FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank BTPN Syariah: Oct24 results: in line; net profit improvement driven by lower CoC (BTPS.IJ Rp 910; HOLD TP Rp 1,200)

- 10M24 net profit fell 20% yoy due to a 7% yoy drop in NII from lower loan balances and a 9% yoy increase in opex from collection efforts.

- CoC improvement and higher NIM drove a 20% mom net profit growth in Oct24, despite a high CIR (46.1%) and loan contraction (-1% mom).

- We view the Oct24 results as neutral, as the market expects stronger 4Q24 profitability from better asset quality and lower CoC.

To see the full version of this report, please click here

MAP Aktif : Store expansions and cost efficiency drive FY24-26F est. and TP upgrade (MAPA.IJ Rp 1,060; BUY TP Rp 1,250)

- New store openings and cost management initiatives drove solid 9M24 net profit growth of 8.4% yoy.

- We increased our FY24/25F net profit estimates by 12.4% and 10.2%, reflecting solid 9M24 results and expectations of more store openings.

- We expect the upcoming festive events to sustain growth momentum for MAPA. Maintain Buy rating with a higher TP of Rp1,250.

To see the full version of this report, please click here

Mitra Adiperkasa: Share price underperformance has priced in pessimistic growth expectation; Maintain Buy rating (MAPI.IJ Rp 1,600; BUY TP Rp 2,000)

- 3Q24 performance was driven by Active in both margins and revenue, while Fashion and F&B faced margin pressures.

- We trimmed our FY24/ 25F net profit est. by 2.3%/5.8%, leading to FY25F EPS growth est of 16.8%, driven by Active and Fashion expansion.

- We expect MAPI to sustain revenue and net profit growth and thus see 9.5% YTD share price correction to be unwarranted. Maintain Buy..

To see the full version of this report, please click here

Semen Indonesia: SMGR's Oct24 Sales Vol: Mom Recovery for Both Domestic & Export Market (SMGR.IJ Rp 3,650; HOLD TP Rp 3,900)

- SMGR’s domestic sales vol reached 3.1 Mt in Oct24 (+7.1% mom/-6.4% yoy), the highest monthly sales vol for SMGR for the last 10 months.

- Export sales vol showed inflection trend, with 598k tons of sales in Oct24 (+53.2% mom/+10% yoy).

- Overall, an inline sales vol for SMGR vs its seasonality (81% to our FY24F target). We have a Hold rating on SMGR with TP of Rp 3,900.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

MACROECONOMY

Bank Indonesia Has Kept the BI Rate Steady at 6.00%

Bank Indonesia (BI) has kept the BI Rate steady at 6.00%. While maintaining its “pro-stability & growth” stance, BI has prioritized stability at this juncture, in response to heightened external pressures, particularly regarding the currency. Despite the recent stronger Dollar Index (DXY) milieu, the IDR has shown some resilience, with YTD depreciation remaining manageable and less pronounced than in some neighboring countries. BI cited potential risks to the IDR stemming from US policies under Trump. Domestically, we noted a subdued macroeconomic backdrop in our latest report. However, BI maintains an optimistic outlook for 4Q growth. BI also noted its expectation of another 25bps Fed rate cut in December but a reduced total Fed rate cut projection for 2025, from 75-100bps to 50bps. We believe this increases the likelihood of a December rate cut, contingent on IDR stabilizing near Rp15,800. (BI, BRIDS)

Chinese Banks Maintain 1-year and 5-year Loan Prime Rates at 3.10% and 3.60%

Chinese banks held their one-year loan prime rate at 3.10% and the five-year rate at 3.60%. Last month, the People’s Bank of China kept its one-year policy rate unchanged after slashing funding costs by the most on record. That move had suggested authorities were cautiously pacing monetary stimulus to support the economy. Also in October, Chinese banks cut their LPR following the PBOC’s outlining of steps to encourage households and companies to borrow money. (Bloomberg)

SECTOR

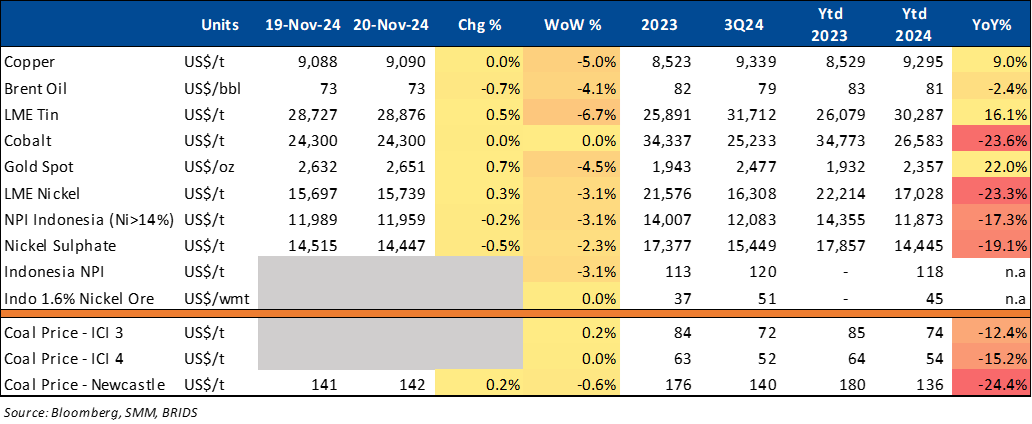

Commodity Price Daily Update Nov 20, 2024

CORPORATE

ADRO to Distribute Additional US$2.63bn in Dividends

ADRO will distribute an additional cash dividend of up to US$2.63bn for FY23, following approval in the EGMS on 18th Nov24. The key dates include 26th Nov24 for cum dividend in the regular and negotiation markets, 28th Nov24 for ex dividend in these markets, and 29th Nov24 as the record date. The dividend payment will be made on 6th Dec24. (Emiten News)

AVIA Received Rp99.9mn Interim Dividend

AVIA received an interim dividend of Rp99.9mn from its subsidiary, PT Tirtakencana Tatawarna (Tirta), on 18th Nov24. The dividend from Tirta’s 2024 profits will be finalized by 11th Dec24. AVIA holds a 99.99% stake in Tirta, and the payout does not impact its operations or financial condition. (Emiten News)

HRTA Offers Rp900bn Bonds

HRTA is raising Rp900bn through two bond series: Series A (Rp59.50bn, 6.90% interest, 3-year term) and Series B (Rp840.50bn, 7.10% interest, 5-year term). The offering starts on 20th Nov24, with listing on the Indonesia Stock Exchange on 28th Nov24. (Emiten News)

Price Drop of Used Hyundai Ioniq 6 Nears Cost of New Xpander Ultimate

The price of used Hyundai Ioniq 6 electric cars has dropped to around Rp890mn, down from Rp1.2bn. This price is close to the cost of a new Mitsubishi Xpander Ultimate, priced at Rp324mn. Allison Auto offers well-maintained Ioniq 6 units with warranties, along with other electric vehicles like the Wuling Air EV. (Kontan)

WIFI Partners with NTT e-Asia to Enhance ICT Infrastructure

WIFI and NTT e-Asia Corporation have signed an MoU to strengthen Indonesia’s ICT infrastructure. The partnership focuses on developing Fiber Optic Backbone networks, including terrestrial and sub-marine systems, and Access Networks like FTTH and FWA. Both parties will collaborate in knowledge sharing, training, and joint innovations to enhance digital connectivity. (Emiten News)