FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Equity Strategy: Weathering the Storm

- We expect JCI to trade in 5.9-6.7k range in 2Q25, as it has largely priced in pessimistic scenarios, yet risks remain due to slowing econ growth.

- Amid lack of growth catalyst, we expect EPS to sequentially drop in 2Q25 and may potentially stay flattish in 3Q25.

- We cut our FY25F EPS growth estimates to 4.5% (from 6.5%) and FY25-end JCI target to 7,350; we still mainly prefer quality names for 2Q25.

To see the full version of this report, please click here

Sarana Menara Nusantara: FY24 inline earnings: Tower Weakness to Persist, but Fiber Remains the Bright Spot (TOWR.IJ Rp 525; BUY TP Rp 870)

- In line 4Q24 earnings; margin dipped on lower EBITDA, but resilient topline and support from other income.

- Tower rev’s drag to extend into FY25 as XLSmart decommissions kick in; TOWR pivots toward fiber connectivity and ISP-driven B2B growth.

- Maintain Buy on robust fiber outlook but lower TP on estimates cut and valuation adjustment.

To see the full version of this report, please click here

Trimegah Bangun Persada: In line FY24 Earnings, Upgrading Our FY25 Estimate (NCKL.IJ Rp 665; BUY TP Rp 1,500)

- NCKL recorded a weaker 4Q24 NP of Rp1.5tr, -24% qoq, due to a weaker FeNi sales volume and contribution from JV as ASP were trending down.

- We slightly revise our FY25-27 earnings estimate by +8.4%/+4.5%/ +4.4% on the back of solid cash cost management, which lifted margins.

- Reiterate our Buy rating with an unchanged TP of Rp1,500. Key risks to our call include lower nickel prices and a lower utilization rate.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

|

BBNI (Buy, TP: Rp5,100) - FY24 Dividend offers 8.8% yield

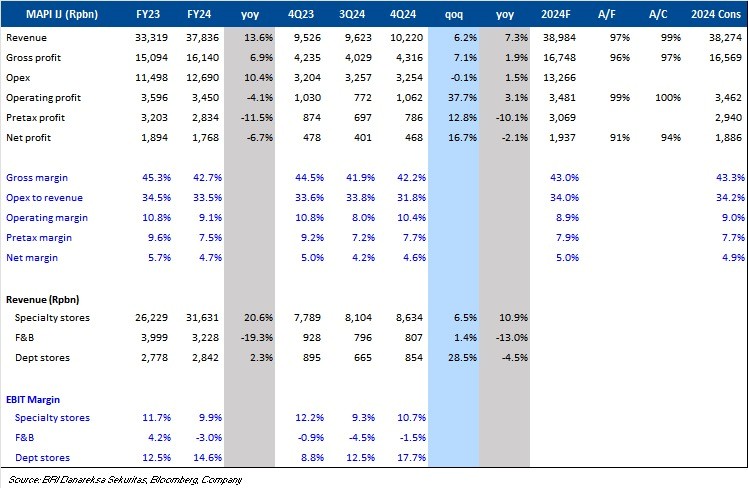

MAPI (Buy, TP: Rp2,000) FY24 Results: Slightly Below Consensus on Lower Margins, Higher Finance Costs, and PPE Impairment Loss

|

|

MAPA (Buy, TP: Rp1,250) FY24 Results: Below Expectations Due to Higher Finance Costs and Forex Loss

|

MARKET NEWS

MACROECONOMY

UK Annual Inflation Fell to 2.8% in Feb25

The annual inflation rate in the UK fell to 2.8% in Feb25 from 3% in January, below market expectations of 2.9%, though in line with the Bank of England's forecast. (Trading Economics)

Trump Signs 25% Auto Import Tariff

Donald Trump signed an order for a 25% tariff on auto imports starting April 2, projected to generate US$100bn in annual revenue, with no plans for exemptions. However, he suggested a possible reduction in tariffs on China to secure a US sale of TikTok. (Bloomberg)

SECTOR

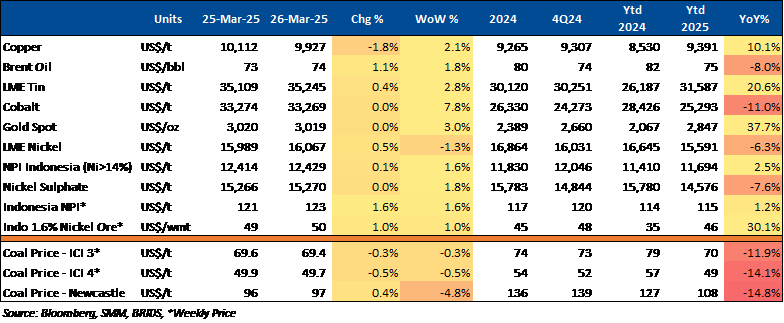

Commodity Price Daily Update Mar 26, 2025

CORPORATE

Grab seeks up to US$2bn loan for potential takeover of GoTo

Grab Holdings is in discussions to secure a US$2bn bridge loan to support its potential acquisition of Indonesian rival GoTo Group, sources revealed. The 12-month loan, still in early negotiation stages, signals progress in what could be one of Southeast Asia’s largest tech mergers, valued at over US$7bn. Grab, backed by Uber, is conducting due diligence while exploring deal structures and additional financing options, including bonds or equity. The transaction comes amid a surge in M&A activity in Asia, with firms like Blackstone and Advent International also raising significant funds for acquisitions. (TheBusinessTimes)

JCC Reported Surge in Traffic on MBZ Elevated Toll Road Ahead of Eid 2025

JCC reported that from H-10 to H-6 of Eid al-Fitr 1446 H/2025, 158,488 vehicles left Jakarta via the Mohamed Bin Zayed (MBZ) Elevated Toll Road, marking a 21.91% increase from the normal daily traffic of 130,004 vehicles. The mgmt reported a significant surge in traffic was observed on H-6, March 25, 2025. (Kontan)

PGEO Estimates 80-90% Dividend Payout for 2024

PGEO estimates the dividend payout ratio for the 2024 fiscal year to be between 80% and 90% of the company's net profit. According to PGEO, the company aims to maintain its dividend per share at least, even if its profits decline. On the other hand, PGEO will also manage its cash flow for capital expenditure (capex) allocations this year. (Bisnis)