|

Macro and Flows Tracker: Influx of Flow The Federal Reserve (Fed) and the European Central Bank (ECB) are expected to raise their policy rates by 25 bps each in their next policy moves. The Fed's rate hike is projected to be the last one in the current cycle. Notably, Indonesian bond yields have moved up in line with the higher UST yields due to the expected Fed rate hike. Foreign investors have been increasing their positions both in equity and fixed income instruments, as Indonesia’s macro conditions continue to show resiliency. We expect GDP growth to remain stable at 5% in Q2-2023, driven by improved household consumption and higher investment. However, there are potential risks to disinflation given the recent spike in wheat prices (yet the impact on core inflation remains limited). To see the full version of this report, please click here

BTPN Syariah: A weak quarter as expected (BTPN.IJ IDR 2,260 BUY.TP IDR 3,000) We reiterate our BUY call on BTPS with a new GGM-derived TP of IDR3,000 (implying 2.2x PBV 2024F) as we roll over our valuation to 2024F. Based on our recent discussions with BTPS, the bank is reimplementing its pre-pandemic business process by requiring its borrowers to attend group meetings while utilizing an attendance rate of 75% as the inflection point for an improvement in assets quality. All in all, we expect less CoC pressure, thus translating to better attendance rates starting in 3Q23 at the soonest. To see the full version of this report, please click here

To see the full version of this snapshot, please click here

MARKET NEWS |

|

||

MACROECONOMY

Indonesia Investment Realization reached IDR 349.8 tn in Q2-23

Investment Realization reached IDR 349.8 tn in Q2 (1H2023: IDR678.6 tn, 48.5% of 2023 target of IDR1,400 tn), growing by 15.7% YoY and 6.3% QoQ. Top 3 sectors for investment are: (1) Transportation, Warehouse, and Telecommunication at IDR43.0 tn, (2) Base Metal at IDR42.4 tn, and (3) Mining at IDR34.9 tn. (CNBC Indonesia)

CORPORATE

July 2020 Gapki: Exports and Domestic consumption improved

CPO production reached 4.2mn tons (-2.1% yoy -6.2% mom) while exports of CPO inched down by -3.2%yoy and -2.8%mom in Jul20 to 656k tons, with refined product exports at 2.5mn tons (+10.5% yoy and +18.2% MoM). Domestic consumption stood at 1.4mn tons (-0.6% yoy and +7.3% MoM) driven by higher FAME absorption. The final stocks for Jul 20 reached 3.6mn tons (+2.9% YoY, -8.3%MoM). China and Middle East exports surged +43% MoM and 65% MoM, respectively, to 629k tons for China in Jul20 while Middle East exports reached 273k tons in Jul20. (GAPKI)

ASII Plans to Acquire OLX Indonesia

ASII through its subsidiary, PT Astra Digital Mobil, plans to acquire a 99.98% stake in PT Tokobagus or OLX Indonesia, which has a business unit selling used cars online. However, management has not disclosed details regarding this plan. (Kontan)

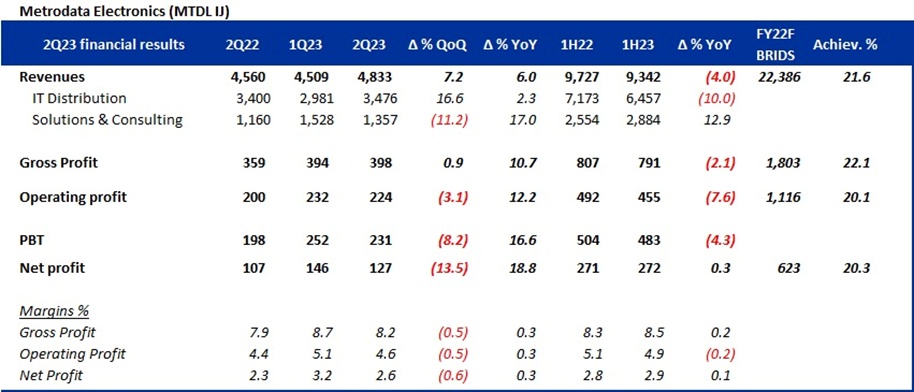

MTDL 1H23 Result: Some recovery witnessed

- 2Q23 Metrodata Electronics relatively stronger revenue Rp4.83tn (+7.2%qoq, +6.0%yoy). IT distribution revenue showed partial recovery after big slump in 1Q23. 1H234 IT distribution revenue is down by 10%yoy.

- 2Q23 Net profit declined to Rp127bn in the quarter qoq basis (-13.5%qoq, +18.8%yoy) mainly due to higher OPEX. On yoy basis, MTDL is operating on a better cost structure. 1H23 YTD Net profit is flattish +0.3%yoy.

- Results depict recovery, but we possibly may have to reduce revenue growth from 10%yoy, to 8% mainly due to weakness in demand for IT hardware from distributors. (Niko – BRIDS)

TLKM Introduces Telkomsel One

TLKM continues the initiative for Fixed Mobile Convergence by introducing Telkomsel One. Telkomsel one combines mobile broadband from Telkomsel and fixed broadband from Indihome. The service is now available throughout Indonesia with a starting price of IDR120,000 per month. (Investor Daily)

SMGR Supplies Tetrapod in Raja Ampat

VUB, a subsidiary of SMGR supplies Tetrapod Concrete in the Raja Ampat area. VUB will supply 2,630 units of tetrapod for Fani Island, Raja Ampat. Each tetrapod unit weighs 1.2 tons and is produced at VUB Gresik concrete plant, East Java. Tetrapod is useful to break sea waves so as not damage the beach and to protect from threats of abrasion. (Bisnis)

SMRA Adds Projects in Serpong to Boost Marketing Sales

SMRA continues to expand its business to boost performance in the remainder of 2023. Most recently, through the Pesta KPR 2023 program, SMRA is marketing residential products in the Gading Serpong area, Banten. In the program on 21 – 30 July 2023, SMRA offers landed house products, apartments, shophouses and commercial plots which are strategically located in the Gading Serpong area. (Kontan)