FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Telco: 2Q24 preview: expect the best momentum on IOH; TLKM and EXCL to focus on their catalysts (OVERWEIGHT)

- We expect a robust and strong 2Q24/ 1H24 net profit momentum for IOH, while we expect TLKM and EXCL to have fewer ST catalysts.

- We estimate TLKM and EXCL to offer limited margin upside in 2Q24, while IOH shall realize leverage and margin expansion (100bps+, Qoq).

- ISAT remains our top pick with room for upgrade. We have a BUY rating on TLKM & EXCL, trading at low multiples offering positive catalysts.

To see the full version of this report, please click here

Bank Rakyat Indonesia: 1H24 earnings: Not yet out of the wood but progressing (NOT RATED)

- Despite the higher NPL ratio, the SML ratio improved to 6.9% in 1H24 from 7.1% in 1Q24 and overall NPL improved to 3.1% (-6bps qoq).

- While we noted two scenarios of higher-than-expected CoC in FY24, the bank remains confident in achieving its current 3.0% CoC guidance.

- BBRI’s implied CoE of 10.3% is slightly above its -1SD of the 5-year avg. of 8.7% with PBV of 2.2x, slightly above mean.

To see the full version of this report, please click here

Sido Muncul: Bright outlook post solid 1H24; upgrade to Buy (SIDO.IJ Rp 700; BUY; TP Rp 810)

- Post robust 1H24, we raised our FY24-25F NP growth by 9.5-11%; expect solid volume growth and higher margins to support a strong 2H24.

- We expect rainy season and volume from direct distribution and export markets to support FY24 vol growth of +15% yoy (2018-13 avg 6%).

- We raise our rating to Buy with a higher TP of Rp810, as we expect robust FY24/25F NP growth of 26%/10% yoy, respectively.

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

RESEARCH COMMENTARY

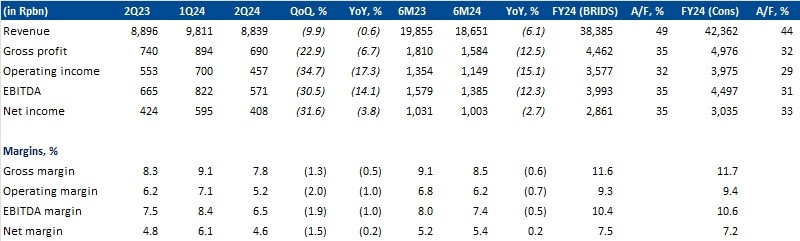

AKRA 1H24 Post-Concall: Miss Estimates and Downgrading Guidance

- AKRA's 1H24 NP declined by 3% yoy to Rp1tr, forming 35%/33% of our/consensus estimate, a miss from the usual seasonality of 37-49%. AKRA earnings were helped by higher financial income (Rp149bn in 1H24 vs Rp50bn in 1H23), and lower tax bracket benefit from SEZ.

- The company's 1H24 revenue/GP/NP declined by 6%/12%/15% yoy, as petrochemical revenue declined by 7% yoy and chemical revenue declined by 8% yoy, due to price normalization on chemical, while rainy season and permit delay affected delivery on petrochemical.

- Meanwhile, industrial estate revenue increased by 12% yoy, as AKRA recorded 18.1ha land sales (-7% yoy) in 1H24 (2Q24: 5 ha), implying higher ASP of Rp2.8mn/m2 (+15% yoy). Land presales were derived from auto and steel companies.

- AKRA's 1H24 GPM/OPM declined by 60/70 bps yoy, brought down by a declining margin in the petro & chemical segment (6.5% in 1H24 vs 7.4% in 1H23), while industrial estate margin was relatively stable at ~45%.

- AKRA revised down its NP guidance from 12-15% yoy to 4%-7% for FY24F (vs our estimate of 3% and consensus of 9%), implying downside on consensus earnings by 2%-5%. AKRA also slightly revised its industrial land sales guidance from 130 ha to 115ha-130ha (our expectation: 100ha), while also revising down trading & distribution volume from 6-8% yoy to 1-3% yoy (our estimate: 1.5% yoy).

- We expect that 2H24E should be a better period for AKRA, as usually, 2H contributes 50-63% of total FY earnings. Miners are also trying to catch up with their production after production delay that occured in 1H, while industrial estate sales are usually backloaded in 2H. We reiterate our BUY rating for AKRA with a TP of Rp1,850. AKRA currently trades at PER of 9.6x (-1.5 std dev of 5-years mean). Surprise suurounding the guidance downgrade might lead to short-term share price weaknesses. (Richard Jerry, CFA & Christian Sitorus – BRIDS)

BBTN 2Q24 Results (Inline) and Meeting KTA

- BBTN reported net profits of Rp642bn in 2Q24 (-5% yoy, -25% qoq), bringing its 1H24 NP to Rp1.5tr (+2% yoy), forming 41% of consensus FY24F NP, similar to the 42% achievement in 1H23.

- Interest income declined 5% qoq in 2Q24, due to an accrued interest reversal of Rp245bn from a corporate loan. Consequently, along with the higher CoF, NII declined 13% qoq, and NIM dropped to 3.0% in 1H24 from 3.6% in 1H23.

- Despite CoF rising to 4.1% in 1H24 from 3.6% in 1H23, the bank's initiatives to reduce high special rates have shown improvement, with CoF improving from 4.2% in 1Q24.

- Due to seasonality, the NPL ratio slightly rose to 3.1% in 1H24 from 3.0% in 1Q24 (but improved from 3.7% in 1H23). The LaR ratio improved to 21.2% in 2Q24 from 23.1% in 2Q23. However, in 1H24, both NPL and LaR coverage declined yoy from 139% to 136% and 22% to 20%, respectively, due to lower provisions.

- The bank's CoC declined to 0.6% in 1H24 from 1.3% in 1H23 (vs. FY24 target of 1.0-1.1%). The 50% yoy lower provisions in 1H24 offset the 24% yoy decline in PPOP, resulting in 2% yoy growth in NP.

- Loans grew 2% qoq to Rp352tr (+14% yoy), with housing loans growing 11% yoy and non-housing loans growing 38% yoy. Loan growth might move towards the company's target of 10-11% yoy as the subsidized housing quota will deplete in Aug24, which will bring the loan growth below 10% from 12%.

- The management continues to pursue the shift from FLPP to SSB but expects no changes until the new government is in place.

- The bank expects bulk asset sales to occur in two stages: 1) Rp1tr in Sep24 and 2) Rp500bn in Nov24. Additionally, it expects another asset sale to DIRE worth approximately Rp100-200bn in 2H24.

- The spin-off of its well-performing Shariah business will be done with the acquisition of a shell company. Hence, the bank expects the acquisition to occur quicker, and the Shariah bank can kick off in 1Q25.

- In our view, the positive NP growth was driven by the 50% lower provisions as the bank was dealing with one-off accrued interest and persistent CoF in 1H24. Hence, the improvement in EA yield in 2H24 might be offset by higher CoC. Key risks to our view in 2H24 include: Subsidized mortgage budget and bulk asset sales. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

.jpg)

MIDI 2Q24 result: Broadly In line to achieve our and consensus’ estimates

- MIDI reported 2Q24 net profit of Rp175bn, +11% yoy and 17% qoq, leading to 1H24 bottom line of Rp325bn, +25% yoy, supported by solid top line (+13% yoy) with higher gross margin (26.5% vs 1H23: 25.9%).

- The 1H24 net profit was 53% of our FY24F and of consensus, i.e broadly inline. Further details to follow. (Natalia Sutanto, Sabela Nur Amalina – BRIDS)

.jpg)

MARKET NEWS

MACROECONOMY

PBOC Decreased the MLF Facility by 20bps to 2.3%

PBoC decreased the rate of the medium-term lending facility (MLF) by 20bps to 2.3%, the first reduction in almost a year. The cut followed the PBOC’s trim of the seven-day reverse repo by 10bps on Monday. (Bloomberg)

US GDP Increased at a 2.8% Annualized Rate in the 2Q24

US GDP increased at a 2.8% annualized rate in the 2Q24, exceeding estimate and 1Q’s 1.4% in the previous quarter, the government’s initial estimate showed. Personal spending advanced 2.3%, also more than projected. A closely watched measure of underlying inflation rose 2.9%, easing from the first quarter but still above estimates. (Bloomberg)

CORPORATE

AKRA to Distribute an Interim Dividend of Rp978bn

AKRA plans to distribute a total interim dividend of Rp978bn, equivalent to Rp50/share (yield: 3.3%), for the fiscal year 2024. AKRA made a decision regarding the distribution of the FY24 interim dividend after recording a net profit of Rp1tr in 1H24. (Bisnis)

GOTO’s Financial Technology Business Unit Launched Gopay Merchant App for MSMEs

GOTO’s financial technology business unit, GoTo Financial, launched the GoPay Merchant application to provide easy and safe access to financial services, especially for MSME players. (VOI)

NFCX to Export Volta Electric Motorcycles to Southeast Asia

NFCX plans to expand its business by exporting Volta electric motorcycles to several countries in Southeast Asia. According to Volta, they have targeted three countries in Southeast Asia: Malaysia, Vietnam, and Thailand. Currently, Thailand is Volta's priority for expansion with a B2B scheme. (Kontan)

WIFI Partners with Nokia to Develop Affordable Home Internet Network

WIFI has officially entered into a strategic partnership with Nokia Indonesia to jointly develop and expand affordable home internet services throughout Indonesia. Nokia will serve as a strategic partner for Surge, providing end-to-end network connectivity. This initiative aims to deliver reliable, high-speed, and affordable internet services to 25 million households on the Java Island, with plans to expand to other islands in Indonesia. (IDX)

WIKA Recorded New Contracts Worth Rp10.2tr in 1H24

WIKA has successfully recorded an increase in new contract acquisitions through Jun24, totaling Rp10.25tr in 1H24. The largest contribution to these new contracts came from the industrial segment, followed by infrastructure, buildings, EPC projects, and properties. A majority of these projects originated from state-owned enterprises and the government sector, utilizing a payment scheme based on monthly progress payments. (Emiten News)