FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Consumer: FY25 Outlook: Growth Drivers from Supported Purchasing Power and Strategic Pricing (OVERWEIGHT)

- We expect higher minimum wages in FY25 and a positive impact from purchasing power and govt’s meal program to create more jobs.

- We estimate stronger volume growth in FY25, supported by ASP adjustments, to drive FY25F core profit growth of 9.3% yoy.

- We prefer market leaders with opportunities to gain market share and implement ASP adjustment. Maintain Overweight with top pick on ICBP.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

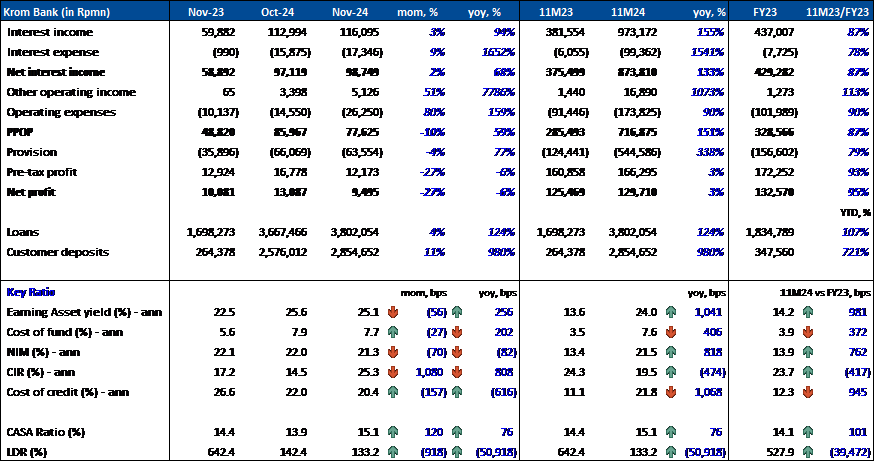

KROM (Not Rated) – Nov24 Results

11M24 Insights:

- Net Profit: KROM’s net profit reached Rp130bn in 11M24, with NIM standing at 21.5%.

- Following the bank’s rebranding as a digital bank in late Feb24, we believe monthly comparisons provide the most relevant insights into its performance.

Nov24 Insights:

- Net Profit Decline: KROM’s net profit fell to Rp9.5bn (-27% mom) in Nov24, driven largely by a surge in opex (+80% mom).

- Surge in CIR: CIR rose sharply to 25.3% in Nov24 from 14.5% in Oct24, primarily due to an 80% mom increase in opex as promotional expenses doubled mom, and salary expenses amounted to Rp8.8bn from a reversal of Rp0.3bn the prior month.

- Lower NIM: NIM decreased 70bps mom to 21.3% in Nov24 despite a 27bps decline in CoF to 7.7%, aided by a higher CASA ratio. This drop was attributed to a lower LDR of 133.2% in Nov24 from 142.4% in Oct24, along with a decline in EA yield to 25.1% (-56bps mom).

- CoC Improvement: CoC improved by 157bps mom, standing at 20.4% in Nov24. However, it remains one of the highest in the digital banking sector.

- Loans and Deposits: Loans and customer deposits grew by 4% and 11% mom, respectively, resulting in a lower LDR of 133.2% (-918bps mom). The CASA ratio continued to rise, reaching 15.1% (+120bps mom) in Nov24.

Summary:

- Overall Performance: KROM’s Nov24 performance was impacted by a sharp rise in opex and a lower NIM, contributing to one of the lowest monthly net profit figures since its digital bank transformation. However, the bank sustained a positive risk-adjusted NIM, with a decline in CoF as it expanded its CASA base. The key risks moving forward are KROM’s ability to maintain NIM while further reducing its LDR, and its high CoC. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

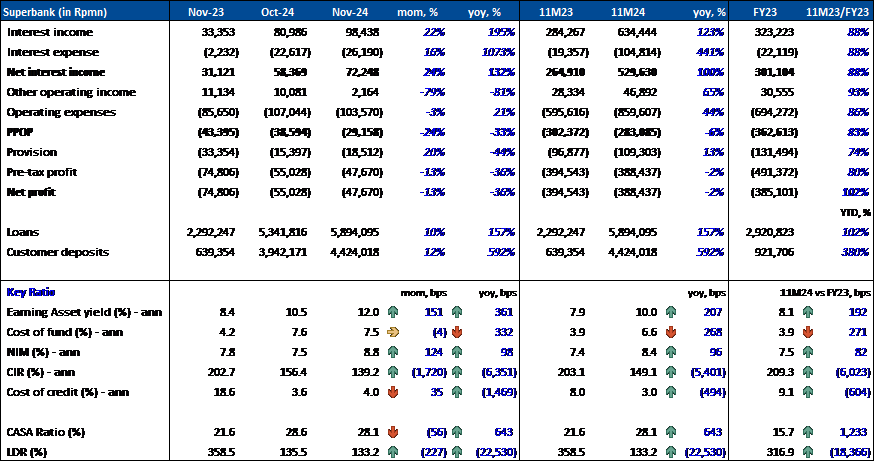

Superbank – Nov24 Results

11M24 Insights:

- Net Loss: Superbank posted a net loss of Rp388bn in 11M24, as NII of Rp530bn was offset by opex of Rp860bn and provisions totaling Rp109bn.

- CIR and Opex: The CIR reached 149.1% in 11M24, driven by elevated opex, primarily from salary expenses (Rp387bn) and other expenses (Rp323bn).

- NIM: NIM stood at 8.4% in 11M24, with an EA yield of 10.0% and CoF of 6.6%.

- Since Superbank was only launched as a digital bank in Dec23, we believe that a yoy comparison is not an ideal measure of performance.

Nov24 Insights:

- 13% mom Improvement in Net Loss: Superbank's net loss declined 13% mom to Rp48bn in Nov24, driven by a 24% mom increase in NII and a 3% decline in opex, despite a 20% mom growth in provisions.

- NIM Rise Supported by a Higher EA Yield: NIM rose to 8.8% (+124bos mom) in Nov24, despite a slightly lower LDR of 133.2% (-227bps mom), as EA yield increased to 12.0% from 10.5% in Oct24 and CoF declined by 4bps to 7.5%.

- Significant CIR Improvement: CIR fell to 139.2% in Nov24 from 156.4% in Oct24, despite a 79% decline in other operating income. The improvement was driven by a 24% mom rise in NII and a 3% mom decline in opex.

- CoC: CoC increased to 4.0% in Nov24 from 3.6% in Oct24.

- Customer Deposits Outpacing Loan Growth, Lowering LDR: Loans and customer deposits grew 10% and 12% mom, respectively, leading to an LDR of 133.2% in Nov24.

Summary:

- Overall Performance: In our view, Superbank demonstrated steady improvement in Nov24 with reduced net loss supported by improved NIM and lower CIR, reflecting ongoing operational efficiency gains. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

TLKM Signs MoU to Strengthen Home Internet Business with MyRepublic

Telkom Infrastruktur Indonesia (TIF), the newly established subsidiary of TLKM, and MyRepublic have entered into a strategic partnership for Fiber to The Home (FTTH) services. This collaboration aims to optimize the potential of TIF's FTTH infrastructure to support MyRepublic's services. TIF is committed to providing FTTH infrastructure with bandwidth options of up to 500 Mbps, featuring a 1:1 ratio for both uplink and downlink bandwidth. (Bisnis)

Comment:

- The potential 3rd party revenue for TIF from MyRepublic is a positive indication that there is a viable business model to build based on infra assets / fixed broadband homepasses that are indirectly controlled until now by an MNO, and potentially the infra company can be transformed from a cost center to profit center within the Telkom group.

- We understand that this is a pilot case for TIF with the Sinar Mas entity and we will wait to hear more info. So far the Telkom's homepassses have not been transferred yet to subsidiary TIF, (potentially this happens around mid 2025).

- Yesterday it was also revealed by the CEO of LINKNET that the existence of 2nd tenant apart from its anchor tenant XL. (Niko Margaronis – BRIDS)

MARKET NEWS

MACROECONOMY

China's Fiscal Deficit Increase for 2025

China is planning to raise the fiscal deficit to 4% in 2025, amounting to an additional CNY1.3tr of debt, while maintaining its GDP growth target of 5%. (Reuters)

MSMEs to Benefit from Loan Write-Offs in January 2025

The Ministry of MSME stated that around 1.09mn MSMEs will get their non-performing loans written off in Jan25, with a similar plan to be expected after Mar25. (Bisnis)

VAT Rate Increase to Raise Inflation by 0.3% in 2025

The Ministry of Finance estimated that the VAT rate of 12% will add 0.3 percentage points to inflation in 2025. (Bisnis)

SECTOR

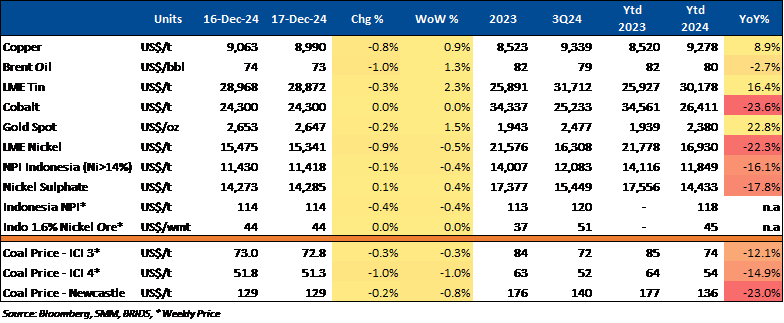

Commodity Price Daily Update Dec 17, 2024

CORPORATE

ADRO to Distribute US$200mn Interim Dividend for 2024

ADRO will distribute an interim dividend of US$200mn for the 2024 fiscal year, with the payment date set for 15th Jan25. (Emiten News)

AMRT Plans 800 New Stores in 2025

AMRT aims to open at least 800 new stores in 2025, focusing on regions like Eastern Indonesia, Sumatra, and Kalimantan. The expansion will be supported by new distribution centers to improve efficiency. Additionally, Alfamart will offer affordable essential products to meet changing consumer preferences. (Kontan)

JSMR Secures BBCA Support for Patimban Toll Access Road Development

JSMR, through its subsidiary PT Jasamarga Akses Patimban (JAP), has secured syndicated loans from BBCA and PT Sarana Multi Infrastruktur (SMI) to support the development of the Patimban Toll Access Road. The loan agreement, signed on 17th Dec24, highlights JSMR’s role in advancing Indonesia’s infrastructure, with BBCA’s financial backing reinforcing its commitment to the country’s economic growth. (Emiten News)

KLBF's Subsidiary Launches Milk for Free Nutritious Food Program

KLBF's subsidiary, Kalbe Nutritionals, supports the government's Free Nutritious Food (MBG) program by launching Milk Pro, a product tailored to children's nutritional needs. The company backs the program through simulations in four schools in Langowan and Bitung, North Sulawesi, to assess the program's technical execution, as well as its clinical and socio-economic impact on children's growth and the local community. (Kontan)

SILO Shares Acquired by Sight Investment for Rp2.97tr

Sight Investment Company purchased 1.04bn SILO shares for Rp2.97tr on 11th Dec24. This acquisition raised Sight Investment's stake to 63.44% from 55.40%, while Prime Health Company Limited’s holding was reduced to zero. The transaction aimed to increase direct investment in SILO. (Bisnis)

Suzuki and Honda Await Hybrid Car Tax Incentive Rules

Suzuki and Honda are awaiting further details on the government's 2025 fiscal incentive for hybrid cars. Starting in 2025, the government will offer a 3% Luxury Goods Tax (PPnBM) subsidy, reducing the current rate to a maximum of 12%. However, the criteria for eligible hybrid vehicles are yet to be clarified, and both companies are monitoring the situation as the government has yet to issue the technical regulations. (Kontan)