BRIDS Market Pulse

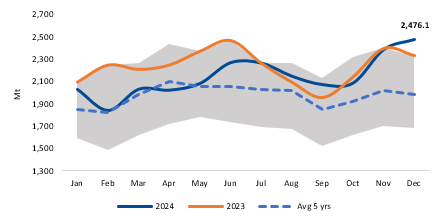

Chart of the week – China coal inventory at port

In the spotlight

- A combination of slight foreign funds outflow and local funds selling has driven a JCI correction of -0.8% wow. Foreign funds flow returned to negative, albeit relatively lighter (at -US$169mn) compared to prior weeks. The outflow was still dominated by the large-cap banks with coal stock AADI also among the top-5 stocks sold by foreign investors.

- EXCL has announced the details of its plan to merge with FREN, which includes: 1) plans for initial share swap and secondary transaction which will enable Axiata and Sinarmas to have joint control (at 34.8% stake each). 2) Offers for dissenting shareholders. Niko Margaronis views that while there is no immediate upside for shareholders, it offers compelling value creation through operational synergies. We continue to like ISAT (Buy, TP Rp3,800) as our preferred pick in the Telco sector.

- ADRO: remains a holder of 15% of AADI. In its disclosure, ADRO unveiled that it still holds 15.4% of AADI shares post the spin-off earlier this month. Based on our calculation, adjusted for latest net cash position of US$1.7bn, this should translate to a slight upside in post-spin off valuation to US$5.5-7.8bn or Rp2,840-3,820/share (vs. US$5.2-7bn as estimated in our prev. note). Meanwhile, taking into consideration stocks still held by ADRO, we estimate that AADI’s free float would be around 35%.

- Poultry FY25 Outlook: Victor Stefano maintains an OW rating on the sector’s sound fundamentals, cheap valuations, and less crowded positioning. Pecking order: MAIN, JPFA, CPIN. We continue to forecast that integrators will report profit growth of 109%/10% for FY24/FY25F, supported by margin expansion.

- Commodities: A rather somber winter for coal price. China imported a record volume of 55Mt (+27% yoy) in Nov24 (per SX Coal report), as also reflected in the rising coal inventory at port. However, imports have reported to soften in Dec24, hence driving Indonesian prices down, with ICI indices falling -0.3 to -2.6% wow across the board, and Newcastle futures also correcting -0.8% wow.

… Read More 20241216 BRIDS Market Pulse