FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Tabungan Negara: Pioneering Financial Inclusion Through the New Govt. Housing Program; Reinitiate with Buy rating (BBTN.IJ Rp1,170; BUY TP Rp1,500)

- Aligned with the government housing program, BBTN is poised to capture growth in the subsidized mortgage segment.

- We believe the newly proposed scheme may lift BBTN’s NIM, as we expect the rising EA yield to outpace the rising CoF.

- We re-initiate coverage with a BUY rating and an inverse CoE GGM-based TP of Rp1,500, implying a fair value PBV of 0.6x

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

MBMA (Buy, TP: Rp560) - 3Q24 result: In line w/ ours, below consensus

- MBMA recorded a 3Q net loss of -US$1.9mn, while 9M24 NP now stood at US$18.5mn, reaching 78%/52% of our/cons estimate.

- 3Q revenue slightly declined to US$458mn, -4% qoq, while 9M24 revenue still grew to US$1.4bn, +58% yoy, reaching 77%/75% of our/cons estimate.

- Overall weakness in 3Q contributed by weaker NPI cash margin of US$1,080/t (vs. 2Q24 of US$1,166/t) and Nickel matte of -US$390/t (vs. 2Q24 of US$1,803/t) from higher cash cost/ton of +5.7%/+6.3%, whilst Matte ASP dropped -9.3% qoq.

- There was a US$5.3mn forex gain that boosted other income to US$5mn in 3Q24. (Timothy Wijaya – BRIDS)

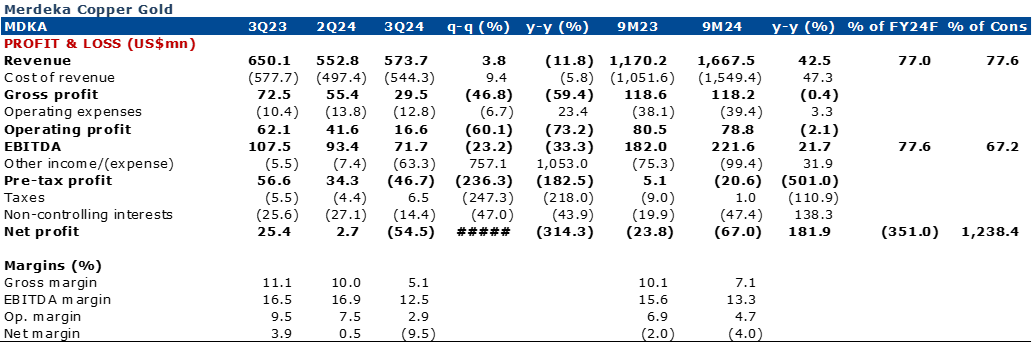

MDKA (Buy, TP: Rp2,600) - 3Q24 result: below expectation

- MDKA recorded a 3Q net loss of -US54.5mn, with 9M24 Net loss widening to -US$67mn (vs. 9M23 of -US$23.8mn).

- 3Q revenue slightly improved to US$574mn, +4% qoq, while 9M24 revenue expanded to US$1.7bn, +43% yoy, reaching 77%/78% of our/cons estimate.

- Underperformance was caused by higher COGS of +9.4% due to higher Copper/NPI/Matte AISC of +28%/+6%/+6%, followed by a -US$63mn other expenses incurred from forex loss of US$35mn and increased int. exp. grew +11% to US$29.6mn as loans increased by +7% qoq to US$1.6bn. (Timothy Wijaya – BRIDS)

SAQU (Not Rated) – Nov24 Results

11M24 Insights:

- Net Loss Due to Elevated Opex: SAQU reported a net loss of Rp260bn in 11M24, despite generating Rp534bn in NII, as operating expenses surged to Rp736bn.

- CIR and Opex: The CIR reached 135.1% in 11M24, driven by significant opex, primarily due to other expenses (Rp311bn) and salary costs (Rp227bn).

- NIM: NIM stood at 5.0% in 11M24, with an EA yield of 7.4% and a CoF of 4.7%.

- Given that SAQU launched as a digital bank towards the end of FY24, we believe a yoy comparison may not fully reflect the bank's performance trajectory.

Nov24 Insights:

- 16% mom Increase in Net Loss: SAQU’s net loss increased 16% mom to Rp42bn in Nov24 as opex and provisions surged 5% and 24% mom, respectively.

- CIR Rise: CIR rose to 153.7% in Nov24, up from 150.1% in Oct24, as opex increased by 5% mom, largely driven by a 23% mom increase in other expenses.

- Higher NIM: NIM increased to 4.9% (+13bps mom) in Nov24 as EA yield rose by 11bps mom to 7.5% and CoF remained flattish mom.

- Increase in CoC: CoC rose to 5.7% in Nov24 from 4.6% in Oct24.

- Loans and Customer Deposits: Loans remained steady at Rp5.0tr (flat mom) and customer deposits declined to Rp6.2tr (-2% mom), resulting in an LDR of 81.4% (+208bps mom). The CASA ratio improved slightly to 17.9% (+117bps mom).

Summary:

- Overall Performance: In our view, the bank’s performance continues to reflect the cost burdens associated with its early development phase, necessitating significant investment, which in turn has resulted in a high CIR. Additionally, we note that the bank’s loans have stagnated at around Rp5tr over the past 5 months, which is unusual given its early stage of development. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MARKET NEWS

MACROECONOMY

Bank Indonesia Holds BI Rate at 6.00%

- Bank Indonesia has decided to keep the BI Rate unchanged at 6.00%, reiterating its priority of stabilizing the Rupiah amid heightened global uncertainty and stating the timing is not right for a rate cut. To drive economic growth, BI will expand macroprudential incentives to additional sectors.

- BI continues to deepen the forex market, aiming to reduce volatility by lowering market dependence on the spot market for USD liquidity. Additionally, BI is ramping up intervention in the spot and DNDF markets to support IDR stability.

- We anticipate the first rate cut to occur in 2Q25, provided the Fed begins easing in March 2025. We maintain our forecast of a 50bps rate cut in 2025. (BI, BRIDS)

SECTOR

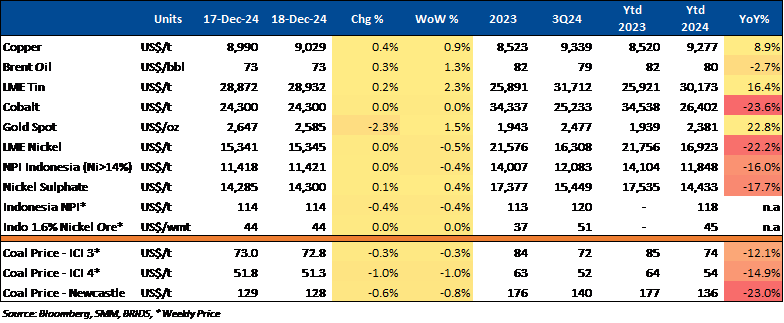

Commodity Price Daily Update Dec 18, 2024

CORPORATE

DRMA Drives EV Infrastructure Growth in Indonesia

DRMA is expanding Indonesia's EV infrastructure through its Dharma Connect ecosystem, which includes battery packs, charging stations, motors, solar solutions, and EV conversion products. The company produces key components like BLDC motors and battery packs while supporting domestic component level (TKDN) regulations and offering workshops to convert fuel-powered motorcycles into electric vehicles. (Bisnis)

Honda and Nissan Consider Merger to Boost EV Competitiveness

Honda and Nissan are in early talks about merging under a single parent company to compete more effectively in the EV market. This follows their agreement to explore a strategic partnership, with plans to formalize the collaboration through a memorandum of understanding. (CNBC)

INCO Seeks US$1.2bn Loan for New Mining Projects

INCO is pursuing a US$1.2bn loan to fund new mining block developments, boosted by an S&P Global Ratings upgrade to BB+ with a stable outlook. INCO is advancing three projects: Morowali, with a US$399mn investment and a 3.84mn tons annual saprolite capacity by 4Q25; Pomalaa, targeting 28.15mn tons saprolite and limonite with US$1bn in capital and operations by 2Q26; and Sorowako, expected to add 11.5mn tons of limonite annually with a US$257mn investment by 3Q26. (Bisnis)

JSMR Secures Rp3.96tr Syndicated Loan

JSMR, through its subsidiary PT Jasamarga Akses Patimban (JAP), has secured a syndicated loan of Rp3.96tr from BBCA and PT Sarana Multi Infrastruktur (SMI). The agreement was signed on December 17, 2024, in Jakarta by JAP's CEO, Victor Nazarenko. He expressed gratitude for the creditors' support, which is vital for completing the Patimban Access Toll Road, a National Strategic Project expected to begin operations in 3Q26. (Investor Daily)

PTBA Partners with UGM to Convert Coal into Humic Acid

PTBA and UGM are developing low-calorie coal into humic acid, a fertilizer additive that enhances soil quality. A prototype launched in Peranap, Riau, will progress to a pilot project, supporting PTBA’s commitment to eco-friendly energy innovation. (Bisnis)