FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Technology: 2025 Outlook: Solid growth outlook with better fundamentals, and the rise of fintech infrastructure (OVERWEIGHT)

- Google projects the internet economy GMV to grow at a 14% CAGR in FY24-30, driven by social media, AI, and fintech amid low penetration.

- Positive CM trends reflect improved cash burn control and marketing costs, as players balance competition and service adoption.

- We maintain an OW rating, supported by solid GMV growth and improving EBITDA margin-to-GTV trajectories; our top pick is GOTO.

To see the full version of this report, please click here

BRIDS FIRST TAKE

- PT Sarimelati Kencana: Driving Growth: PZZA’s Ristorante Strategy and Cost Management Success (PZZA.IJ; NOT RATED)

To see the full version of this report, please click here

RESEARCH COMMENTARY

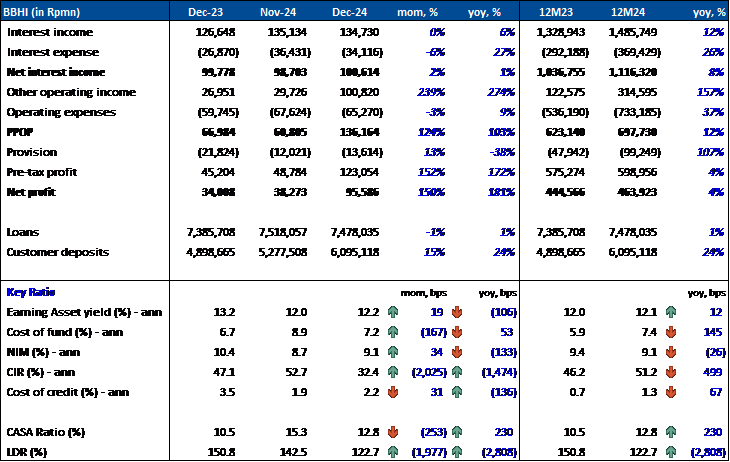

BBHI (Not Rated) - Dec24 Results

FY24 Insights:

- 4% yoy Net Profit Growth: BBHI posted a net profit of Rp464bn (+4% yoy) in FY24, primarily driven by an 8% and 157% yoy rise in NII and other operating income, respectively, despite a 37% and 107% rise in opex and provision expenses, respectively.

- Higher CIR Due to Rising Opex: CIR increased to 51.2% (+499bps yoy) in FY24, driven by a 37% surge in opex, with notable rises in other expenses (+73% yoy) and personnel expenses (+18% yoy).

- NIM Decline: NIM contracted to 9.1% (-26bps yoy) in FY24, as the rise in EA yield to 12.1% (+12bps yoy) was offset by a higher CoF of 7.4% (+145bps yoy).

- Loans and Deposits: Deposits grew by 24% yoy, outpacing a 1% yoy increase in loans, resulting in a significantly lower LDR of 122.7% in FY24 (vs. FY23: 150.8%).

- CoC Surge Despite Flat Loan Growth: Provision expenses doubled yoy, driving a CoC rise to 1.3% in FY24, from 0.7% in FY23.

Dec24 Insights:

- Net Profit Increase Supported by Surge in Other Operating Income: BBHI saw its net profit rise sharply to Rp96bn (+150% mom, +181% yoy) in Dec24, largely due to a substantial increase in other operating income (+239% mom, +274% yoy).

- mom Rise in NIM: NIM rose mom to 9.1% (+34bps mom, -133bps yoy) in Dec24, with CoF at 7.2% (-167bps mom, +53bps yoy) and EA yield at 12.2% (+19bps mom, -106bps yoy).

- CIR Improvement: CIR improved to 32.4% in Dec24, from 52.7% in Nov24 and 47.1% in Dec23. This was driven by a sharp rise in other operating income (+239% mom, +274% yoy), including a Rp69bn gain from the sale of financial assets.

- Loans and Deposits: Loans contracted by 1% mom, while deposits grew by 15% mom, bringing the LDR down to 122.7% in Dec24 from 142.5% in Nov24.

- Rise in CoC (mom): CoC rose to 2.2% (+31bps mom, -136bps yoy) in Dec24.

Conclusion:

- Overall Performance: BBHI showed a massive monthly improvement in Dec24, mostly due to gain from sale of financial assets. Furthermore, the bank achieved notable reductions in CIR and a rise in NIM as CoF decreased and EA yield increased, although CoC remains elevated. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MARKET NEWS

SECTOR

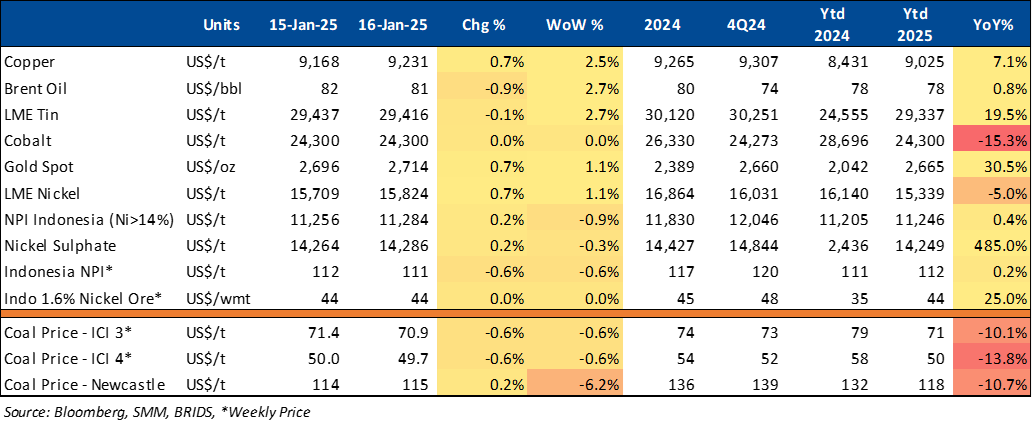

Commodity Price Daily Update Jan 16, 2025

Automotive: Several Provinces Delay Implementation of Vehicle Tax Options

Several provincial governments on Java, including Banten, West Java, Central Java, and East Java, have decided to postpone the implementation of additional options for Motor Vehicle Tax (PKB) and Motor Vehicle Name Transfer Duty (BBNKB). Gaikindo explained that other provinces like Lampung, East Kalimantan, and West Nusa Tenggara (NTB) are also delaying these options. The postponement periods vary, with West Java delaying for three months and East Java for one year. Each provincial government will evaluate the situation and make decisions based on the governor's directions. (Kontan)

Oil: Indonesian Government Targets Oil Lifting Production of 900,000 BPD by 2029

The Ministry of Energy and Mineral Resources has set a target for lifting oil production to reach between 800,000 and 900,000 barrels per day by 2029. This target is considered ambitious, given that Indonesia's current oil lifting stands at 596,381 barrels per day, which is lower than the target of 605,000 barrels per day set for this year. (Kontan)

CORPORATE

BUMI Reportedly Partners with Laman Mining on Bauxite Mining

According to information from Kontan, PT Bumi Resources Tbk (BUMI) is currently exploring opportunities to acquire a bauxite mine. BUMI plans to collaborate with PT Laman Mining for bauxite mining operations. Additionally, the Bakrie Group's listed company intends to build an alumina smelter in the future. (Kontan)

GOTO Partners with NVIDIA to Develop the Next Phase of AI Technology

GOTO announced that NVIDIA is interested in collaborating on the development of the next phase of its artificial intelligence technology, Sahabat-AI. This AI archetype is designed to assist GoTo's businesses in improving communication with customers. The commitment from NVIDIA to support the advancement of Sahabat-AI was confirmed by NVIDIA's CEO, Jensen Huang. (Bisnis)