BRIDS Market Pulse

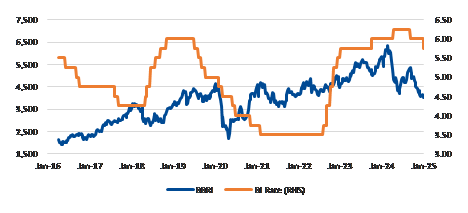

Chart of the week – BBRI vs. rate cut

In the spotlight

- JCI ended the week up +0.9% wow, amidst mixed performances for the other EMs. Foreign funds recorded a slight inflow (+US$14.9mn), aided by flows into BMRI, TLKM, UNTR. BBRI saw a small inflow (US$1.7mn), marking the first reversal from the outflow in prior weeks.

- BI’s surprise rate cut. Despite the surprise timing, BI’s policy rate cut is in-line with our expectation (of 50bps reduction in FY25) and thus, shall support our FY25 EPS growth forecast (of 6.5%). JCI has demonstrated an inverse relationship with the policy rate (+21% return during the last FY16-18 125bps rate cut), with the Banking sector delivering the highest return (+74-108%).

- Banks are potential winners from the surprise rate cut, but risks from IDR weakness. We see an early rate cut may ease liquidity pressure faster, with BBCA and BBRI having the upper hand with their fixed/ floating rate of 50/ 12% and 60/ 7% of total loans.

- FY25 Banking Sector Outlook: Our analyst Victor Stefano expects a moderate earnings growth of 5.8% in FY25F (from 6.7% in FY24F) due to slower loan growth, still tight liquidity, and higher CoC. In our view, the biggest risk is higher delinquency as liquidity remains tight, and we expect MSME quality to remain at risk. We lowered the sector’s rating to Neutral amid our cautious FY25F outlook, with BBCA remaining as our top pick.

- FY25 Property Outlook: Analyst Ismail Fakhri expects the VAT & BPHTB incentives to continue until 2H25. We maintain our OW rating on the sector as it trades at a sharp discount with improving pre-sales. Pecking order: CTRA> PWON> SMRA> BSDE

- FY25 Tech Sector Outlook: We maintain an OW rating, supported by solid GMV growth and improving EBITDA margin-to-GTV trajectories, with top pick on GOTO. Our analyst Niko Margaronis sees the positive CM trends to reflect improved cash burn control and marketing costs, as players balance competition and service adoption.

- Commodities: Coal price has continued to weaken, driven by softer prices in China domestic market. The ICI4 has continued to breach the floor price of US$50/t, indicating the shift in bargaining power toward buyers.

… Read More 20250120 BRIDS Market Pulse