FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Energi Mega Persada : Growth prospects aplenty (NOT RATED)

- ENRG produces 46MBOEPD of both Oil (17%) and Gas (83%) with five main assets including Bentu, Kangean, Sengkang, Malacca, and B block.

- Mgmt expects a 10%-15% production growth in FY25-26 from the newly acquired Siak and Kampar from PHE, as well as the Sengkang block.

- ENRG trades at 6.3x FY24 TTM PE and 0.6x FY24 TTM PB. Downside risks include lower oil price, increasing cost, and poor exploration result.

To see the full version of this report, please click here

Indocement Tunggal Prakarsa: INTP Oct24 Sales Vol: inline with seasonality, yet flattish in mom basis (INTP.IJ Rp 6,900; BUY TP Rp 8,800)

- Industry sales volume grew by 6% mom/+0.2% yoy inc Grobogan/-2.2% yoy ex-Grobogan in Oct24

- INTP recorded +1.1% mom sales growth in Oct24, bringing 10M24 sales vol to expand by 9.6% yoy (0.2% yoy ex-Grobogan).

- INTP still recorded inline growth within its seasonality despite weaker mom momentum. We have a BUY rating for INTP with TP of Rp 8,800

To see the full version of this report, please click here

Kalbe Farma: Healthy FY25 growth outlook intact despite ST Rupiah headwinds (KLBF.IJ Rp 1,435; BUY TP Rp 1,800)

- Solid prescription revenue and operating efficiency drove strong 9M24 net and core profit growth of 15.2%/10% yoy.

- We estimate healthy FY25 net profit growth of 7.3% yoy, supported by 7.5% rev. growth with sustained margins.

- Stronger Rupiah will provide a positive catalyst. We maintain our Buy rating with an unchanged TP at Rp1,800 (FY25F PE of 24.6x).

To see the full version of this report, please click here

PT Sariguna Primatirta : Strong 3Q24 Results, Expanding Distribution amid Strong Volume Growth (NOT RATED)

- CLEO’s 3Q24 revenue rose 70.1% yoy, with net profit +47.7% yoy, driven by volume growth, rising market share to 7% and a 3-5% ASP increase.

- Mgmt. aims for 25% revenue contribution from Outside Java by FY25, expanding factories and reaching 500 channels over the next five years.

- CLEO main challenge is raw material distribution outside Java. CLEO’s share price was up 71% Ytd and currently trades at 22.9x ann. 2024 PE.

To see the full version of this report, please click here

Macro Strategy: Stability vs Growth: What's at the Fore?

- The recent trend in IDR and liquidity appears to constrain the possibility of a rate cut, but the need to stimulate growth should be at the fore.

- Rate reduction aimed at bolstering business confidence would lead to stronger growth expectations, attracting inflows and benefiting the IDR.

- An increasingly hawkish Fed would reduce the scope for rate cut, limiting BI’s room for future reductions if they choose to delay now.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

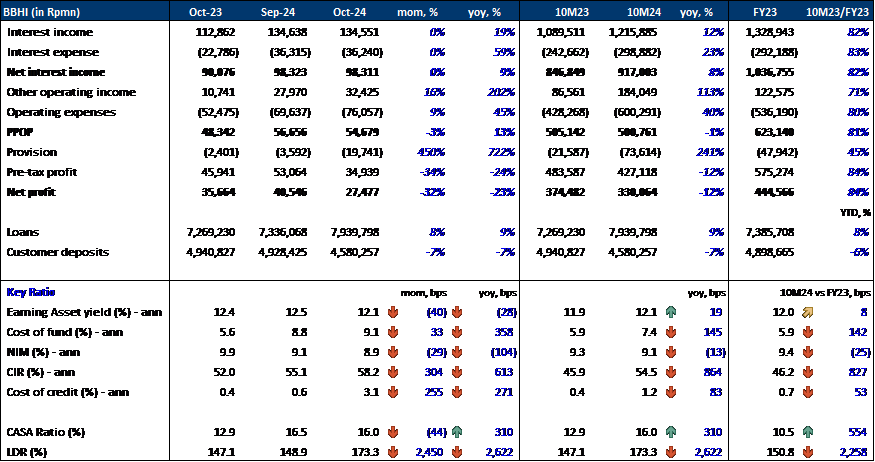

BBHI (Non Rated) - Oct24 Results

10M24 Insight:

- 12% yoy Decline in Net Profit: BBHI reported a net profit of Rp330bn (-12% yoy) in 10M24, primarily due to a 40% increase in opex and a 241% rise in provisions, which offset the 8% growth in NII and the doubling of other operating income.

- Higher CIR Driven by Increased Opex: CIR rose to 54.5% (+864bps yoy) in 10M24, driven by a 40% increase in opex, with other expenses and promotional costs surging by 78% and 11% yoy, respectively.

- NIM Decline Despite Higher LDR: NIM declined to 9.1% (-13bps yoy) in 10M24, despite the increase in LDR to 173.3%. The improvement in EA yield to 12.1% (+19bps yoy) was offset by a rise in CoF to 7.4% (+145bps yoy).

- Loans and Deposits: Despite the rise in CoF, customer deposits fell by 7%, resulting in a higher LDR of 173.3% in 10M24 (from 147.1% in 10M23) as loans grew 9% yoy.

- CoC Jumped as Loans Grew: With provision expenses more than tripled yoy, CoC increased to 1.2% in 10M24, from 0.4% in 10M23.

Oct24 Insight:

- Drop in Net Profit: BBHI’s net profit dropped to Rp27bn (-32% mom, -23% yoy) in Oct24, due to a rise in opex (+9% mom, +45% yoy) and a surge in provisions (+450% mom, +722% yoy). The flat NII also contributed to this decline on a mom basis.

- NIM Decline: NIM fell to 8.9% (-29bps mom, -104bps yoy) in Oct24, as CoF sharply increased to 9.1% (+33bps mom, +358bps yoy) and EA yield declined to 12.1% (-40bps mom, -28bps yoy).

- CIR: CIR increased to 58.2% (+304bps mom, +613bps yoy) in Oct24. The 45% yoy rise in opex was driven by a substantial increase in other expenses (+134% yoy), while the 9% mom rise in opex was due to a 16% mom increase in other expenses.

- Loans and Deposits: Loans grew 8% mom, while customer deposits fell by 7% mom, leading to an LDR rise from 148.9% in Sep24 to 173.3% in Oct24.

- Significant CoC Increase: CoC surged to 3.1% in Oct24, from 0.6% in Sep24 and 0.4% in Oct23, signaling a deteriorating asset quality.

Summary:

- Overall Performance: In our view, BBHI’s Oct24 performance was weak as CoF remained under pressure, likely due to intensified competition, particularly within the digital banking space. Combined with the decline in EA yield in Oct24, this has resulted in compressed NIM. Moreover, the spike in CoC also raises concerns on loan quality and could pose a risk to BBHI’s future performance. (Victor Stefano & Naura Reyhan Muchlis - BRIDS)

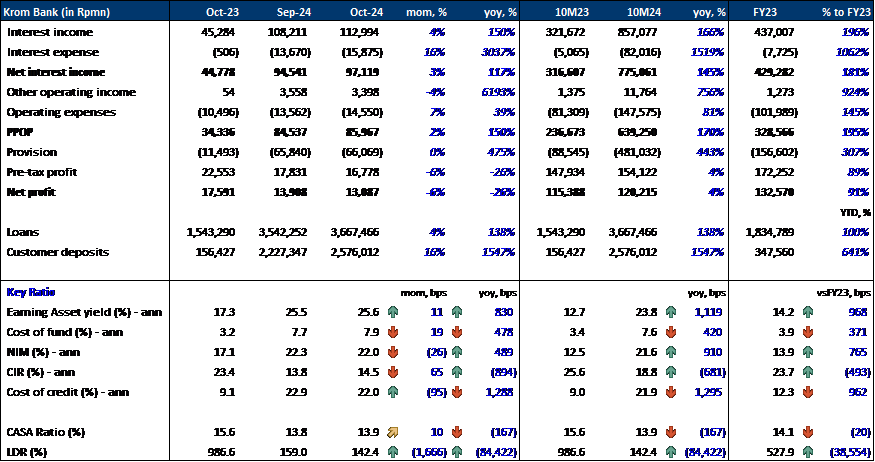

KROM Bank (Non Rated) - Oct24 Results

10M24 Insight:

- Net Profit: KROM’s NP reached Rp120bn in 10M24, with NIM standing at 21.6%.

- Following the bank’s rebranding as a digital bank in late Feb24, we believe monthly comparisons offer the most relevant insights into its performance.

Oct24 Insight:

- Net Profit Decline: KROM’s net profit decreased to Rp13bn (-6% mom) in Oct24 due to the higher other expenses (one-off) offsetting the 2% PPOP growth.

- Surge in CIR: CIR surged by 65bps mom to 14.5% in Oct24, driven primarily by a 7% mom increase in opex, which was due to a threefold rise in other expenses and an 87% increase in promotional expenses.

- Lower NIM: NIM declined 26bps mom to 22.0% in Oct24, despite an 11bps increase in EA yield to 25.6%. This was due to a drop in LDR to 142.4% in Oct24 from 159.0% in Sep24, alongside a rise in CoF to 7.9% (+19bps mom).

- CoC Improvement: CoC improved by 95bps mom, standing at 22.0% in Oct24. Nevertheless, it remains among the highest in the digital banking sector.

- Loans and Deposits: Loans and customer deposits grew by 4% and 16% mom, respectively, resulting in a lower LDR of 142.4% (-1,666bps mom). The CASA ratio continued to improve, reaching 13.9% (+10bps mom) in Oct24.

Summary:

Overall Performance: KROM’s performance was solid, achieving a positive risk-adjusted NIM in Oct24, with the decline in NP attributed to a one-off rise in other expenses. However, the bank's primary risk lies in its high-cost funding, particularly amid the ongoing trend of reducing LDR. (Victor Stefano & Naura Reyhan Muchlis - BRIDS)

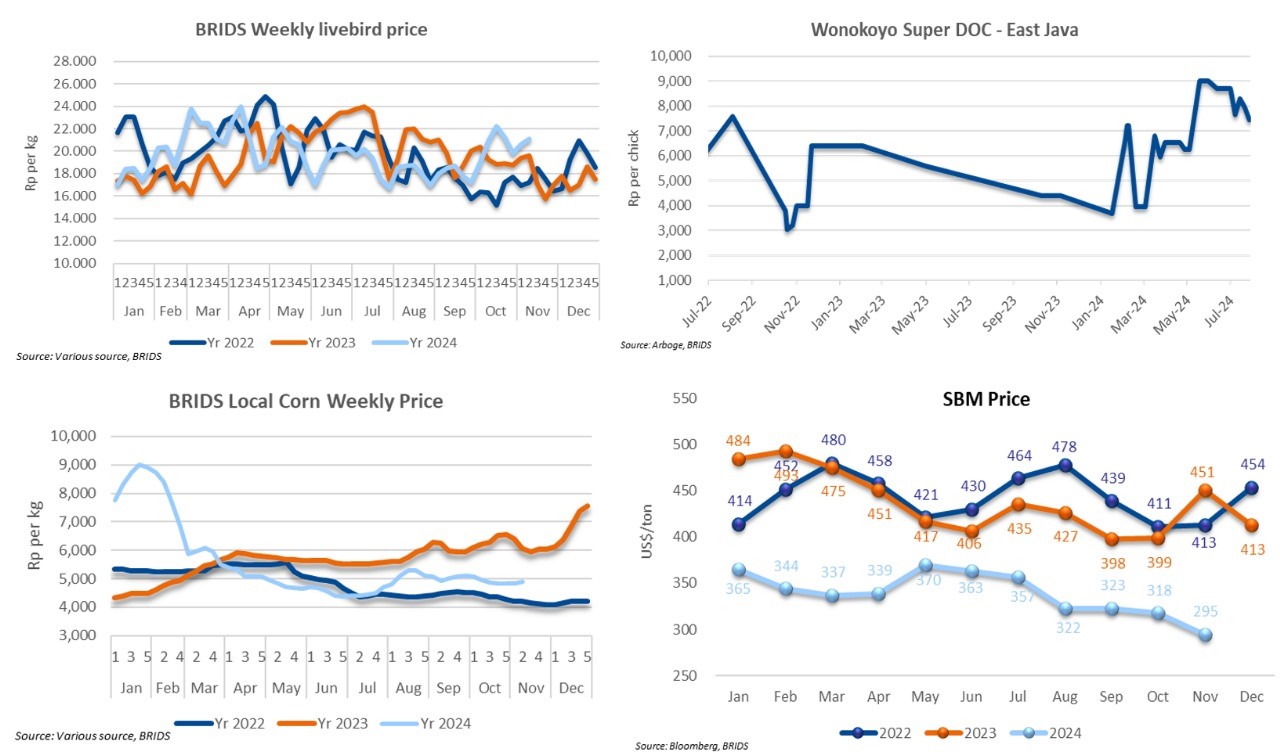

Poultry (Overweight) – 2nd week of November 2024 Price Update

- Livebird prices declined but remained high at Rp20.3k/kg, with an average of Rp21.1k/kg in the second week of Nov24, marking a 2.6% wow increase.

- DOC prices remained stable at around Rp6k/chick.

- Local corn prices held steady at Rp4.9k/kg, with a weekly average of Rp4.9k/kg (+1.2% wow) in the second week of Nov24.

- Soybean meal (SBM) prices declined to an average of US$292/t in the second week of Nov24. The Nov24 average price is relatively low at US$295 (-7% mom, -35% yoy) marking the lowest YTD monthly average.

- We continue to expect improvement in earnings for 4Q24, supported by favorable livebird prices and controlled feed costs. (Victor Stefano & Wilastita Sofi – BRIDS)

MARKET NEWS

MACROECONOMY

US Rent Inflation in the CPI May Take until Mid-2026 to Subside Towards Pre-Pandemic Norm

US Rent inflation in the CPI may take until mid-2026 to subside towards pre-pandemic norm. While several measures suggest that new rents in particular are coming down, fewer people are moving and signing new leases — so the sample in the CPI doesn’t capture as much turnover, the researchers said. (Bloomberg)

SECTOR

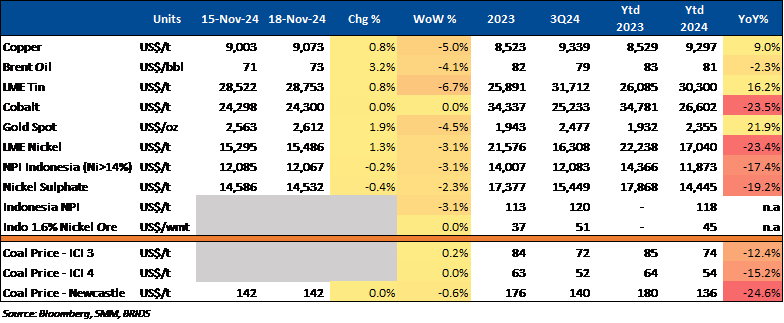

Commodity Price Daily Update Nov 18, 2024

Coal Production Exceeded 2024 Target

As of November 15, 2024, Indonesia's national coal production has reached 711.37mn tons, surpassing the government target of 710mn tons. This rapid production growth is attributed to increased domestic demand for electricity and smelters, as well as rising export demand due to droughts in several countries. Production is projected to reach 800mn tons by the end of 2024, compared to 775mn tons produced in 2023. (Kontan)

Indonesian Government Expands Incentives for Electric Vehicle Imports

The government has expanded incentives for the import of battery electric vehicles (BEVs). This new regulation was enacted on November 12, 2024, and is valid until December 31, 2025. According to Article 2, Paragraph (1), businesses can receive incentives for importing completely built-up (CBU) electric vehicles in specified quantities. In addition to a 0% import duty, other incentives include the government covering the Luxury Goods Tax (PPnBM DTP). Meanwhile, Article 2, Paragraph (2) provides incentives for importing completely knocked-down (CKD) electric vehicles in certain quantities, which will be assembled in Indonesia with a Domestic Component Level (TKDN) between 20-40%. Similar to CBU imports, the incentives include a 0% import duty and PPnBM DTP coverage. (Kontan)

Oil and Gas Investment Recorded Below Target of US$10.3bn

SKK Migas reported upstream oil and gas investments of US$10.3bn by Oct24, falling short of the US$17.7bn target. Although up slightly from US$10.2bn last year, investment is expected to reach US$16bn by year-end despite challenges like TKDN delays, drilling safety issues, and weather disruptions. (Kontan)

CORPORATE

ADRO Approves US$2.6bn Dividend and Name Change

ADRO’s EGMS approved a final cash dividend of up to US$2.6bn and a name change to PT AlamTri Resources Indonesia Tbk. This move aligns with the company's shift toward mineral downstream and renewable energy, supporting Indonesia’s net-zero emissions target by 2060. The change reflects the company's long-term vision and commitment to sustainable energy transformation. (Emiten News)

Honda Motor Sales Reached 4.19mn Units by Oct24

PT Astra Honda Motor (AHM) reported a strong sales performance in 2024, with 4.19mn units sold by Oct24, marking a 1.79% yoy increase. Honda continues to lead the Indonesian motorcycle market, in line with a 3.42% national sales growth to 5.42mn units. Automatic motorcycles dominate Honda's sales, accounting for about 91% of its total sales in Indonesia. (Kontan)

TBIG Prepares Rp1.5tr for Bond Repayment in Dec24

TBIG has allocated funds to repay its Sustainable Bonds VI TBIG Phase II, due on December 15, 2024, totaling Rp1.5tr. The company has also prepared funds for the fourth interest payment on these bonds, which were issued on December 6, 2023, with an annual interest rate of 6.75%. (Emiten News)

TLKM: Launches Year-End Loyalty Program; Modernizes Over 11,500 Micro and Small Enterprises

TLKM's "Poin Gembira Festival" boosts customer engagement and transactions, it aims to increase transactions by up to 30%, and offering rewards like vouchers and luxury cars. The program features two schemes: a national prize draw and a city-based one for 160 Indonesian cities, allowing customers to win by redeeming Telkomsel Poin through the MyTelkomsel app. (Kontan)

In other news, Telkom through its Rumah BUMN Telkom (RB Telkom) initiative has successfully modernized 11,544 micro and small businesses (UMK), exceeding its target by 120.25%. As key drivers of the economy, UMKs need to be supported in adapting to technology. By 2024, RB Telkom has carried out a series of mentoring activities for UMKs in 43 RB Telkom locations across Indonesia. (Investor Daily)

TPIA Targets 15 New Ships by 2025

TPIA’s subsidiary, CDI, plans to add 15 new ships by 2025 after acquiring four carriers this year. The move aims to boost efficiency and competitiveness while strengthening the global supply chain. CDI will expand beyond internal transport to serve third-party clients and diversify into ship management services. (Kontan)