BRIDS Market Pulse

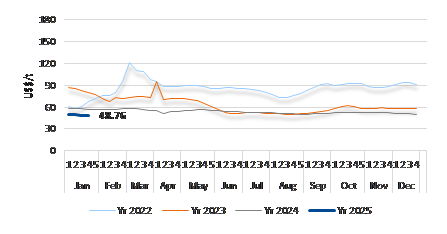

Chart of the week – ICI-4 Coal price

In the spotlight

- JCI closed the week up 0.2% wow, despite the reversal of foreign funds flow back to negative (-US$56.7mn), in-line with other EMs. Last week’s positive sentiment on JCI stemmed from the strengthening of IDR (+1.2% wow) on weaker USD (DXY: -1.7% wow) amid expectation of Trump’s softer policy on tariffs. This may reverse this week as DXY regained strength following re-emergence of Trump’s threats.

- The Coordinating Minister of Economics announced the plan to implement changes in export funds (DHE) policy, which will require 100% of export revenue (DHE) to be kept in domestic accounts for 12 months, effective from Mar25. We see a potentially neutral impact on most listed exporters, as the fund under DHE will now be allowed to be utilized for working capital. Exporters may also potentially benefit from higher interest income as DHE funds will be offered higher rates. We see Banks to be the potential indirect beneficiary due to potential from higher USD deposit and loan growth

- Commodities:

- Coal: China appears to have completed restocking of coal at its ports, ahead of the CNY week, as stocks now hovered near the peak of its 5-year range. The CNY holiday have put further pressure on Indonesian coal prices, with ICI4 price falling further to US$48.76/t.

- Metals: China’s industrial profit growth data (Dec24: +11% yoy; FY24: -3.3% yoy) and the unexpected drop in manufacturing PMI to 49.1 dragged copper prices down, despite positive sentiment from weak DXY. Copper’s inventory have continued to trend down since 2H24, but remains slightly above post-pandemic level.

- Poultry: Live bird prices fell to Rp19.7k/kg, with the weekly average price in the fourth week of Jan25 at Rp19.9k/kg, a decline of 2.6%. Despite the seasonal trend of weaker prices in January, the average live bird price in Jan25 remained elevated at ~Rp20k/kg. This deviation from historical patterns may indicate the potential impact of MBG and electricity subsidies, on chicken consumption.

… Read More 20250130 BRIDSMarketPulse