FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Macro Strategy: Finding The Inflection Points

- Recent developments seem to ease risks from the Trifecta of Challenges, offering potential improvements in DXY, yields, and liquidity.

- BI's rate cut led to declines in INDOGB yields and SRBI awarded yields, reflecting the policy shift, providing a base for growth momentum.

- Recent global events indicate a de-escalation of tensions, easing reflation risks and trade concerns, though challenges persist.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE

- Aspirasi Hidup Indonesia: ACES Delivers 13% yoy Revenue Growth, Backed by Strong SSSG (ACES.IJ Rp 745; BUY TP Rp 1,100)

To see the full version of this report, please click here

RESEARCH COMMENTARY

BBTN (Buy, TP: Rp1,400) – Bank Victoria Syariah Acquisition

BBTN is set to acquire 100% of Bank Victoria Syariah shares for Rp1.06tr as part of its strategy to establish a Sharia Commercial Bank (BUS) through inorganic growth.

The acquisition will be fully funded by BBTN’s internal resources.

Timeline:

- The deal is expected to close by May 2025, pending shareholder approval at the 2025 AGMS, scheduled for March 14, 2025.

Valuation:

- The deal is expected to close by May 2025, pending shareholder approval at the 2025 AGMS, scheduled for March 14, 2025.

- The transaction is valued at Rp1,000/share, or 1.0x P/BV and 183.5x P/E.

- BBTN’s current P/BV and P/E stand at 0.4x and 4.6x, respectively.

- Thus, the transaction is dilutive to BBTN, as Bank Victoria Syariah’s valuation ratios are higher than BBTN’s.

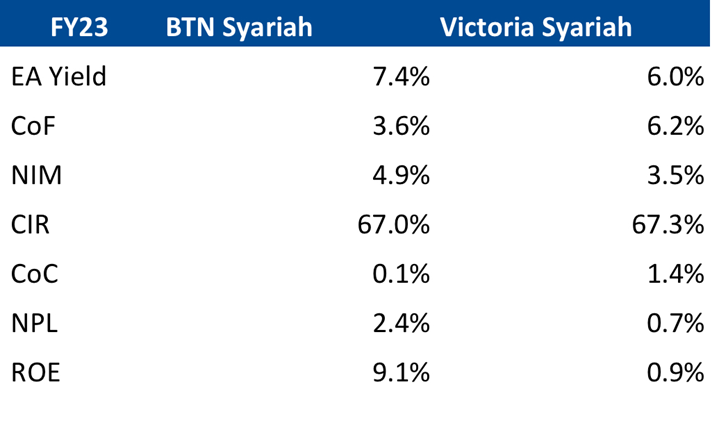

Performance Comparison (FY23):

- BTN Syariah’s FY23 ROE is significantly higher at 9.1%, compared to Bank Victoria Syariah’s 0.9%.

- NIM for BTN Syariah stood higher at 4.9%, vs. Victoria Syariah’s 3.5%, as BTN Syariah’s CoF was much lower at 3.6% (vs. 6.2%) and its EA yield was higher at 7.4% (vs. 6.0%).

- The CIR for both entities is similar at around 67%.

- In terms of asset quality, BTN Syariah has a much lower CoC at 0.1% compared to Victoria Syariah’s 1.4%. However, Bank Victoria Syariah has a lower NPL at 0.7% vs. BTN Syariah’s 2.4%.

Impact:

- Expected to strengthen BBTN's presence in the Islamic banking market.

- Potential for growth in the customer base and product offerings within the syariah banking sector.

- Possible cost synergies and operational improvements through integration. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

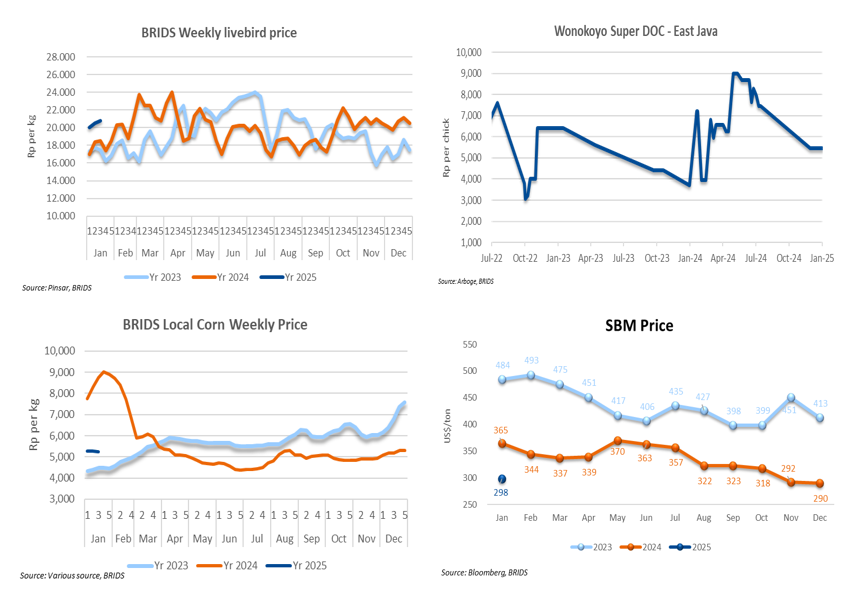

Poultry (Overweight) – 3rd week of January 2025 Price Update

- Live bird prices remained strong at above Rp20k/kg. The weekly average price for the third week of Jan25 stood at Rp20.8k/kg, a 1.2% wow increase.

- Day-old chick (DOC) prices remained steady at approximately Rp5.5k/chick.

- Local corn prices edged down slightly to Rp5.2k/kg, with the weekly average price also at Rp5.2k/kg, reflecting a 0.5% wow decline.

- The average soybean meal price stayed below US$300/t, maintaining the monthly average at US$298/t (+3% mom, -18% yoy).

- Live bird prices during the first half of Jan25 have been higher than the usual seasonal trend for this period of weaker prices. This anomaly may reflect potential impacts of MBG (Minimum Basic Goods) and electricity subsidies on chicken consumption. (Victor Stefano & Wilastita Sofi – BRIDS)

TOWR (Buy, TP: Rp1,400) - Acquire 40% Stake in DATA, Fiber/FTTH Company with a View for Mandatory Tender Offer

TOWR acquisition plan for DATA IJ

- The primary shareholders of DATA IJ, Verah Wahyudi Singgih Wong (80.48%) and Jimmi Anka (3.2%), are in discussions to sell part of their stake. iForte, a subsidiary of TOWR, intends to acquire approximately 40% of DATA, triggering a mandatory tender offer. However, it remains unclear whether Verah Wahyudi Singgih Wong will sell her remaining stake. TOWR aims to maintain close collaboration with existing business owners.

DATA IJ Valuation

- DATA IJ has guided EBITDA of Rp165bn for 2024F and Rp186bn for 2025E. A comparable entity, WIFI.IJ, is trading at 9.3x/7.8x EV/EBITDA for 2024/25. Based on these multiples, DATA.IJ appears relatively richer after a 25% surge in its share price this morning.

TOWR's Financing and Leverage

- TOWR plans to finance the acquisition by issuing new debt, estimated at Rp1.5tr to Rp1.7tr, assuming a full acquisition of DATA.IJ. We expect post-acquisition, TOWR’s net debt/EBITDA ratio to reach ~4.3x by YE 2025.

Rationale for the Acquisition

- This acquisition aligns with our telco/tower sector thesis of establishing new sustainable revenue streams via fixed broadband (BB) and FMC in markets with low penetration. By acquiring DATA.IJ, TOWR can tap into the growing demand for residential broadband with a lean cost structure, as DATA.IJ offers fixed internet at a competitive price of Rp200k/month per connection. TOWR is rapidly scaling up its FTTH business, and we understand in a value accretive way; potentially after March 2025, will announce details of its Rights Issue to help manage its interest expenses.

About DATA.IJ, solid Java fiber network with Retail, Business, Wholesale clients

- Ramala Abadi (DATA.IJ) operates an extensive 11,000 km fiber optic network across 34 provinces in Indonesia, with a strong presence in Java. The network features 400/200/100 Gbps connections, linking key cities such as Jakarta, Bandung, Semarang, Yogyakarta, and Surabaya, which serve as major regional hubs.

- Wholesale clients: Partnerships with 168 ISPs.

- Retail segment: 17,744 residential customers

- B2B customers: 8,745 businesses, including government institutions.

- Starlink partnership: Supporting advanced connectivity solutions. (Niko Margaronis & Kafi Ananta – BRIDS)

MARKET NEWS

MACROECONOMY

China Holds Loan Prime Rates Steady

China maintained its 1Y and 5Y Loan Prime Rate at 3.10% and 3.60%, respectively. The move on the Loan Prime Rate followed last month’s unchanged rate of the 1Y Medium-term Lending Facility. (Bloomberg)

Indonesia to Extend Export Proceeds Deposit Term to 12 Months

Coordinating Minister for Economic Affairs ensures that the minimum deposit term for export proceeds will be lengthened to 12 months from the current 3 months. Gov’t will provide additional incentives for the exporters. The law is in the finalization stage and will be published in the near future. (Bisnis)

SECTOR

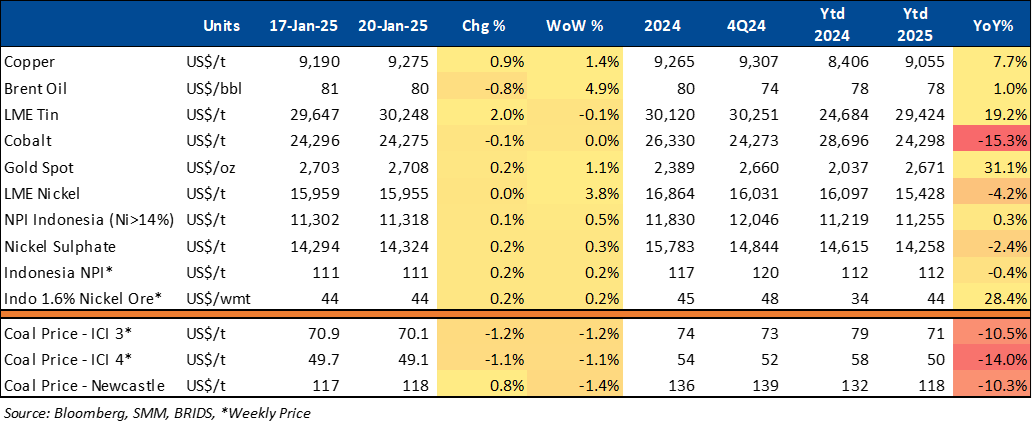

Commodity Price Daily Update Jan 20, 2025

Indonesian Government Imposes Goods Transport Restrictions on Toll Roads During Long Holiday

The Ministry of Transportation (Kemenhub) will limit goods transportation on toll roads during the Isra Mikraj and Chinese New Year holidays. Restrictions apply to trucks with three or more axles and those carrying mining materials. Exemptions include vehicles transporting essential goods. These limits will be enforced on selected toll roads from January 24 to 25, and January 29, 2025. (Bisnis)

The Indonesian Crude Price for Dec24 is set at US$71.61 per barrel

The Ministry of Energy and Mineral Resources (MEMR) has determined the Indonesian Crude Price (ICP) for Dec24 at US$71.61 per barrel, reflecting a decrease of US$0.21 compared to Nov24, which was US$71.83 per barrel. According to the MEMR, based on the analysis of the ICP Price Team, the decline in ICP is attributed to the decrease in global oil prices, driven by the slowdown in the global economy. (Investor Daily)

CORPORATE

AVIA Prepares for Seasonal Paint Demand Ahead of Lebaran

AVIA is maintaining production utilization below 80% to buffer against seasonal paint demand spikes ahead of Lebaran. The mgmt. stated while no special preparations are made, the company remains focused on long-term expansion strategies. The demand increase aligns with the tradition of repainting homes during Idul Fitri. AVIA expects 1Q25 sales to benefit from this seasonal trend, though its 2025 sales target will be announced after. (Kontan)

BYD Targets Rp16.38tr EV Plant in Subang by Late 2025

BYD plans to complete a US$1bn (Rp16.38tr) plant in Subang, West Java, by 2025, with a production capacity of 150,000 units annually, focusing on exports. Supported by Indonesia’s import duty exemptions, this aligns with the government’s 2030 target of producing 600,000 EVs domestically. (Kontan)

GOTO Targets Rp8.6tr in Consumer Loans

GOTO Financial aims to double its consumer loans by 2025, compared to the realization as of September 2024. The outstanding loan amount reached Rp4.3tr in Q3 2024, with a stable and low NPL rate. This means GoTo Financial targets Rp8.6tr in loans by 2025, with 45% of the total sourced from e-commerce, 40% from on-demand services, and the remainder from the Gopay application. (Bisnis)

TBIG Prepares Funds for Bond Maturity and Interest Payment

TBIG confirms readiness to settle its Sustainable Bonds VI Phase III 2024, maturing on 16th Feb25. The bond principal amounts to Rp2.7tr, alongside the 4th interest payment. The settlement will be distributed via KSEI as the payment agent. (IDX)