, citing the impact of local player DeepSeek.

- On the macro front, Tsai said confidence is returning in China’s tech sector post-President Xi’s meeting with top entrepreneurs. Alibaba is preparing to rebuild headcount after 12 straight quarters of cuts.

- HSBC Chair Mark Tucker reinforced this optimism: China is shifting policy to proactively support consumption, income generation, and wealth creation—with Hong Kong playing a key role as a global connector. (SCMP)

Nvidia’s China chip sales at risk

FT reports Beijing may block Nvidia’s H20 chip due to new energy efficiency rules for AI chips used in data centers. H20, already downgraded to meet US export restrictions, doesn’t meet China’s new standards. Authorities have quietly told local giants like Alibaba, ByteDance & Tencent to avoid the chip. Nvidia plans to tweak H20 to comply, but this could lower its performance & competitiveness vs Huawei. Although the rules aren’t strictly enforced yet, they signal further pressure ahead. China is a key AI market for Nvidia, but it’s now facing tighter scrutiny, with an antitrust probe reportedly launched and Washington weighing more export curbs. (investing.com, FT)

The U.S. blacklisted over 50 Chinese companies

US intensifies restrictions on China’s AI, quantum computing, and advanced chip development. It's the first major export control effort under Trump, targeting firms supporting China’s military modernization, supercomputers, and supplying sanctioned entities like Huawei. Companies include subsidiaries of Inspur Group, already targeted by Biden previously. China condemned the action, increasing tensions amid Trump's escalating tariffs. The U.S. emphasized preventing loopholes that allowed China to acquire sensitive American tech via 3rd parties.(CNBC.com)

Comment: This escalates the ongoing tech-war, deepening economic and geopolitical tensions. Likely incentivizes China to double down on developing domestic chip and AI capabilities to reduce reliance on American technologies. Heightened uncertainty may cause volatility in tech stocks, affecting investor confidence in both U.S. semiconductor firms (e.g., Nvidia, AMD) and Chinese tech giants. Tighter U.S. monitoring and stricter enforcement on 3rd-party companies or intermediaries facilitating tech transfers to China, leading to greater burdens.

Microsoft pulls back from more data center leases in US and Europe

Microsoft has canceled data center projects totaling 2 gigawatts of electricity in the U.S. and Europe over the past six months due to an oversupply relative to its current demand forecast, according to TD Cowen analysts. This move, largely driven by a decision not to support additional AI training workloads from OpenAI, comes amid growing investor skepticism about the high costs of AI infrastructure and competition from lower-cost Chinese rivals like DeepSeek. While Google and Meta have stepped in to fill the vacated capacity in international and U.S. markets respectively, Microsoft emphasized that its US$80bn AI infrastructure investment plan remains on track, despite strategic adjustments in some regions. (Reuters)

To see the full version of this News, please click here