FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Sarana Menara Nusantara: Navigating merger headwinds with strategic positioning in ex-Java (TOWR.IJ Rp 835; BUY TP Rp 1,300)

- We expect spending for IBST, FTTH, and site relocations to secure incremental EBITDA, recurring income and strong positioning in ex-Java.

- Preemptive RI in the ~Rp8tr range will reduce leverage, fund growth, and maintain IG Status amid IBST acquisition and targeting IOH’s cables.

- We maintain our Buy rating on TOWR with a TP of Rp1,300; TOWR is trading at an attractive level vs. peers and mean multiples.

To see the full version of this report, please click here

Macro Strategy: Fact Check: Expectation vs Reality

- Recent U.S. macroeconomic data release further confirms our expectation of gradual FFR cuts, indicating a soft-landing trajectory.

- Yield and IDR assumption adjustment budget still highlights the government's conservative approach to maintaining a fiscal buffer.

- To avoid subsidy spending profligacy, the government plans to restrict subsidized fuel usage which could impact consumer spending.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

RESEARCH COMMENTARY

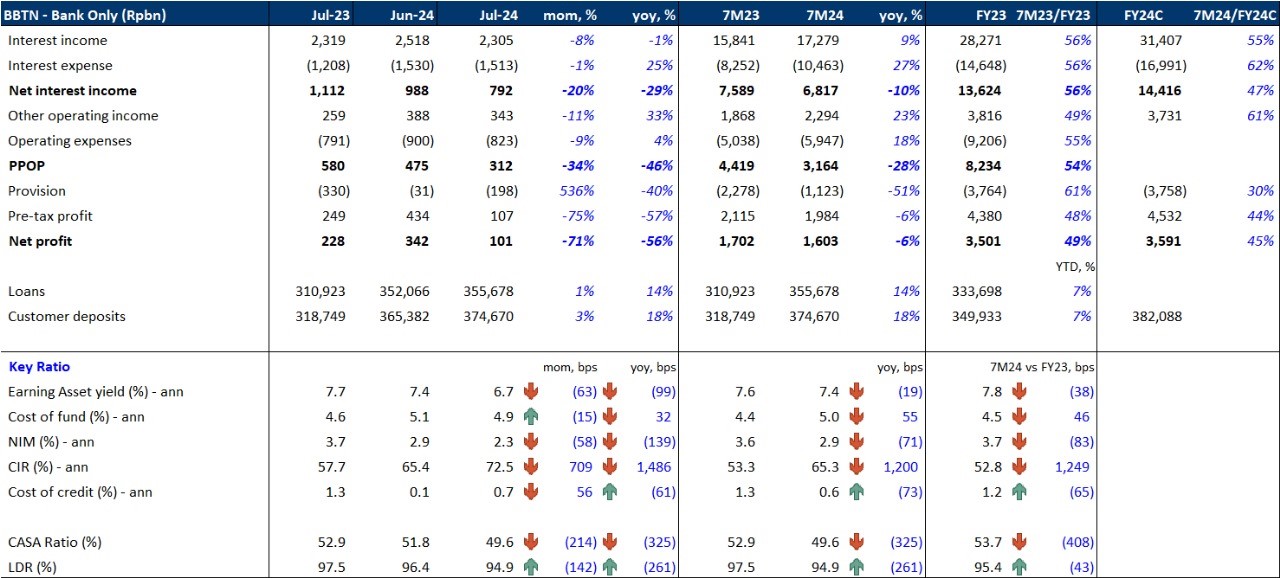

BBTN Jul24 Bank Only Results

7M24 Insight:

- Net Profit: BBTN reported net profits of Rp1.6tr in 7M24, down 6% yoy, due to a 28% decline in PPOP, slightly offset by a 51% yoy increase in provisions. CoC remained low at 0.6% (-73bps yoy), but NIM contracted to 2.9% (-71bps) due to higher CoF and lower LDR.

- Performance vs. Consensus: The 7M24 net profit forms 45% of the FY24 consensus forecast, lower than the 49% achieved in 7M23/FY23, marking the first yoy negative NP growth in FY24.

- Loan and Deposit Growth: Loan growth remained robust at 14% yoy in 7M24 (+1% mom), while deposits grew 18% yoy (+3% mom), resulting in an LDR of 94.9% (-142bps mom, -261bps yoy).

- NIM: NIM fell below 3% to 2.9% in 7M24, with EA yield dropping 19bps and CoF increasing 55bps.

- CIR: Operating expenses rose 18% yoy, leading to a CIR of 65.3% compared to 53.3% in 7M23.

Jul24 Insight:

- Net Profit: BBTN reported a weak net profit of Rp101bn in Jul24, down 71% mom and 56% yoy, primarily due to weak NII of Rp792bn (-20% mom, -29% yoy), soft NIM, and high CIR.

- NIM: NIM declined to 2.3% (-58bps mom, -139bps yoy), driven by a lower EA yield of 6.7%, partly offset by a lower CoF of 4.9%.

- CIR: Although opex decreased by 11% mom, it was still high in Jul24 (+33% yoy). Coupled with lower NII, CIR rose significantly to 72.5% (Jun24/Jul23: 65.4%/57.7%).

Summary:

- Overall Performance: BBTN's Jul24 results were weak, with pressure on NIM due to a lower EA yield and persistently high opex. Despite the lower CoC, BBTN's cumulative yoy NP growth turned negative for the first time this year, which may prompt consensus to downgrade FY24F earnings. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MACROECONOMY

Euro Inflation Dropped to 2.2% in Aug24

Euro inflation dropped to 2.2% in Aug24 from 2.6% in Jul24, according to initial estimate. Core inflation was unchanged at 2.8%. (Trading Economics)

Indonesia: Aug24 Headline Inflation Expected at 2.15%, Core Projected to Rise to 2.05%

Aug’s inflation will be announced today at 11am. We expect headline inflation to reach 2.15% on the back of stable prices of major cooking ingredients. For core inflation, we expect an acceleration to 2.05%. (BRIDS)

Indonesia: Pertalite and Solar Consumption Hit 59.5% and 59.8% of Annual Quotas

Pertalite consumption reach 18.8mn kl ytd as of August 16, 2024, equivalent to 59.5% of this year’s quota. During the same period, Solar consumption reached 10.7mn kl or 59.8% of the quota. (Bisnis)

US PCE Rose 2.5% yoy in Jul24

US PCE rose 2.5% yoy in Jul24, unchanged from Jun24. Core PCE rose 2.6% for the third straight month. The year-ahead inflation expectations were revised down to 2.8% in Aug24, the lowest since Dec20, compared to an earlier estimate of 2.9% and easing from 2.9% in Jul-24. (Trading Economics)

CORPORATE

GOTO Group Secures Approval for 120.14bn Share Private Placement and Management Changes

GOTO Group has received approval for a private placement of 120.14bn shares, equivalent to 10% of its total issued and fully paid-up capital, with the series A shares issued at a nominal value of Rp1/share. The plan will primarily fund working capital, with 20% allocated to Dompet Anak Bangsa and 25% to Multifinance Anak Bangsa. Existing shareholders' stakes will be diluted by up to 9.09% without affecting the voting rights ratio between series A and B shares. Additionally, Simon Tak Leung Ho has been appointed as a new director, replacing Wei-Jye Jacky Lo. (Emiten News)

ITMG to Distribute US$90.04mn in Interim Dividends

ITMG plans to distribute an interim dividend of US$90.04mn, or 70% of its net profit of US$129.07mn as of 6M24, equating to Rp1,228/share (yield: 4.5%). The dividend distribution, approved by the board on August 29, 2024, will be finalized with eligible shareholders determined by September 25, 2024, and payment scheduled for the same day. (Emiten News)

SMGR Announces Rp2tr Capital Expenditure Plan for 2024

SMGR plans to allocate Rp2tr in capital expenditure by the end of 2024, exceeding its typical budget of Rp1.3tr. This increased spending will support strategic projects, including completing a plant in Tuban to boost cement exports to the U.S. West Coast and a partnership with Taiheyo Cement Corporation. With a current cement supply shortage on the U.S. West Coast, SMGR aims to expand its production capacity to meet the growing demand. (Emiten News)

Telkomsel Partners with UAA to Implement Robotic Telesurgery Technology

Telkomsel has established a strategic partnership with the Urological Association of Asia (UAA) to introduce an evolution in innovative remote surgical procedures using robotic technology (Robotic Telesurgery) with 5G broadband connectivity. This collaboration also supports the transformation of the healthcare system initiated by the government through the Ministry of Health, specifically focusing on the pillars of human resources in healthcare for remote surgical services and health technology. (Investor Daily)