FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Tabungan Negara: FY24 Results: missing estimates on lower NIM and persistent higher operating costs (BBTN.IJ Rp940; BUY TP Rp 1,100)

- BBTN reported net profit of Rp3.0tr (-14% yoy) in FY24, missing our and consensus’ estimate on lower NIM and higher CIR.

- BBTN’s 4Q24 net profit of Rp92bn (+59% yoy, -22% qoq) was boosted by a strong recovery income, but opex remained elevated.

- We lowered our FY25-26F est. by 12-8% on higher CoC projection. Maintain Buy rating for BBTN with a lower TP of Rp1,100.

To see the full version of this report, please click here

Central Omega Resources: An Agile Miner Ready to Reap Profits (DKFT.IJ Rp276; NOT RATED)

- Prod/sales posted CAGR 53%/43% since 2021, reaching 2.9wmt/2.6wmt in FY24, and is aiming for RKAB revision to further increase production.

- Based on latest statement, its reserve stood at 14.3wmt, equal to 3-5 years of operation, though it still has premium ore grade of up to 2.1%.

- DKFT owns a 10ktpa FeNi BF, but is dormant due to high coke prices, making it uneconomical, though it is mulling over a heap leach plant.

To see the full version of this report, please click here

Unilever Indonesia: FY24 Earnings Missed; Potential One-Off Gain to Support FY25 Earnings and Dividend (UNVR.IJ Rp 1,415; HOLD TP Rp 1,500)

- Following FY24 results miss, we cut our FY25/26 net profit forecasts by 10%/13% due to lower volume, lower ASP, and higher opex.

- Mgmt guides that stock reduction will continue until 1Q25, which will prevent UNVR from delivering a strong quarter despite the Eid festive.

- One-off gain from selling Ice Cream business could increase dividend yield up to 11%. We upgrade our rating to HOLD with TP Rp1,500.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

MACROECONOMY

|

Indonesian Government Reaffirms Fiscal Budget Efficiency at Rp306.7tr After Reassessment Finance Minister reaffirmed that the fiscal budget efficiency still amounted to Rp306.7tr after the reassessment process. Several ministries got smaller budget cuts compared to the initial plan. Minister of Public Works, which initially got its 2025 budget cut to Rp29.6tr, is now get cut to Rp50.5tr. (Bisnis)

Indonesia to Launch Danantara Sovereign Wealth Fund on February 24, 2025 Indonesia will launch Danantara, the new sovereign wealth fund, on February 24, 2025, according to President Prabowo’s statement at World Government Summit. (Bisnis) |

SECTOR

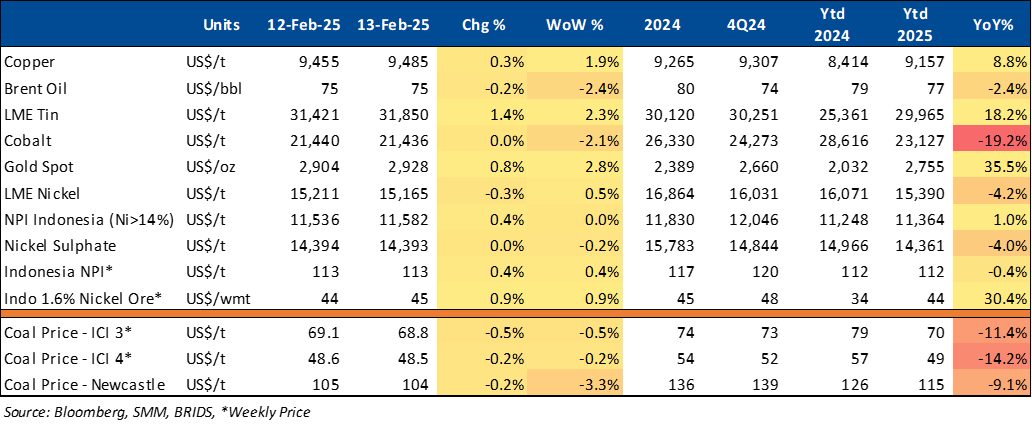

Commodity Price Daily Update Feb 13, 2025

CORPORATE

|

ACES Opens First AZKO Store in Jayapura ACES expands to Eastern Indonesia with its first AZKO store at Matoa Square Abepura, Jayapura, marking its 246th store in the 76th city. The mgmt. highlighted Abepura’s economic potential and AZKO’s role in supporting Papua’s growth while enhancing local access to home and lifestyle products. (Kontan)

BYD Unveils Sealion 7 at IIMS 2025 PT BYD Motor Indonesia introduced the BYD Sealion 7 at IIMS 2025, available in Premium (Rp629mn OTR Jakarta) and Performance (Rp719mn OTR Jakarta) variants. The EV delivers 690 Nm of torque, accelerates from 0–100 km/h in 4.5 seconds, and has a top speed of 215 km/h. Equipped with a Blade Battery, Intelligent Driving Assist, nine airbags, and a V2L function for external power supply, it ensures safety and versatility. (Kontan)

CNMA Plans Rp300bn Share Buyback CNMA plans a Rp300bn share buyback, citing undervaluation of its stock. The buyback, pending shareholder approval on March 24, 2025, will be conducted gradually through IDX with a maximum price of Rp270 per share. The program will run for up to 12 months, with a limit of 2.48% of issued capital, ensuring a minimum 7.5% free float. CNMA aims to enhance shareholder value and optimize capital structure through this initiative. (Bisnis) |

|

ERAA Expands into F&B with Chagee Joint Venture ERAA is expanding into Indonesia’s food and beverage sector through a joint venture with Singapore-based investor Tea Explorer Pte Ltd (TEA). Its subsidiary, PT Era Boga Nusantara (EBN), has formed PT Chagee Era Indonesia (CEI) to operate under the Chagee brand. EBN holds a 40% stake worth Rp120bn, while TEA owns the remaining Rp180bn, with CEI’s total capital set at Rp300bn. EBN’s investment comes entirely from internal funds, further diversifying ERAA’s business portfolio. (Bisnis)

EXCL Partners with AWS and Snowflake to Monetize AI EXCL has partnered with Amazon Web Services (AWS) and Snowflake, a leading AI Data Cloud company, to implement cutting-edge cloud technology, advanced data management, and AI. Through this collaboration, EXCL has leveraged AWS and Snowflake’s latest cloud technologies to build an integrated data and AI ecosystem, providing a 360-degree view of its more than 58mn customers. With these strategic AI and digital transformation initiatives, EXCL reaffirms its commitment to leading AI-driven innovation and digital transformation in Indonesia. (Kontan)

Freeport Indonesia Conducted First Gold Bar Shipment to ANTM PT Freeport Indonesia (PTFI) has made its first gold bar shipment from the Precious Metal Refinery (PMR) Smelter facility to Antam in Pulogadung, Jakarta. This inaugural shipment consisted of 125 kilograms of gold, valued at Rp207bn, with a purity of 99.99%. (Kontan)

Hyundai Launches Venue SUV at IIMS 2025 PT Hyundai Motors Indonesia (HMID) unveiled the Hyundai Venue at IIMS 2025, a stylish and agile compact SUV. Equipped with a 1.0L Turbo GDI engine, it delivers 120 PS and 172 Nm of torque, ensuring a responsive driving experience. The 7-speed Dual Clutch Transmission (DCT) provides smooth acceleration, ideal for urban mobility. Priced at Rp340mn (OTR Jakarta), the Venue comes in six color options, including two-tone variants. (Kontan)

VinFast Expands in Indonesia with VF3 Launch VinFast introduced the VF3 at IIMS 2025, reinforcing its presence in Indonesia’s EV market. The two-door, five-seater compact car measures 3,190 mm in length, offering more space than rivals like the Wuling Air EV. Powered by an 18.64 kWh LFP battery, it has a 215 km range and supports CCS2 fast charging, reaching 70% in 36 minutes. (Kontan) |