FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

XL Axiata: FY24 results: in-line, resilient 4Q24 performance while awaiting the next milestones in its merger (EXCL.IJ Rp 2,270; BUY TP Rp 2,800)

- XL posted strong 4Q earnings, with revenue growth driven by the new LINK subs and a resilient EBITDA margin, while mobile faced challenges.

- XL strengthens its FMC with an IPTV channels, leveraging an inventory of 6mn HPs, and is open to deploying FWA and 5G to drive growth.

- We take a more conservative stance on XL valuation, applying a 4.2x EV/EBITDA for 2025 alongside our DCF, leading to a revised TP: Rp2,800.

To see the full version of this report, please click here

Kalbe Farma: Improving Growth Outlook at Reasonable Valuation (KLBF.IJ Rp 1,210; BUY TP Rp 1,800)

- KLBF targets FY25 revenue and EPS growth of 8-10% YoY, driven by growth in the Consumer Health and Nutrition divisions.

- We expect greater adoption of RMB-based API purchases and a strengthened product portfolio to improve earnings prospects in KLBF.

- We think KLBF’s underperformance should have priced in concerns on Rupiah thus, current valuation is attractive; maintain our Buy rating.

To see the full version of this report, please click here

Sido Muncul: Expects strong 4Q24 result with FY25 growth target of 10% yoy (SIDO.IJ Rp 565; BUY TP Rp 640)

- Trump’s aggressive tariff announcement is expected to have significant market impacts, given its broader and more extensive scope.

- Indonesia's primary risks would arise from financial channels, driven by currency pressure on stronger DXY and risk-off sentiment.

- Positive progress on Indonesia’s fiscal outlook with signal to reduce supply risk, uphold fiscal discipline and support growth improvement.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

BMRI (Buy, TP: Rp6,400) - FY24 Results (Below) & Concall KTA

FY24 Insights:

- Net profit up 1% yoy: BMRI recorded a net profit of Rp55.8tr in FY24, slightly missing our estimate (97%) and consensus (98%) on higher-than-expected CIR (37.8% vs realization of 40.0%).

- High loan growth offsetting lower NIM: BMRI booked loan growth of 19.5% yoy, offsetting a 33bps decline in NIM, resulting in a 6% increase in NII. The corporate and commercial segments remained the biggest contributors, with 27% and 23% yoy growth, respectively.

- LDR reached a 5-year high: Deposits grew by 8%, resulting in an LDR of 98%, as the bank reduced its special rate deposits to stabilize NIM.

- NIM dragged down by higher funding costs: NIM declined to 5.15% from 5.48% in FY23 as cost of deposit rose from 1.74% to 2.16% due to the tight liquidity. Management is looking at improving liquidity in FY25F from positive BI stance and government spending.

- Lower CoC amid lower coverage: CoC remained low at 0.8% (FY23: 0.9%), while NPL coverage declined to 271% (FY23: 326%). The NPL ratio improved from 1.2% in FY23 to 1.1% in FY24.

- CIR increased in FY24: CIR rose to 40.0% in FY24 from 38.8% in FY23, driven by higher opex (+9% yoy) mainly due to the elevated opex in the 4Q24.

4Q24 Insights:

- NP declined both qoq and yoy due to high opex: BMRI posted a net profit of Rp13.8tr in 4Q24 (-11% qoq, -14% yoy), despite an NII of Rp27.1tr (+6% qoq, +13% yoy). The decline in NP was driven by high opex, which increased 36% qoq and 22% yoy due to higher G&A and other expenses.

- Bank-only NIM improved qoq: NIM increased to 4.95% in 4Q24 from 4.86% in 3Q24, driven by higher loan yields, which offset the rise in CoF, along with a higher LDR. Loan yields increased across all segments except corporate, supported by repricing and higher yields on newly booked loans during the quarter, according to management.

- Strong qoq loan growth and decent deposit growth: Loans grew 7% qoq, while deposits increased 2% qoq, lifting LDR from 93% in 3Q24 to 98% in 4Q24. The bank stated that LDR had dropped below 95% as of Jan25.

- Overall asset quality remained solid: Despite strong loan growth, the NPL ratio remained steady qoq at 1.1% (4Q23: 1.2%), with improvements in the corporate segment offset by an increase in NPLs in the micro and payroll segments.

FY25 Consolidated Guidance – Normalizing growth to preserve NIM:

- 10-12% loan growth vs. FY24’s 19.5%.

- 0-5.2% NIM vs. FY24’s 5.15%.

- 0-1.2% CoC vs. FY24’s 0.79%.

- 1% NPL vs. FY24’s 0.97%.

- Mid to low 90% LDR vs. FY24’s 98%.

- Recovery income of Rp7-8tr vs. FY24’s Rp6.8tr.

Summary:

- Overall Performance: BMRI’s FY24 results were weak, as robust loan growth was accompanied by persistently high funding costs, while operating income growth was eroded by elevated opex in 4Q24. On a positive note, the bank reported higher NIM in 4Q24 and expects this trend to continue in FY25F. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MARKET NEWS

MACROECONOMY

GDP Grew by 5.02% yoy in 4Q24

- GDP grew by 5.02% yoy in 4Q24, with household consumption rising 4.98%. Although consumption growth remained below 5%, it reached its highest level in the past five quarters. In our view, the seasonal boost from increased demand for holiday-related activities in December was the primary driver of this improvement.

- On Sectoral, Manufacturing, the largest sector, continued its recovery, reaching a five-quarter high with 4.89% yoy growth. Trade, the second-largest sector, also saw a significant jump to 5.2% yoy, marking its highest growth in five quarters. Meanwhile, service sectors, including Transportation & Storage, Business Services, and Other Services, experienced the strongest expansion, driven by increased holiday demand and Umrah-related activities.

- In FY24, GDP grew by 5.03% yoy, slightly below the 5.05% recorded in FY23. The slowdown was primarily due to a decline in net exports, despite some acceleration in household consumption and gross fixed capital formation (GFCF), which reached a six-year high.

- From the sectoral output, construction growth reflected acceleration in GFCF with 13-year high of 7.02% yoy. Manufacturing still subdued on annual basis with growth of 4.43% yoy, the lowest since 2022. (BPS)

SECTOR

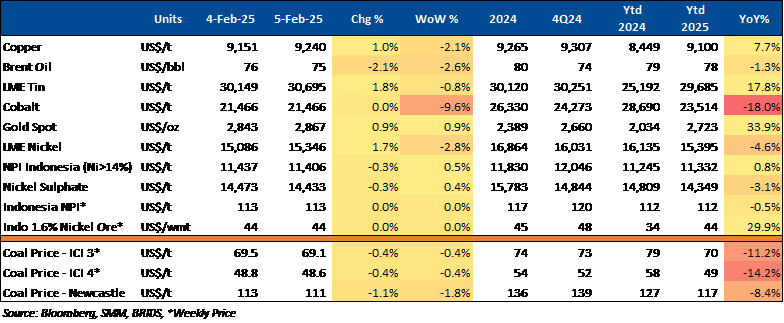

Commodity Price Daily Update Feb 5, 2025

Coal Contribution Continues to Shrink

The contribution of coal in the energy mix has been reduced in the Draft Government Regulation (RPP) on the National Energy Policy (KEN). The share of coal in the national energy mix is targeted to decline to 7.8% by 2060. As of the first half of 2024, coal still accounted for 39.48% of the energy mix. (Kontan)

Google Invests US$75bn for AI Development

Alphabet has allocated US$75bn in capital expenditures for AI development this year. Capital spending is increasing amid the emergence of China’s AI, DeepSeek, which is more efficient. Meanwhile, Mark Zuckerberg acknowledged that DeepSeek and other competitors bring novel advances and reaffirmed Meta’s commitment to heavy investment in AI infrastructure as a strategic advantage. (Bisnis)

Healthcare: The Indonesian Government Potentially Plans to Increase BPJS Health Contributions in 2026

The government is considering increasing BPJS Health contributions in 2026. The government is currently calculating the potential increase in contributions in line with the implementation of the standard inpatient care class system (KRIS), which is expected to be completed by June 30, 2025, at the latest. According to the Minister of Health, no specific figures regarding the increase have been determined yet, as the calculation process is still ongoing. This increase is not related to the implementation of KRIS by BPJS Health, but rather due to the potential rise in claims for services related to heart disease, stroke, and other conditions. (Kontan)

Heavy Equipment: Hinabi Projects National Heavy Equipment Production to Reach 8,500 Units in 2025

From January to December 2024, heavy equipment production from Hinabi members was recorded at 7,022 units, reaching only 88% of the national production target of 8,000 units. For 2025, Hinabi expects domestic heavy equipment production to reach 8,500 units, surpassing last year’s realization. This optimism is driven by the growing demand for heavy equipment in the agriculture, construction, and mining sectors. (Kontan)

CORPORATE

BBNI Plans to Conduct a Buyback with a Budget of Rp905bn

BBNI plans to conduct a buyback with a budget of Rp905bn. Additionally, BBNI intends to transfer the repurchased shares in accordance with the regulations set by the Financial Services Authority (OJK). According to BBNI, the General Meeting of Shareholders to approve the buyback plan will be held on March 13, 2025. The buyback will be completed within a maximum of twelve months after the buyback plan is approved by the AGMS. (Stockwatch)

Neta to Showcase Neta V-II and Neta X at IIMS 2025

PT Neta Auto Indonesia will make its debut at the Indonesia International Motor Show (IIMS) 2025, held from 13-23 Feb25 at JIExpo Kemayoran, Jakarta. The company will showcase its electric vehicle models, Neta V-II and Neta X, as part of its commitment to offering innovative and eco-friendly transportation solutions in Indonesia. (Kontan)

PTPP Targets Rp28.44tr in New Contracts for 2025

PTPP aims to secure Rp28.44tr in new contracts in 2025, reflecting a 5% increase from the previous year. The mgmt. stated that growth will be driven by the construction sector, with major contributions from building projects (31.19%), roads and bridges (26.47%), and ports (12.95%). In 2024, PTPP secured Rp27.09tr in new contracts, down from Rp31.67tr in 2023. (Bisnis)