FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

|

Aspirasi Hidup Indonesia: Inline Oct24 Sales and Still Robust 10M24 SSSG (ACES.IJ Rp 815; BUY TP Rp 1,100)

To see the full version of this report, please click here

Bank Negara Indonesia: Oct24 results: in line net profit supported by higher NIM, but partly offset by higher CoC (BBNI.IJ Rp 4,850; BUY TP Rp 7,600)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS |

|

|||||||||||

MACROECONOMY

Bank Indonesia to Announce BI Rate Today; BRIDS Expects 25bps Cut to 5.75%

Bank Indonesia (BI) will announce the BI Rate today around 2pm. We expect BI to cut the BI Rate by 25bps to 5.75% (cons: 6.00%) due to the weakening economic backdrop. Real rates is near a 20-year high and household consumption remains sluggish. Recently, gov’t is planning to cut back spending towards the end of the year, which would constrain liquidity further if there’s no policy changes by BI. (BRIDS Economic Research)

SECTOR

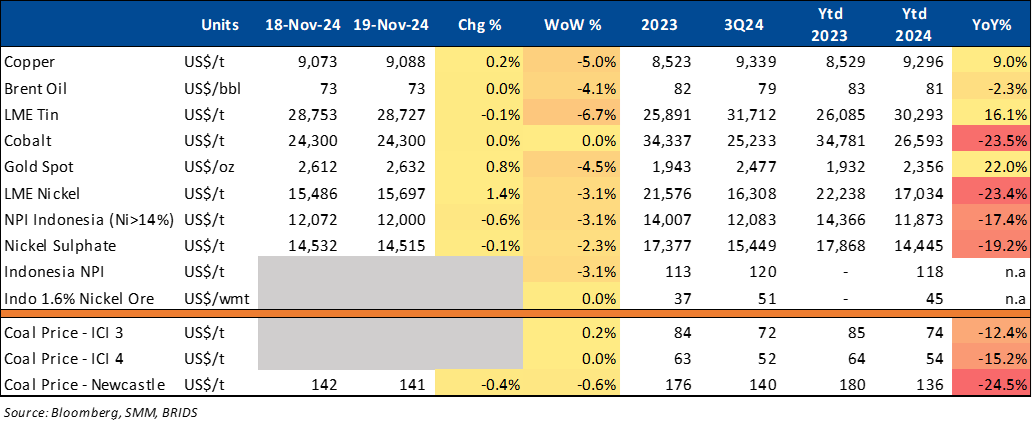

Commodity Price Daily Update Nov 19, 2024

Heavy Equipment: Hinabi Optimistic About Achieving 8,000 Units of Heavy Equipment Production in 2024

The Indonesian Heavy Equipment Industry Association (Hinabi) is optimistic that the target of producing 8,000 units of heavy equipment this year will be met. According to Hinabi, as of 9M24, production has reached 5,138 units. Specifically, production for the 3Q24 period reached 1,636 units. Currently, the heavy equipment market is divided into Mining, Construction, Plantations, and Forestry, accounting for 55%, 20%, 15%, and 10%, respectively. (Kontan)

CORPORATE

ISAT Evaluates VAT Increase to 12% Effective in 2025

The Indonesian government has announced that the Value Added Tax (VAT) will increase to 12% starting January 1, 2025, aiming to boost state revenue. In response, Indosat Ooredoo Hutchison (ISAT) is assessing how this change will impact its tariff rates, seeking to balance compliance with competition and customer needs. This move underscores the broader economic adjustments affecting multiple sectors in Indonesia. (Bisnis)

FREN Shares Amounting to 4.63% were Transeferred by Sinarmas Group

FREN announced that PT Gerbangmas Tunggal Sejahtera transferred 22,088,940,284 shares (4.63%) from UOB Sekuritas to PT Sinarmas Sekuritas on November 12, 2024. This move, part of a portfolio restructuring, increased Gerbangmas's stake in FREN to 9.38% from 4.75%. Additionally, DSSA sold 4.72% of FREN shares to BMT for Rp562.15 billion. This transaction is considered an affiliated transaction under POJK 42/2020, as both DSSA and BMT are controlled by Franky Oesman Widjaja, son of Sinarmas Group founder Eka Tjipta Widjaja. (Emiten News)

GOTO Promotes Digitalization for MSMEs

GOTO is pushing for the digitalization of micro, small, and medium enterprises (MSMEs) in Indonesia through its GoNusantara initiative. This program aims to formalize and certify MSMEs, helping them use the GOTO ecosystem to expand their markets and boost revenue. With millions of merchants, primarily in the food sector, GOTO plays a vital role in the national digital transformation of MSMEs. (Investor Daily)

JSMR Executives Boost Share Ownership

JSMR executives purchased 1.22mn shares on November 14-15, 2024, as a direct investment. Key buyers include the President Director, who now holds 527,700 shares, (0.00727%), and several commissioners and directors, each adding up to 170,000 shares. (Emiten News)

Tokopedia Recorded 9-Fold Increase in Electronics Sales on 11.11

Tokopedia reported a nearly ninefold increase in electronic product sales during the 11.11 shopping event in 2024. Aditia Grasio Nelwan highlighted significant growth in household and grocery items during the same period. The platform is preparing for the upcoming Harbolnas on December 12, focusing on local brands and promotions. GOTO, Tokopedia's parent company, also benefited financially from this surge. (Bisnis)

MBMA Provides a US$200mn Loan to Merdeka Tsingshan

MBMA has entered an affiliate transaction with PT Merdeka Tsingshan Indonesia (MTI). As a creditor, MBMA is providing up to US$200mn in financing to MTI. This funding will be used by MTI for general corporate purposes. The agreement between MBMA and MTI regarding this transaction was signed on November 14, 2024. (Kontan)

New Honda Scoopy Debuts with Discounts

Honda launched the sixth-generation Scoopy in Nov24, featuring a fresh design, advanced features, and prices starting at Rp22.525mn. A Rp1.6mn discount is offered during the launch. (Kontan)