|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

BRIDS FIRST TAKE

To see the full version of this report, please click here

RESEARCH COMMENTARY Coal (Neutral) sector – a relative safe haven? · Despite the still weak coal price (Newcastle price at US$95/t as of end of last week) coal stocks have outperformed today. · A few possible reasons behind the strong performance: o Positive impact of lower royalty for IUPK holders (i.e., INDY, BUMI, AADI) o Company-specific driver: BUMI’s plan to seek approval for quasi-reorganization. · Additionally, investors may also see coal sector as a relative safe haven (i.e., sectors to tactically position, aside from metals, amid the backdrop of soft domestic growth for other sectors) on the back of: o Expectation of in line 1Q25 operational performance: our check with ITMG and AADI indicated in-line/ slightly ahead production volumes in 1Q25, amid lower-than-expected rainfall in 1Q25. o Possible limited downside risk on coal price: despite persisting weak demand from China (based on our latest channel check) to potentially still weigh on prices, cost support for Australian producers is estimated at US$85-90/t. o Additionally, the shift in rainfall in Indonesia toward 2Q25 (hence, lesser supply) and expectation of China summer demand may support coal price to rebound in 2Q25. o A laggard sector (-14% YTD) with low investors’ ownership (as of Mar25, domestic funds were neutral (+10bps vs. JCI on the sector) and attractive dividend yield (9-14%) potentials. · Earnings risk vs. coal price: o Our FY25 estimates currently implies -24% earnings contraction for stocks under our coverage (Bloomberg consensus: ~-22%), where we assumed Newcastle coal price of US$110/t (vs. YTD average of US$106/t). Our quick sensitivity sees 9-29% downside in earnings if Newcastle price averages at US$100-105/t. This will be partly offset by the positive impact from lower royalty (for AADI). · Our picks in the sector: UNTR (Buy, TP Rp31,000), AADI (Buy, TP Rp9,850), ADRO (Buy, TP Rp2.630), ITMG (Buy, TP Rp27,300), PTBA (Buy, TP Rp3,100). (Erindra Krisnawan – BRIDS)

SMGR (Buy, TP: Rp3,400) - Mar25 Sales Volume · Domestic Mar25: 1.73 Mt (-21.7% mom/-29.6% yoy) · Domestic 3M25: -12.6% yoy · Total Mar25: 2.60 Mt (-14.2% mom/-16.9% yoy) · Total 3M25: 8.57 Mt (-6.6% yoy)

Comment: SMGR recorded a sales volume decline of -14.2% mom/-16.9% yoy, slightly below expectation due to Lebaran season at end of Mar-25, while regional production showed a positive volume growth of +6.2% mom/+29.2% yoy. Cumulatively, SMGR reported a better volume decline of -6.6% yoy compared to the industry (-7.8% yoy), but still below INTP's level (-5.9% yoy). Bag ratio dropped to 69.4% on Mar25 (vs. Feb25: 72%, Mar24: 69.6%). We maintain our Buy rating with a TP of Rp3,400. (Richard Jerry, CFA & Sabela Nur Amalina – BRIDS)

MARKET NEWS |

||||||||||||

MACROECONOMY

Bank Indonesia is Expected to Hold the BI Rate at 5.75%

Bank Indonesia is expected to hold the BI Rate at 5.75% today (cons: 5.75%) amid ongoing tariff uncertainty and the IDR’s underperformance relative to regional peers. The announcement is scheduled for around 2:30 pm. (BRIDS Economic Research)

Indonesia: Government Raises Job Loss Insurance Training Budget to Rp2.4mn

The Indonesian government has officially increased the maximum job training benefit under the Job Loss Insurance (JKP) Program from Rp1mn to Rp2.4mn per participant. This adjustment is stipulated in Finance Minister Regulation (PMK) No. 26/2024, signed by Finance Minister on April 14, 2024. The change aims to enhance the program’s effectiveness and better align with societal needs. (Kontan)

US Treasury Secretary: US-China Tariff Dispute Unsustainable, De-escalation Likely

US Treasury Secretary Scott Bessent said the current US-China tariff standoff is unsustainable and de-escalation is likely soon. He ruled out decoupling, calling the current 145% US and 125% Chinese tariffs a trade embargo. A broader deal may take 2–3 years and must rebalance trade in favor of US manufacturing. President Trump echoed a softer stance, saying final tariffs will likely be much lower and talks have not yet begun. (Bloomberg)

SECTOR

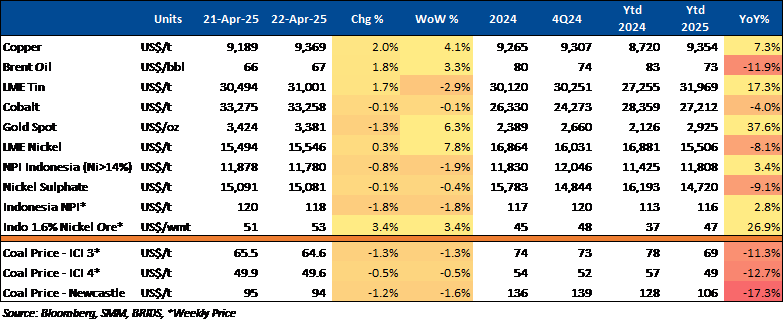

Commodity Price Daily Update Apr 22, 2025

Automotive: Aismoli Urges Government to Clarify Electric Motorcycle Incentive Scheme

The Indonesian Electric Motorcycle Industry Association (Aismoli) urged the government to immediately clarify and implement the Rp7mn electric motorcycle purchase incentive, citing its significant impact on sales. 1Q25 sales reached only 20%-30% of last year’s figures, despite a 2025 target of 200,000 units. The delay in incentive realization has caused consumers to hold off on purchases. Aismoli also warned against relaxing TKDN rules, noting that many members are working to meet the 40% local content requirement. (Kontan)

Coal: Indonesia’s Coal Exports Declined in 1Q25

Indonesia’s coal exports saw a significant decline in the 1Q25 due to weakened global demand, falling prices, and the impact of HBA policy. The export value dropped 17.8% yoy to US$6.2bn, while export volume decreased by 4.2% yoy to 91.9mn tons. On a monthly basis, Mar25 exports were valued at US$1.9bn, -5.5% mom and -23.1% yoy. Export volume for March was recorded at 30.7 mt, slightly lower than February’s 30.8 mt. (Kontan)

CORPORATE

BFIN Secures Credit Facility from BCA Worth Rp2.8tr

BFIN has signed a credit agreement with Bank Central Asia (BCA) with a total value of Rp2.8tr. According to BFIN, the credit facility includes a term loan amounting to Rp2tr with a three-year tenor. The loan will be used to support the company's working capital for its financing business. Additionally, BFIN has extended its existing multi-facility credit line worth Rp800bn. (Kontan)

DCII Sets Rp1tr Capex to Expand Data Center Footprint

DCII plans to spend up to Rp1tr this year to expand its data center operations. The funds will mainly support the development of the JK6 facility in Cibitung and a new data center in Surabaya (up to 9MW capacity). The company is also advancing plans for a hyperscale campus in Bintan with potential capacity of up to 1,000MW, showing strong ambition in capturing rising AI/cloud demand. (Kontan)

DRMA Increases Dividend Payout to 35%

DRMA performed well in 2024, with stable revenues and net profit, supported by a strong 2W segment and operational improvements. Today's AGM approved a cash dividend of Rp202bn or Rp43/share (yield: 4.7%). This increases the dividend payout ratio to 35% for FY24, up from 28% last year. (Company)

KEJU Approves Dividend and New Factory Investment

KEJU approved a Rp13/share dividend (2.2%), equivalent to Rp73.12bn or 49.8% of FY24 net profit, and plans to build a new Rp691.55bn factory in Sumedang, West Java, by 2028. The expansion addresses high market demand, with current Cikarang plant utilization reaching 85% in 2024. (Emiten News)

MEDC Issues Rp1tr Bonds in First Phase of Rp5tr Program

MEDC is issuing Rp1tr in bonds under its Sustainable Bonds VI Phase I 2025, part of a total Rp5tr plan. The offering includes four series with tenors from 3 to 10 years and coupon rates ranging from 6.75% to 9.00%. First interest payment is set for September 12, 2025. (Emiten News)

To see the full version of this snapshoot, please click here