FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Mayora Indah: Expect 1Q24 sales momentum to continue (MYOR.IJ Rp2,290; BUY; TP Rp3,200)

- We expect strong 2Q24 top line to continue (from low base in 2Q23); Apr24 YTD sales indicated to still see strong double-digit growth.

- Factoring in higher input costs, we lower our FY24-25F core profit by 3.3%/2.7% to Rp3.3tr (-0.7% yoy) and Rp3.6tr (+10.6% yoy).

- Expect a strong 2H24 on seasonal factors. Maintain Buy with an unchanged TP of Rp3,200 (implying FY24F PE of 21x).

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

RESEARCH COMMENTARY

BBCA Apr24 Result

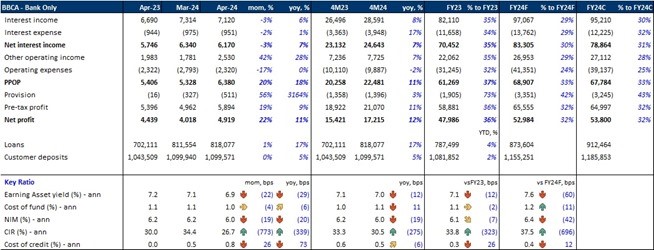

- BBCA reported net profits of Rp17.2tr in 4M24 (+12% yoy) supported by 11% higher PPOP offsetting the 3% increase in provisions. The NP is inline with our FY24F (32%) and consensus estimates (32%).

- The 7% growth in NII was supported by 17% yoy loans growth (with a higher LDR), while NIM was slightly down (-19bps) at 6.0% due to a slight increase in the CoF and a slight decrease in the EA yield.

- Provisions rose 3%, but the CoC remained stable at 0.5% in 4M24 partly due to the higher loans balance.

- The CIR improved 275bps to 30.5% due to 2% lower opex and a 7% increase in both NII and other operating income.

- In Apr24, BBCA reported net profit of Rp4.9tr (+22% mom, +11% yoy) supported by dividend income of Rp770bn. Hence, the growth in PPOP (+20% mom, +18% yoy) offset the rising provisions.

- The bank’s NIM declined to 6.0% (-19bps mom, -20bps yoy) due to the lower EA yield of 6.9% (-22bps mom, -29bps yoy). However, we see improvements in the CoF which dipped to 1.0% as the bank lowered its TD rates.

- Despite the lower TD rates, the bank’s customer deposits remained flat mom at Rp1,100tr (+5% yoy).

- The rise in the CoC to 7.3% in 4M24 (+626bps yoy) was mostly attributed to 1Q24. In Apr24, the CoC was recorded at 2.8% (flat yoy). (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MARKET NEWS

MACROECONOMY

IMF Upgrades its 2024 GDP Growth Forecast for China to 5.0%

The IMF has upgraded its GDP growth forecast for China to 5.0% in 2024, a 0.4 percentage point increase from the previous forecast. The revision comes after several stimulus packages were instigated by the government to boost the manufacturing and property sectors. The IMF suggests that structural changes are still necessary to help address the issue of slow domestic consumption. (IMF)

SECTOR

Gaprindo Responds to the Ban on Cigarette Advertisements in the Health RPP

The Association of Indonesian White Cigarette Producers (Gaprindo) rejects the ban on advertising, promotion and sponsorship of tobacco products, including cigarettes, as regulated in the Draft Government Regulation (RPP) for Health as the implementing regulation for Health Law Number 17 of 2023. Gaprindo believes that this regulation would be detrimental to the cigarette industry as a whole because it hinders the promotion of tobacco products. (Kontan)

CORPORATE

EXCL Collaborates with Ericsson to Implement Dual-Mode 5G Core

EXCL announced a partnership with Ericsson to deploy dual-mode 5G Core Solutions. Ericsson's dual-mode 5G Core will combine XL Axiata's 4G and 5G services into a fully integrated, container-based, and cloud-native core network. This technology will be used for the first time in a new area located in East Java to meet the increasing data flows in the region. (Kontan)

Smarfren for Business and PT Alita Praya Mitra Collaborate to Strengthen IoT Solutions

Smarfren for Business and PT Alita Praya Mitra will collaborate to strengthen and expand their portfolio of internet of things (IoT) technology solutions. According to Alita, with a focus on IoT solutions such as smart home, smart city, smart healthcare, and others, as well as an emphasis on cyber security, this partnership aims to meet the market needs that continue to grow rapidly. (Kontan)

Telkomsel-backed Healthtech Startup Hits EBITDA Profitability

Telkomsel injected US$1.9mn through its investment arm Indico in late 2022 and become one of Fita’s investors. Fita reported promising numbers for 2024, hitting positive EBITDA for three consecutive months starting February and logging a 30% increase in revenue from January to April compared to the same period in 2023.

According to Fita’s management, by prioritizing product-market fit and leveraging Telkomsel’s assets and capabilities, Fita has developed a sustainable business model that drives profitability and lays a solid foundation for future innovations. Moving forward, the company will ramp up its partnership with Telkomsel via initiatives such as Combo Fit Jamsostek, which would facilitate collaboration with Indonesia’s social security body. A joint program that would allow Fita to combine telecom services with health and fitness is also in the works. (Techinasia)