In the spotlight

- Market: JCI rose +5.8% w-w, reversing its previous week’s performance and outperforming the EM peers. JCI’s recovery was attributed to the weaker USD amid more benign narrative from trade tensions (e.g., postponement of tariffs for Mexico and Canada) and improved sentiment on the banks post Jan25 earnings. Foreign investors remained net sellers, albeit with a much lower outflow of US$28mn (vs. YTD average of US$133mn). Interestingly, selected big banks (i.e., BBCA, BBRI) started to see foreign inflows. Like in Indonesia, foreign outflows in other EMs have also abated during the week.

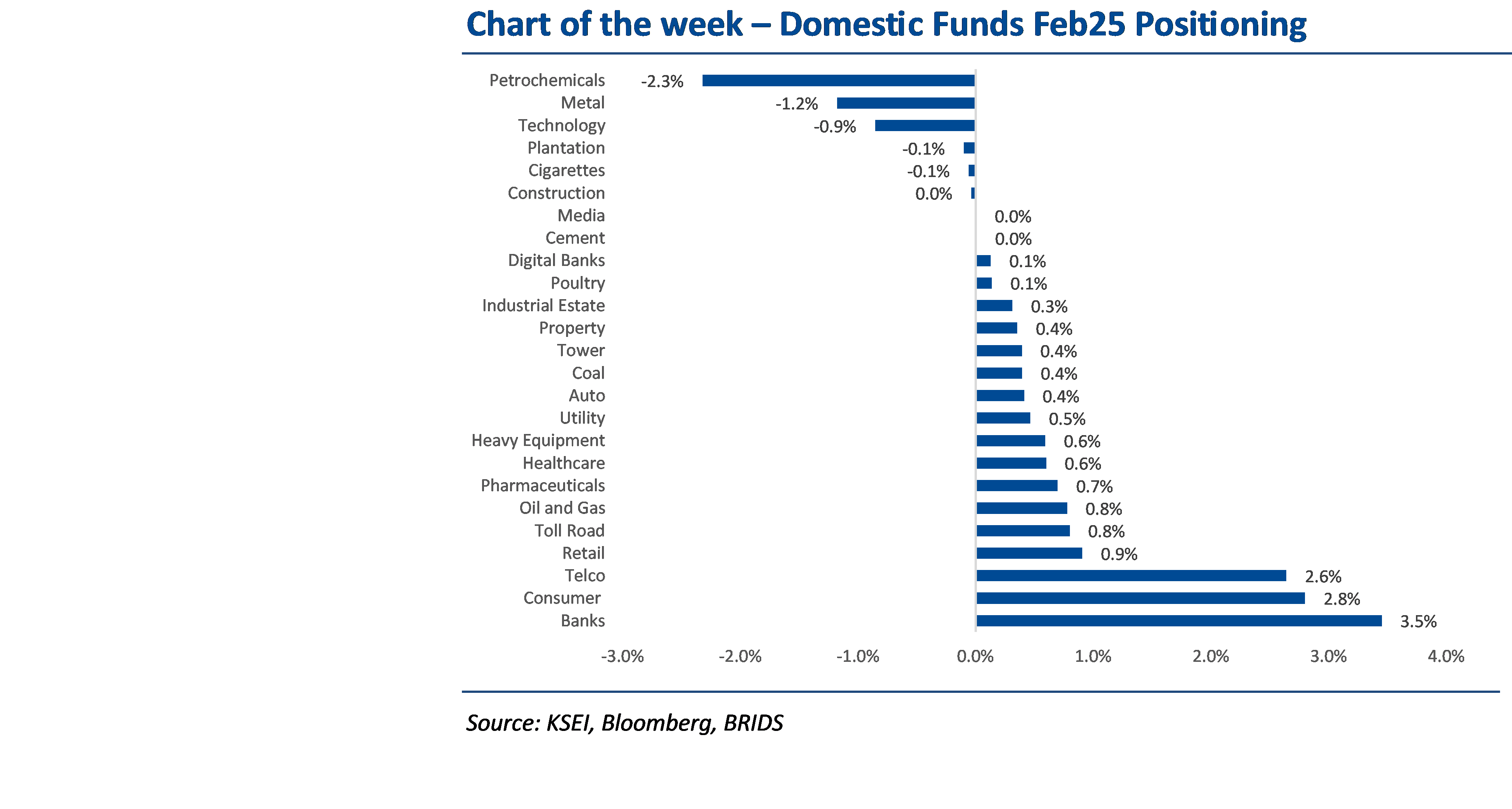

- Domestic funds positioning Feb25: In Feb25, domestic funds trimmed their positioning in banks by a further -44bps (following -121bps cuts in Jan25), lowering their holding in the sector to +345bps OW, based on KSEI data. The current OW positioning in banks were largely in BMRI and BBNI, while UW was in BBRI. Funds slightly added positions into Metals (+24bps) and Consumers (+18bps) in Feb25, largely in ICBP, INDF and ANTM. On average, Feb25 data indicates OW positioning in Banks (+345bps), Consumer (+280bps) and Telco (+264bps) and UW in Petrochemical, Metals and Tech.

- EXCL: Merger plan with FREN progresses smoothly as EXCL secures approvals from creditors, vendors and Komdigi, all expected before the March 25th EGMS. Funding for buyback of Rp3.09tr (initially at Rp2,350/ share), has also been secured, backed by Axiata’s RM1bn facility and from DSSA from Sinarmas side. We maintain Buy rating on EXCL and see Axiata’s 13.14% stake sale at Rp3,189 to set a benchmark for the mergeCo XLSmart, implying a 40%+ upside.

- Metals 4Q24 Earnings Preview: We estimate a slightly weaker 4Q24 earnings trend from declining ASPs, though some companies excel through soaring sales volume. We expect ANTM and NCKL to beat consensus’ FY24 estimate at 132%/ 111% from increased sales volume. We maintain our Neutral rating with a revised pecking order of ANTM> NCKL> INCO> TINS> MBMA> MDKA.

… Read More 20250310 BRIDSMarketPulse