|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

AKR Corporindo: 1Q25 Earnings In Line; Management Remains Cautiously Optimistic (AKRA.IJ Rp 1,185; BUY TP Rp 1,500) · AKRA recorded net profit of Rp565bn (-5% yoy, 23% of our/cons, in line), driven by better petroleum margin and utilities revenue. · Management reiterates its net profit target of Rp2.4-2.6tr and land sales of ~100 ha in FY25F and is cautiously optimistic on this year’s outlook. · AKRA will propose final dividend of Rp50/share in the next AGM. Reiterate BUY with TP of Rp1,500. To see the full version of this report, please click here

Bank Jago: 1Q25 Earnings: Positive Development from Its Higher-Risk Strategy (ARTO.IJ Rp 1,920; BUY TP Rp 3,400) · ARTO booked a robust NP of Rp60bn in 1Q25 (+41% qoq, +178% yoy) as less insurance coverage improved the NIM, offsetting the higher CoC. · CoC spiked to 4.7% in 1Q25 from 3.1% in 4Q24 due to seasonality and will be normalized from Apr25 onwards. · We tweaked our LT projection to account for higher NIM and higher CoC, resulting in a higher TP of Rp3,400; maintain Buy rating. To see the full version of this report, please click here

Bank Tabungan Negara: 1Q25 Results: One-off Earnings Remedy from Changes in Accounting Treatment (BBTN.IJ Rp 940; BUY TP Rp 1,400) · BBTN reported a robust 1Q25 net profit of Rp904bn, forming 31% of our and 29% of consensus’ FY25F earnings driven by accounting changes. · NPL ratio continued to rise to 3.3%, with coverage dropping to 105%, as the non-subsidised mortgage NPL rose to 4.9% in 1Q25. · Maintain BUY with a higher TP of Rp1,400, reflecting higher ROE due to the accounting changes. To see the full version of this report, please click here

Bank BTPN Syariah: 1Q25 Results: Better Asset Quality Supporting Earnings Growth Amid Asset Cleanup (BTPS.IJ Rp 1,140; BUY TP Rp 1,300) · BTPS booked a net profit of Rp311bn in 1Q25 (+7% qoq, +18% yoy), driven by a lower CoC of 8.5% (-125bps qoq, -516bps yoy). · Despite the improving asset quality, the bank remained conservative in asset and earnings growth, retaining flat asset and earnings target. · Maintain Buy rating with a higher TP of Rp1,300. Key risk to our call includes changes in asset quality trend. To see the full version of this report, please click here

Unilever Indonesia: Recovery in Progress, But Too Early to Turn Positive; Downgrading Rating to Sell (UNVR.IJ Rp 1,750; SELL TP Rp 1,500) · Management expects continued improvement following the completion of price and inventory adjustments in 1Q25. · 2Q25 will be a crucial period to assess sustainable progress, given expectations of sub-5% GDP growth and a seasonal slowdown. · Following share price rally from YTD low, we downgrade rating to Sell. Key risk is earnings upside if performance and cost control continue. To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

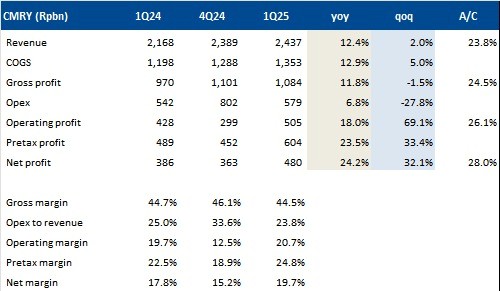

RESEARCH COMMENTARY CMRY (Not Rated) - Posts Strong 1Q25 Results with 24% yoy Net Profit Growth

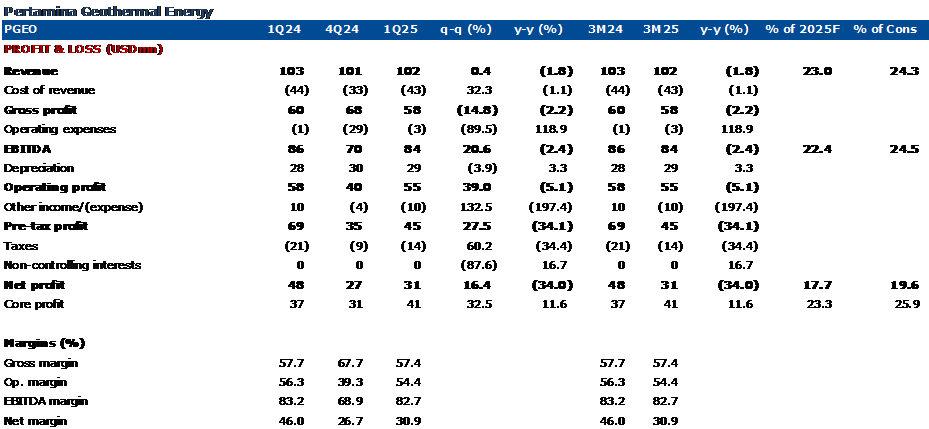

PGEO (Buy, TP Rp1,200) - 1Q25 Results: Core Profit Slightly In Line · 1Q25 core profit grew +33% qoq to US$41mn, reaching 23%/26% of ours/cons estimate. Operation was largely stable, where its 2M25 power generation stood at 770GWh, -3.5% yoy. · PGEO recorded a -US$8.9mn forex loss from its JPY denominated LT loan, which brought net profit down to US$31mn, -34% yoy. However, core profit remains higher QoQ and YoY at US$41mn, +33% qoq and +12% yoy. · There was a different accounting treatment which made 4Q24 opex grew significantly to US$29mn in the audited FY24 report. (Timothy Wijaya - BRIDS)

UNTR (Buy, TP Rp31,000) - In Line Dividend Payout and Mar25 Operational Performance UNTR AGM approved total of FY24 dividend of Rp2,151/share (final dividend of Rp1,484/share, translating to 6.4% yield). Payout ratio is 40%, in line with our expectation and company’s guidance.

Mar25 key operational performance: · Komatsu sales - Mar25: -5% mom; +38% yoy; 1Q25: +23% yoy (30% of our FY25F - ahead) · Mining contracting - Mar25 (OB+ Coal getting): -7% mom; -17% yoy; 1Q25: -11% yoy (21% of our FY25F – in line vs. 1Q: 21-23%) · Coal sales - Mar25: -16% mom; -24% yoy; 1Q25: -3% yoy (24% of our FY25F – in line) Comment: · Mar25 operational performance, particularly for Pama, was affected by the shorter working hours (Ramadhan) and substantially higher rainfall levels during the month. Despite Pama’s 1Q25 volume of -11% yoy, we believe 1Q25 operational still came in line with our expectation considering the shorter working days and higher rainfall in March, with recovery prospect in Apr25 (normalizing working days). · Our checks with coal miners indicated that despite the drop in coal price (Newcastle at US$93/t) there is no plan yet to re-negotiate mining fee with Pama. 1Q25 earnings is due out on 29th April. (Erindra Krisnawan – BRIDS)

MARKET NEWS |

||||||||||||

MACROECONOMY

U.S. Holds Special Negotiations with Key Global Partners

US Treasury Secretary Scott Bessent said the U.S. is negotiating with 18 major trading partners, with China in a “special negotiation” and talks with the other 17 set to progress over the next 90 days. He noted good progress with Asian countries and expects a potential trade deal with South Korea soon, with Korean officials targeting early July for tariff exemptions. (Bloomberg)

SECTOR

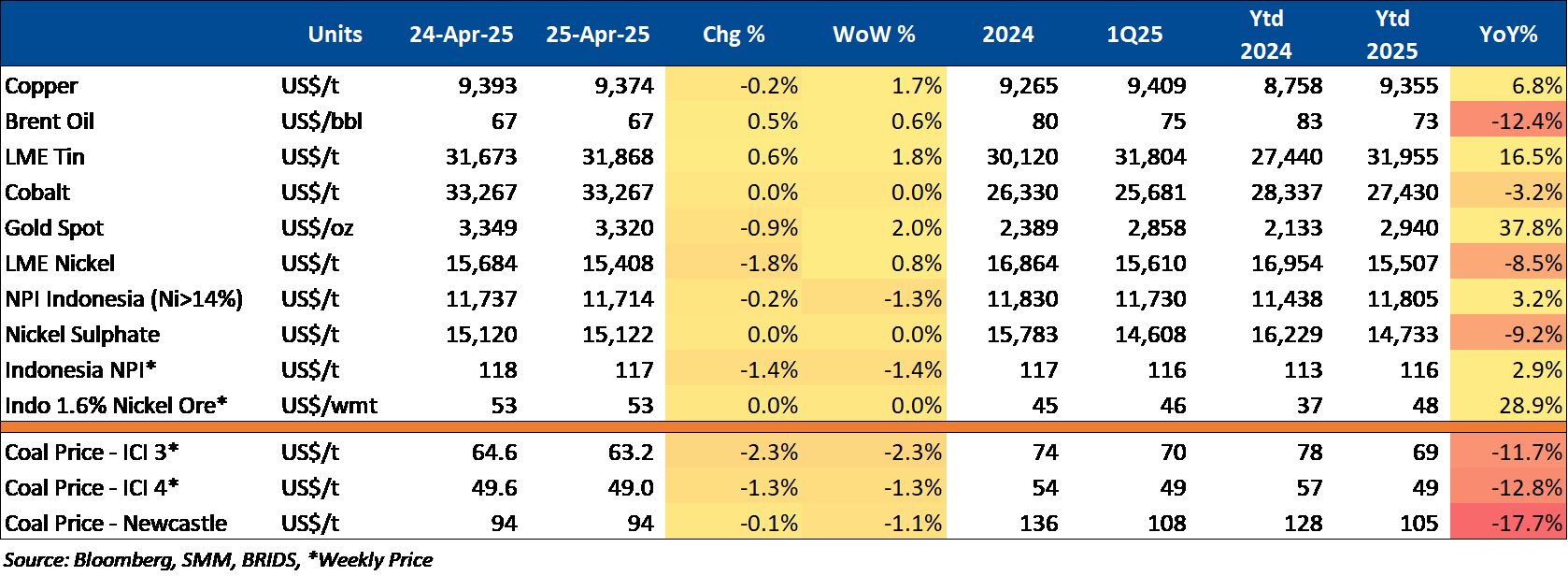

Commodity Price Daily Update Apr 25, 2025

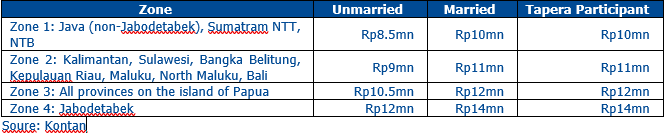

Indonesia Government Raises Income Cap for Public Housing Eligibility

The Indonesian government is taking various measures to realize the target of building 3 million housing units this year. In its latest move, the government has expanded the eligibility criteria for housing subsidies by increasing the monthly income threshold for low-income communities entitled to the public housing program. Under the new regulation, the eligible income levels for low-income households are divided into four zones, as outlined in the following table:

CORPORATE

ANTM to Supply Nickel for the Titan Project

ANTM has commented on the company's next steps following LG Energy Solution Ltd (LGES) withdrawal from the integrated electric vehicle (EV) battery ecosystem project in Indonesia, known as the Titan Project. In this project, ANTM will serve as the supplier of nickel-based EV battery raw materials, specifically nickel manganese cobalt. According to ANTM, the company will coordinate intensively with the government regarding adjustments to its partnership arrangements. This step aims to ensure the continuity of the project in alignment with national policies and priorities. (Kontan)

BMRI Disburses Rp12.83tr KUR to MSMEs as of Mar25

BMRI disbursed Rp12.83tr in KUR to over 110,807 borrowers by March 2025, reaching 33.34% of its annual target. The bank remains committed to supporting MSMEs and strengthening regional economies through targeted, sustainable financing. (EmitenNews)

SRTG Buys 71.56mn Shares of AADI

SRTG purchased 71.56mn shares of AADI at Rp6,005/share for investment purposes. Following the transaction on April 21, 2025, SRTG’s direct ownership in AADI rose from 3.46% to 4.38%, while its indirect ownership remained unchanged at 13.2%, according to the company’s disclosure dated April 25, 2025. (Kontan)

TINS Develops Rare Earth Metals

TINS is developing rare earth metals (REM) through the revitalization of a pilot plant facility for monazite processing in Tanjung Ular, West Bangka. The development of this facility is part of the national mineral downstreaming strategy and aligns with the program to enhance added value within the country. TINS and MIND ID are focused on promoting the utilization of by-products from tin mining to establish a competitive rare earth metal industry. (Kontan)

UNTR Allocates Up to US$1bn for Mineral and Renewable Energy Expansion

UNTR plans to invest up to US$1bn in 2025 to expand into non-coal sectors, focusing on minerals like nickel, gold, and possibly bauxite, as well as renewable energy. The company is pursuing new acquisitions to balance coal and non-coal revenue by 2030, using a mix of internal cash and bank loans for funding. (Emiten News)Top of Form