FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Rakyat Indonesia: 3Q24 earnings: Strong recovery income offset the higher CoC, FY24 guidance maintained (NOT RATED)

- BBRI reported net profit of Rp15.4tr in 3Q24, bringing its 9M24 NP to Rp45.1tr (+2% yoy), in line with consensus FY24F.

- CoC rose to 3.2% in 3Q24 (2Q24: 3.1%), bringing 9M24's to 3.4%. Mgmt. maintains its FY24 target at 3.0% citing improvements in 4Q24.

- BBRI currently trades at 2.1x FY25F PBV, or at its 5-year mean, with an implied CoE of 10.7% (-1.5SD of its 5-year mean).

To see the full version of this report, please click here

Bank Neo Commerce: Turning positive in 3Q24, lower CoC offsetting the lower NIM; maintain FY24F net losses forecasts (BBYB.IJ Rp 258; BUY TP Rp 600)

- BBYB reported a slight net profit of Rp10bn in 3Q24 (vs. a slight net loss in 2Q24), resulting in a positive 9M24 NP of Rp4bn.

- As commercial loans kicked in, NIM started to fall to 13.9% (-185bps qoq), while CoC improved 21.0% (-570bps qoq).

- Maintain Buy rating with an unchanged TP of Rp600, supported by a low LDR and sufficient coverage to drive loan and earnings growth.

To see the full version of this report, please click here

HM Sampoerna: Trimming FY24F post weak 3Q24 earnings; expect modest FY25 growth outlook (HMSP.IJ Rp 690; HOLD TP Rp 730)

- Following weak 9M24 results, we have trimmed our FY24F NP by 12.7%, with lower volume and ASP assumptions.

- FY25F offers a better outlook, with projected NP growth of 6.3% yoy and vol. growth of 2% yoy (assuming no excise tax increase).

- Maintain our Hold rating with an unchanged TP of Rp730 (FY25F PE of 11x) as we see uncertainty remains until the MOF regulation is released.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

- ADRO (Buy, TP Rp3,770) – Strong 3Q24 earnings; 9M24 Strong Beat

- ANTM (Buy, TP: Rp2,000): Above cons, in line with ours

- ASII (Buy, TP: Rp5,700) - 9M24 Results: Above

- BELI (Buy, TP: Rp520) –In Line Earnings, New Marketing efforts in 3Q24 with Dekoruma

- BMRI (Buy, TP: 8,200) - 3Q24 Results (In Line) and Concall KTA

- BNGA (Not Rated) - 3Q24 Results (In Line) and Meeting KTA

- BUKA (Buy, TP: Rp340) – 9M24 Results: Below

- GGRM (Hold, TP: Rp17,500) - Below Estimates with Weak Revenue, Lower Margins and Higher Opex

- GOTO IJ (Buy, TP: Rp90) – In Line Earnings, Strong 3Q24 Adj. EBITDA Firmly in Positive Territory, with Continued Loan Growth Guidance

- INCO (Buy, TP: Rp5,700) - 3Q24 Results: Below due to weak ASP

- ISAT (Buy, TP: Rp3,300) – 9M24 Results: In Line

- KLBF (Buy – TP Rp1,800) - 3Q24 Results: In line with Our and Consensus Estimates

- MAPA (BUY, TP: Rp1,000) - 3Q24 Results: Above Our and Consensus Estimates

- MAPI (Buy, TP: Rp2,000) - 3Q24 Results: Broadly In Line with Consensus Estimates

- MIKA (Buy, TP: Rp3,400) - KTA from 9M24 Earnings Call

- MTEL (Buy, TP: Rp960) - 3Q24 Earnings Results and KTA

- SILO (Buy, TP: Rp3,000) - 9M24 Results: Below Our and Consensus Expectations

- TLKM (Buy, TP: Rp4,250) - 3Q24 Results: Broadly In Line, Solid Effort amid Weak Environment

- UNTR (Buy, TP Rp29,200) – Solid 3Q24 Earnings; 9M24 Beat Ours/Cons. Est.

MARKET NEWS

MACROECONOMY

Eurozone GPD Rose 0.4%

Eurozone GDP rose 0.4%, higher than the previous quarter and the consensus of 0.2%. Germany surprise consensus expecting contraction with 0.2% growth. (Bloomberg)

US GDP Expanded at 2.8% Annualized Pace in 3Q24

The US GDP expanded at 2.8% annualized pace in 3Q24, lower than 3% in 2Q24 and below consensus of 2.9%. Consumer spending rose 3.7%, the most since early 2023. Final sales to private domestic purchasers, a combination of consumer spending and business investment, rose 3.2%, the highest in 2024. (Bloomberg)

SECTOR

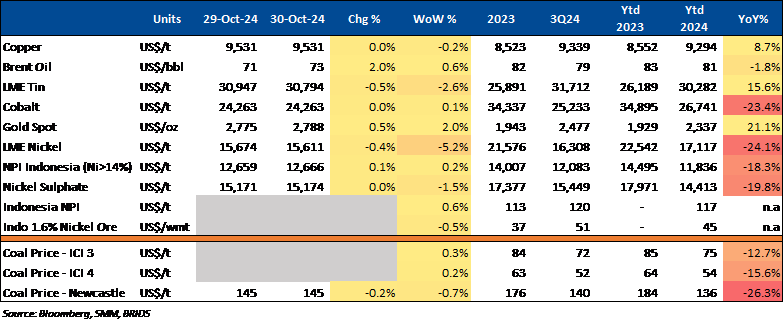

Commodity Price Daily Update Oct 30, 2024

|

Indonesia's Automotive Sector Faces Mixed Prospects as Motorcycle Sales Surge, Car Exports Decline Indonesia's automotive sector presents a mixed outlook, with motorcycle sales set for growth while car exports face challenges. AISI projects that motorcycle sales will reach 6.7mn units by 2025, with 4.87mn sold domestically and 1.83mn for export, driven by urbanization, government support, rising incomes, and infrastructure improvements. Conversely, Indonesia's car exports are expected to decline by 10% this year, as PT Toyota Motor Manufacturing Indonesia (TMMIN) reports that declining purchasing power in several target markets has led to a 5% to 10% reduction in global demand in 2024. Nevertheless, demand for Toyota exports has remained strong in certain countries despite the overall economic challenges. (Investor Daily) |

CORPORATE

Dongfeng Honda Operates Electric Vehicle Plant in China

Dongfeng Honda Automobile Co., Ltd. has launched its first dedicated electric vehicle production facility in Wuhan, China, featuring advanced automation and eliminating logistics personnel in stamping operations. The plant aims to enhance efficiency in new energy vehicle manufacturing. Honda plans to introduce 10 branded electric vehicle models in China by 2027, targeting 100% electric vehicle sales by 2035. (Kontan)

ISAT Adds 21,462 Units of 4G BTS in Q3 2024, Expanding Coverage

Indosat (ISAT) has added 21,462 units of 4G base transceiver stations (BTS) in Q3 2024, increasing the total to 247,000 units. This expansion supports the growth of data traffic, which has reached 12,050 Petabytes. Additionally, Indosat launched a digital intelligence operation center to monitor the network in real-time. (Bisnis)

MBMA Plans Capital Increase to Support Business Expansion

MBMA plans to implement a capital increase without pre-emptive rights to develop the company’s business activities and to create opportunities for potential expansion. MBMA intends to issue up to 10.8bn shares, which is a maximum of 10% of the total shares that have been issued and fully paid. (Company)

MIND ID Aims to Harness Thorium for Future Power Generation

MIND ID is aiming to utilize thorium as a source of energy for power generation. According to MIND ID, the energy demand over the next five years is projected to reach 5 GW. Meeting this energy need will optimize existing potential while considering cost implications. Energy costs are expected to rise depending on the type of energy used. Therefore, MIND ID plans to harness thorium, which is a byproduct of tin mining. (Kontan)

MTEL Expands Towers and Fiber Optics, Number of Tenants Increases

Mitratel (MTEL) reported a 5.8% increase in tower assets, totaling 39,259 units, and a 36.7% expansion in fiber optic length to 39,714 km as of Q3 2024. The number of tenants rose by 6.7% year-on-year, reaching 59,431. This growth reflects successful investments, particularly in areas outside Java. (Bisnis)

TINS Provides Long-Term Loan to PT DOK & Perkapalan AIR Kantung

TINS has provided a long-term loan to PT DOK & Perkapalan AIR Kantung amounting to Rp30.62bn. This loan has a maximum term of six years and an interest rate of 8.16% per annum. (IDX)

TLKM Upgrades Batam Data Center, Aiming to Implement AI

Telkom Indonesia is enhancing its Neutra DC data center in Batam, planning to implement artificial intelligence (AI) technologies. The first floor is expected to be completed by Q1 2025, with overall construction progress currently below 10%. The redesign aims to increase the data center's capacity from 12-16 MW to 21-30 MW per facility. (Bisnis)