FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Central Asia: 1H24 results: in-line earnings, supported by robust loan growth, resilient NIM, and stable LaR ratio (BBCA.IJ Rp 10,075; BUY; TP Rp 11,300)

- Amid tight liquidity condition, BBCA maintained its NIM flat at 7.4% in 1H24, supported by a higher LDR and higher contribution from loans.

- Despite the higher NPL ratio and lower coverage in 1H24, the bank`s LaR ratio and coverage remained robust, suggesting still strong credit quality.

- We maintain our FY4F forecasts and TP of Rp11,300. We reiterate our Buy rating and preference on BBCA in the sector.

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

RESEARCH COMMENTARY

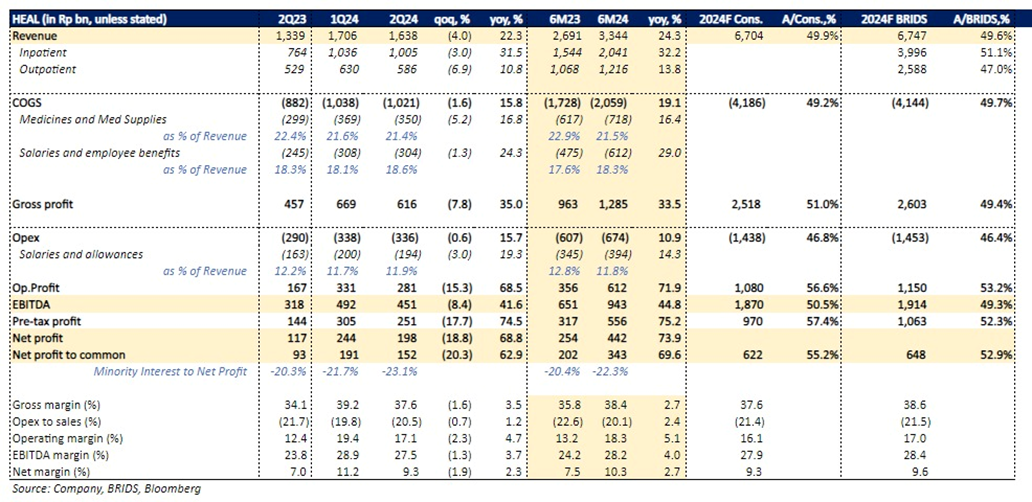

HEAL 1H24 Results: Inline with ours and consensus expectation

- HEAL reported 2Q24 Net Profit of Rp152bn (-20.3%qoq; +62.9%yoy), an expected lower achv. due to seasonality, yet overall 1H24 net profit was reported at Rp343bn (+69.6%yoy) and formed 53% and 55% of our and consensus FY24F estimates, respectively (i.e. In-Line).

- EBITDA margin showed positive growth of 4% yoy to 28.2% from 24.2% in 1H23, backed by an increase in the top-line of 24%yoy, while medicines cost as% of revenue is lower by 145bps. Labor cost remain increasing as a %of revenue, we believe primarily due to THR payment (religious holiday allowances).

- Overall, top line achv. and EBITDA margin is in-line with mgmt's guidance. (FY24F revenue guidance Rp6.6-6.7tr; EBITDA margin ~27-28%).

- HEAL remains our top pick in the sector. Maintain Buy rating with a TP of Rp2,000 (implying FY24F/FY25F EV/EBITDA of 16.6/14.6x). (Ismail Fakhri Suweleh & Wilastita Sofi – BRIDS)

HMSP 2Q24 result: Below our and consensus’ estimates

- HMSP reported 2Q24 net profit of around Rp1.1tn, down 33% yoy and -52% qoq, leading to 1H24 bottom line of Rp3.3tn, down 12% yoy. The 1H24 net profit was 40% of our FY24F and 39% of consensus, i.e Below.

- By end of Jun24, only SKT reported growth of 20% yoy, while the revenues from SKM and SPM were down 4% and 11% yoy, respectively. (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

.jpg)

SIDO 2Q24 result: Inline to achieve consensus’ estimates

- SIDO reported 2Q24 net profit of Rp218bn, +48% yoy but down 44% qoq, leading to 1H24 bottom line of Rp608bn, +36% yoy, supported by solid top line (+15% yoy) with high gross margin (58.2% vs 1H23: 53.1%).

- The 1H24 net profit was 56% of our FY24F (i.e slightly above) and 53% of consensus, i.e slightly inline.

- 1H24 Herbal revenue grew +11% yoy, followed by F&B of 20% yoy. In 2Q24, Herbal and F&B reported a lower gross margin vs previous quarter. (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

.jpg.png)

KTA from SIDO’s 2Q24 earnings call

- Export market (8% contribution to total 1H24 rev.) showed strong growth of 73% yoy, supported by Malaysia (driver: Kuku Bima), Philippines (Tolak Angin gained market share supported by a new distributor) and Nigeria (also from Kuku Bima Energy Drink).

- 2H24 outlook: La Nina and rainy season are expected to support volume ahead. Direct distribution to Alfamart (start in early May24) and Indomaret (early Jul24) will boost higher volume (possibly around 5%). Demand for energy drinks in the domestic market remains strong. However, SIDO’s management maintained the top and bottom-line guidance of above 10% for FY24 while continuing to observe purchasing power.

- A&P spending: will be maintained within guidance of 10-12% to support sales in 2H24. (1H24: 9.5% to sales).

- Export contribution: Targeting to reach 10-15% contribution to sales within 3-5 years period, from existing countries, Vietnam and African countries. (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

UNVR 2Q24 result: In line, Volume remains soft despite price correction

- UNVR reported 2Q24 net profit of around Rp1tr, down 25% yoy and -30% qoq, leading to 1H24 bottom line of Rp2.47tn, down 11% yoy. The 1H24 net profit was 54% of our FY24F (i.e above) and 49% of consensus, i.e Inline (vs avg 46% in the past years).

- Despite the price correction (1H24 UPG: -5% yoy), 1H24 volume remained soft at -0.7% yoy. Nonetheless, the management stated that the market share in value and volume has improved to 35% and 29%, respectively, compared to the lowest point in Dec23. However, this is still lower compared to the Oct23 position.

- UNVR will continue to spend on A&P to support sales and invest in brands (1H24: 9.1% to sales vs1H23: 7.4%). Lower input prices sustain UNVR’s gross margins and benefit the company by allowing the implementation of a favorable pricing strategy amidst soft purchasing power and a volatile geopolitical situation. However, the company acknowledges that the volatility will continue in 2H24. (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

.jpg.png.jpg)

MARKET NEWS

MACROECONOMY

Bank of Canada Cut its Key Policy Rate by 25bps to 4.5%

Bank of Canada cut its key policy rate by 25bps to 4.5%, extending the 25bps cut from the June meeting. BoC was the first of G-7 countries to cut its policy rate. BoC noted that excess supply has helped slowing inflation and see that lower interest rate can help bring down inflation by lowering mortgage and shelter cost. (Trading Economics)

SECTOR

Mining: Reference Metal Mineral and Coal Prices for Jul24

The Ministry of Energy and Mineral Resources has set reference metal mineral and coal prices. For coal in the equivalent CV of 6,322 kcal/kg GAR is set at US$130.4/ton. The HBA for Coal I commodities in the equivalent CV of 5,300 kcal/kg GAR is US$91.85/ton, the HBA for Coal II commodities in the equivalent CV of 4,100 kcal/kg GAR is US$56.1/ton and the HBA for Coal III in the equivalent CV of 3,400 kcal/kg GAR is US$36.2/ton. The Ministry of Energy and Mineral Resources also set the HMA for Jul24, HMA for Nickel at US$18,824/dmt, Cobalt at US$26,981/dmt and Lead at US$2,196/dmt. (Emiten News)

The Government is Reviewing New Excise Objects

The government is reviewing new excise objects in the study stage, including plastic, fuel oil, processed sodium food products, packaged sugar drinks, and sales tax on luxury motorized vehicles. Other goods in the pre-study stage include houses, concert tickets, fast food, tissue, cell phones, MSG, coal, and detergent. However, the excise extensification policy is still a proposal from various parties, requiring time and community aspirations. (Kontan)

CORPORATE

GOTO to Conduct a Buyback of 10.26bn Treasury Shares

GOTO has announced plans to buyback of 10.26bn Series A shares, which are treasury shares resulting from buybacks in 2021 and 2022. According to GOTO, the repurchase of these treasury shares will not impact the implementation of the previously approved share buyback plan by shareholders on Jun24. (Investor Daily)

PGEO Plans to Acquire PLTP

PGEO revealed that the company plans to carry out inorganic expansion through the acquisition of PLTP in Indonesia and abroad by 2025, with a total capacity of 175 MW. PGEO did not specify the timeline and the target capacity plan to be acquired later. The additional capacity of 175 MW is equivalent to 26% of PGEO's total capacity of 672 MW until the 1Q24. (Investor Daily)