FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Property: KTA from Meeting with JLL: Landed-Houses, Retails, and Industrial Estate as Growth Proxy (OVERWEIGHT)

- As affordability remains a key challenge for Indonesia’s housing end-users, we prefer exposure to companies with Rp1-5bn landed products.

- JLL expects the retail market to maintain stable occupancy and rental rate growth amid active tenant expansion in limited space supply.

- Chinese EV dominates Industrial Estate inquiries. Maintain OW rating on the Property and Industrial Estate sector. Top Picks: CTRA and SSIA.

To see the full version of this report, please click here

Bank Mandiri: FY24 Results: Below; Higher Opex in 4Q24 Eroded Net Profit Despite Improving Loan Yield (BMRI.IJ Rp 5,100; BUY TP Rp 5,900)

- BMRI recorded NP of Rp55.8tr in FY24 (+1% yoy), slightly missing our and consensus’ estimate on higher-than-expected CIR amid lower CoC.

- Despite the robust NII, 4Q24 NP declined to Rp13.8tr (-11% qoq, -14% yoy) as opex jumped, offsetting the higher NIM.

- Maintain Buy rating for BMRI with a lower TP of Rp5,900. Risks to our view include lower EA yield and possible asset quality deterioration.

To see the full version of this report, please click here

Bank Syariah Indonesia: FY24 Results: Above; Solid Financing Growth and Asset Quality Offseting the Higher Opex (BRIS.IJ Rp 2,880; HOLD TP Rp 2,900)

- BRIS reported a net profit of Rp7.0tr in FY24 (+23% yoy), beating our and consensus’ FY24F due to lower-than-expected CoC.

- Despite the higher opex, 4Q24 net profit of Rp1.9tr (+11% qoq, +26% yoy) was supported by higher asset yields and lower CoC.

- Maintain Hold on BRIS with an unchanged TP of Rp2,900, as we believe that the robust growth has been priced into its premium valuation

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE

- Bumi Serpong Damai: FY24 Pre-sales In-Line with Our and Company’s Expectations (BSDE.IJ Rp 910; BUY TP Rp 1,550)

To see the full version of this report, please click here

RESEARCH COMMENTARY

ANTM (BUY, TP: Rp2,000) Feb ore premium rises to US$10-$13.5/wmt from US$6-$13/wmt in January

- Based on our channel check, premium rises as smelters are in a restocking period

- Ore ASP seems to have a ceiling price of US$40-$44, at which NPI smelters are able to record a 20% cash margin

- Thus, declining LME nickel price = lower ore benchmark price = higher ore premium

Other notable update:

- NCKL's 3rd party ore purchase are bound with a LT contract that has a lower than market premium. Thus, further increase in ore premium should not affect NCKL's cash cost as much. (Timothy Wijaya – BRIDS)

MARKET NEWS

MACROECONOMY

Bank of England Cuts Interest Rate to 4.5%

Bank of England officials decided to cut interest rates to 4.5%, a 19-month low, with two supporting a bumper 50-basis-point cut, prompting markets to boost bets on further easing. (Bloomberg)

SECTOR

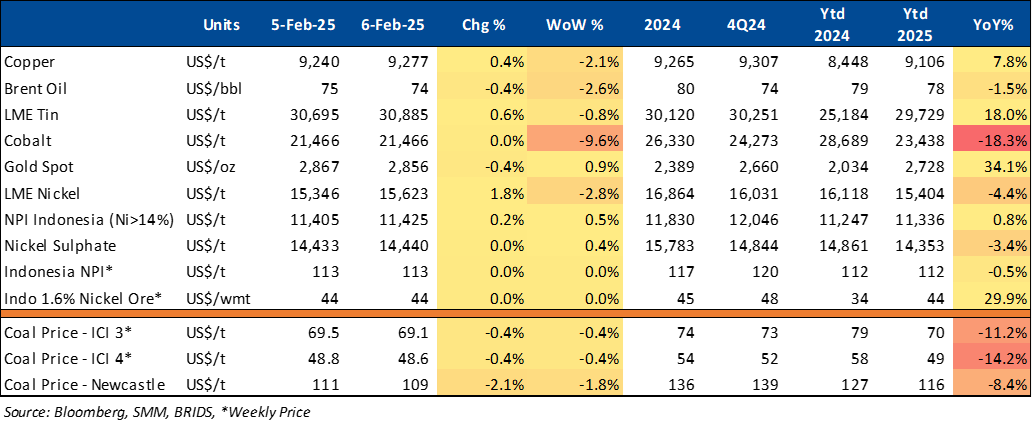

Commodity Price Daily Update Feb 6, 2025

Telco: 1.4 GHz Selection: Komdigi Evaluates Two Winners per Region

The Ministry of Communication and Digital (Komdigi) is reviewing proposals from academics and telecommunications experts to allow two winners per region in the 1.4 GHz spectrum selection. This aims to lower costs for telecom providers, ensuring affordable prices for consumers. Komdigi has divided the spectrum into three regions with a total of 15 zones, each containing a varying number of areas. A total of 80 MHz bandwidth will be allocated to the winners. (Bisnis)

CORPORATE

BRMS Increases Gold Production Target to 75,000 Ounces Troy in 2025

BRMS has raised its gold production target for 2025, aiming for a production level of 72,000 ounces troy. According to BRMS, last year's gold production reached the target of 55,000 – 60,000 ounces troy. Therefore, the 2025 gold production target represents an increase of 25% to 36.36% compared to last year's actual production. (Kontan)

MAPI Secures Rp81.69bn from Treasury Share Transfer

MAPI gained Rp81.69bn from transferring 63.08mn buyback shares at Rp961.10–1,310 per share. On 3rd Feb25, Rp79.1bn was raised through a block sale of 60.39mn shares at Rp1,310 each, fully absorbed by Golden Asia. (Emiten News)

Nissan and Honda Delay Merger Announcement

Nissan and Honda have reportedly postponed their merger agreement until mid-Feb25, after initially planning to announce the merger at the end of Jan25. According to Kyodo News, the proposed merger between the two Japanese automotive giants has not progressed as smoothly as expected, with both companies still discussing key aspects of the integration. In the agreement announced last month, the full merger under a single parent company was scheduled to be implemented in 2026, with each brand continuing to operate under its own identity. (Oto Detik)

PTBA Collaborates with CATL to Develop Synthetic Graphite

PTBA has partnered with CATL to develop synthetic graphite. This product is a crucial component in the production of batteries for electric vehicles (EVs), particularly lithium-ion batteries. Currently, PTBA is conducting research to optimize synthetic graphite production, with a target of achieving full-scale production by 2028. (Kontan)

TPIA Ready to Settle Maturing Bonds Worth Rp300bn

TPIA has confirmed its readiness to settle the principal and final coupon payments totaling Rp300bn, which are due in March. The principal and coupon payments are related to the Series C Bonds of the Sustainable Bonds I Chandra Asri Petrochemical Phase II of 2018, with a fixed coupon rate of 9%. (Investor Daily)