BRIDS Market Pulse

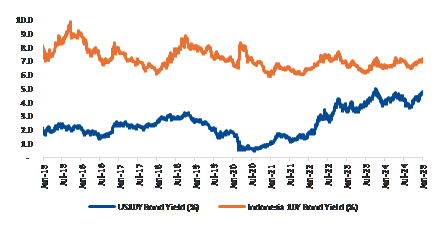

Chart of the week – US10Y vs Indonesia 10Y Bond Yield

In the spotlight

- JCI closed the week down 1.1% wow as foreign outflow intensified (-US$131mn), dominated by persisting selling in the big banks. Other EMs saw similar trends of foreign funds flow, except for inflow into South Korea, amid Fed’s comments on upside risk on inflation and possible slowing rate cuts. The strong US jobs data over the weekend and rising oil price may add to the negative sentiment this week.

- Commodities:

- Brent and copper rose 4.2% and 2.4% wow to US$80/bbl and US$9,092/t respectively despite persisting strong DXY, as US has imposed fresh sanctions targeting Russian oil producers, tankers, intermediaries and traders.

- Coal price fell across the board, led by Newcastle (-6% wow) and ICI1 (-1.9% wow), while the benchmark ICI4 was traded slightly below the psychological threshold of US$50/t amid continued weak demand from China. The positive sentiment on oil price may lend support for Newcastle and ICI1 this week.

- Sector: talks of royalty cut for IUPK license holders resurfacing, driving up the sentiment on coal stocks. While the decision has yet to be confirmed, our latest conversation with coal miners indicates a possible 4-5ppt cut from the current 28% rate, which may translate to 10-12% upside in AADI’s future EPS.

- GOTO (Buy, TP Rp90): announces new 5yr-term for the current CEO with performance-based compensation. The disclosure solidifies GOTO’s position in any potential merger discussions, cementing mgmt’s confidence in a viable standalone path.

… Read More 20250113 BRIDS Market Pulse