FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Trimegah Bangun Persada: Additional 10% stake in ONC lifts FY25 earnings (NCKL.IJ Rp 745; BUY TP Rp 1,500)

- NCKL bought a 10% stake for Rp2.1tr, growing its income from JV to Rp3.2tr/ Rp3.3tr in FY25/ 26F.

- We raised our FY25/26F forecast by +9.7%/+9.1% on the back of a stronger income from JV and a growing ore contribution.

- Reiterate our Buy rating with a higher TP of Rp1,500. Key risks to our call include lower nickel prices and a lower utilization rate.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE

- Summarecon Agung: FY24 Marketing Sales: In-Line with Our Expectations, Missed Company Target (SMRA.IJ Rp 464; BUY TP Rp 800)

To see the full version of this report, please click here

RESEARCH COMMENTARY

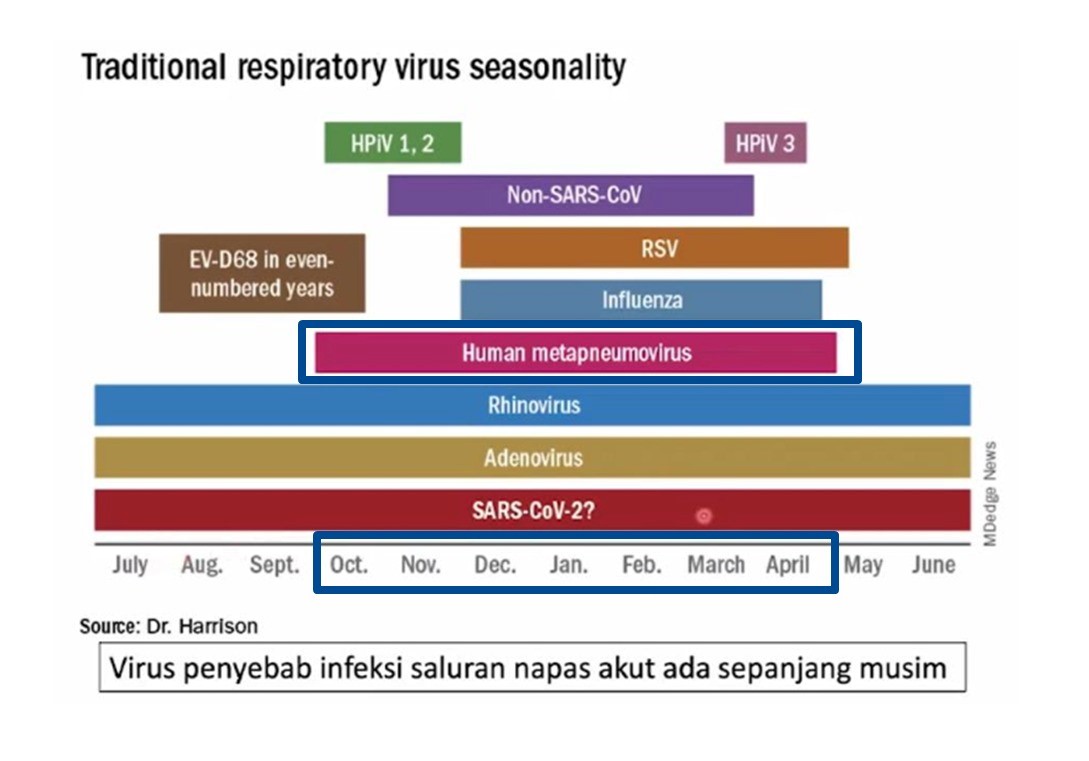

Healthcare (Overweight) Sector Update: Key Takeaways from Meeting with the Indonesian Society of Respirologists (Perhimpunan Dokter Paru Indonesia - PDPI)

Our discussion with PDPI on HMPV highlighted several key insights regarding the virus:

- Virus Characteristics: HMPV is a droplet-transmitted virus that mutates year-round but shows seasonal trends, primarily during winter or early spring. The recent mutation in December 2024, especially in China, was well-documented due to their advanced surveillance systems.

- Mortality and Treatment: HMPV has a very low mortality rate, with treatments similar to those for influenza. No specific antiviral has been developed yet.

- Local Observations: According to our speaker, dr. Fathiyah, Sp.P, a Pulmonologist at RS Persahabatan, Jakarta Timur, no HMPV cases have been observed among her patients.

- Hospital Findings: Our checks with listed hospitals confirmed no notable increase in HMPV cases. This could be attributed to limited diagnostic activity (tests cost up to Rp3.5mn), but the standard outpatient treatments seem effective in managing the illness. Thus far, HMPV appears controlled in Indonesia with no signs of widespread transmission.

- Precautions: Despite the low prevalence, PDPI emphasized maintaining a healthy lifestyle and caution, especially for vulnerable groups like infants, children, and individuals with respiratory conditions (e.g., pneumonia).

- Other Viruses: Similar trends were observed with Influenza A in December 2024. While cases were reported in hospitals offering complex diagnostics, the virus exhibited low mortality and was manageable with outpatient care.

- TBC Eradication Programs: Indonesia’s tuberculosis (TB) eradication program remains focused on vulnerable groups, directing them to receive treatment at their nearest healthcare facilities (Faskes).

- We maintain our Overweight (OW) rating on the healthcare sector, as we anticipate robust profitability growth over the next five years, with a projected EBITDA CAGR of 19% for FY24F-FY29F. The sector’s average valuation stands at 13.5x FY25F EV/EBITDA (-24% disc. to EM peers).

- Companies under our coverage continue to demonstrate strong capabilities in expanding patient volumes, enhancing revenue intensity, and improving operational efficiency, which collectively support future margin expansion. Top Picks: HEAL →MIKA → (Ismail Fakhri Suweleh & Wilastita Muthia Sofi – BRIDS)

MARKET NEWS

MACROECONOMY

Bank Indonesia Reported Business Slowdown in 4Q24

Bank Indonesia reported a business slowdown in 4Q24 vs 3Q (12.5% vs. 14.4%) based on its quarterly Business Activity Survey. The survey also indicated a further slowdown in 1Q25 with a net-weighted balance of 12.0%. (Bank Indonesia)

China’s GDP Rose by 5.4% yoy in 4Q24

China’s GDP rose 5.4% yoy in the 4Q24, marking the fastest pace in six quarters. The jump brought full-year growth to 5%. Annual consumption growth languished below pre-pandemic levels, while property investment contracted by the most on record and deflation persisted for a second straight year. Nominal GDP expanded only 4.2% in 2024, the slowest since the economy opened up in the late 1970s barring the pandemic slump. (Bloomberg)

Indonesia: BGN Expects Rp171tr Budget for MBG in 2025

The National Nutrition Agency (BGN) requires an additional Rp100tr to cover 82.9mn beneficiaries of the Free Nutritious Food (MBG) program in 2025, raising the total budget to Rp171tr. BGN Head presented this proposal to President on January 17, with the aim to accelerate MBG distribution. While the current budget of Rp71tr only supports 15 to 17.5mn beneficiaries, BGN confirmed that the Ministry of Finance is aware of the need for additional funds, with the official decision to be made by the president. (Kontan)

SECTOR

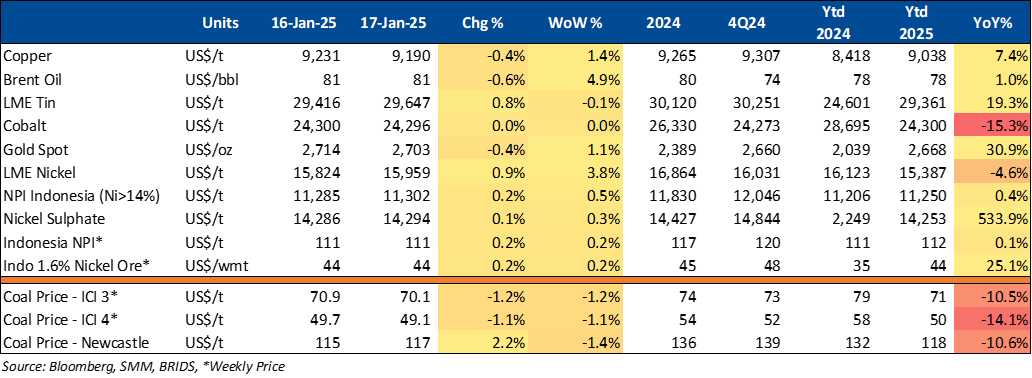

Commodity Price Daily Update Jan 17, 2025

Automotive: IIMS 2025 Sets Target of Rp6.7tr in Sales

The Indonesia International Motor Show (IIMS) 2025 will take place from February 13-23 at JIExpo Kemayoran, Jakarta. The event is expected to boost the national automotive market and entertain enthusiasts of both four-wheel and two-wheel vehicles. The mgmt. aims to reach Rp6.7tr in sales, matching the results of IIMS 2024. The exhibition will feature the latest automotive technology and unite stakeholders from across the industry. (Kontan)

Coal DMO Target for 2025 Set at 239.7mn Tons

The Ministry of Energy and Mineral Resources (ESDM) has announced that the target for the coal Domestic Market Obligation (DMO) for 2025 will be higher than in 2024, reaching 239.7mn tons. For reference, the ESDM set the DMO target for 2024 at 181.3mn tons. This means the 2025 DMO target represents an increase of approximately 24.3% compared to last year's target. The actual DMO realization throughout 2024 reached 209.9mn tons, or 115.79% of the allocated quota. (Kontan)

CORPORATE

BBTN to Acquire Bank Victoria Syariah for Rp1.06tr

BBTN has announced plans to acquire PT Bank Victoria Syariah for Rp1.06tr, aiming to strengthen its syariah banking services. The acquisition will be funded entirely by BBTN’s internal resources and is part of its broader strategy to create a fully-fledged Syariah Bank. The deal is expected to conclude by May 2025, following approval from both companies' shareholders. This move aligns with BBTN’s corporate strategy to separate its Syariah Unit and integrate Bank Victoria Syariah's services into its portfolio. (Bisnis)

KIJA Explores Collaboration with Indian Ambassador at Jababeka Movieland

KIJA welcomed Indian Ambassador to Indonesia, Sandeep Chakravorty, at Jababeka Movieland. During the visit, KIJA's President Director discussed collaboration opportunities, particularly in developing India’s film industry at the 35-hectare Jababeka Movieland in Cikarang. Both parties agreed to explore potential partnerships and discussed the entry of Indian companies into the Indonesian market. (Kontan)

Nvidia Shares Drop Amid New AI Chip Export Restrictions

NVDA’s share price fell nearly 2% after the Biden administration introduced new rules limiting AI chip exports to certain nations, including China, without a special license. Shipments of 1,700 GPUs or fewer are exempt from the cap, while 18 key U.S. allies face no restrictions. Countries under arms controls, such as China and Russia, remain banned from receiving the latest AI chips. (Yahoo Finance)

MIKA Targets Double-Digit Performance Growth in 2025

MIKA aims for double-digit performance growth in 2025. To achieve this target, MIKA continues to innovate and expand its medical services across several hospital branches. This year, MIKA introduced new technology in the medical field, the SOMATOM Force CT System. After launching its latest CT scan at Mitra Keluarga Kelapa Gading Hospital, MIKA is now focusing on expanding this advanced technology to Surabaya. Another innovation currently in development is the Digestive System Center. MIKA plans to launch the most advanced endoscopic equipment in 2025, which will enable more accurate and effective medical procedures. (Kontan)