FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Central Asia: 1Q25 Results: In line earnings with robust PPOP growth offsetting the higher provisions (BBCA.IJ Rp8,725; BUY TP Rp11,900)

- BBCA booked 1Q25 net profit of Rp14.1tr (+3% qoq, +10% yoy), in line with our and consensus’ FY24 estimate.

- The bank continues to demonstrate a strong deposit franchise, allowing it to grow customer deposits 5% qoq amid the tight liquidity in 1Q25.

- We maintain Buy rating on BBCA with an unchanged TP of Rp11,900. BBCA remains our top pick in the sector.

To see the full version of this report, please click here

ESSA Industries Indonesia: Blue Ammonia as Future Value Driver; Initiate with Buy Rating and TP of Rp750 (ESSA.IJ Rp630; BUY TP Rp750)

- We forecast ammonia prices to be ~8% lower in FY25F vs FY24, and continue to normalize, lowering ESSA's GPM by ~300bps ex-maintenance.

- We project the Blue ammonia project will enhance ESSA earnings to US$42-52mn/yr in FY29F-FY35F (vs. US$30-40mn/yr currently).

- Initiate ESSA with a Buy rating and TP of Rp750. Downside risks are delay of blue ammonia project and lower blue ammonia premium.

To see the full version of this report, please click here

Summarecon Agung: Lowering Our FY25F Pre-Sales by -11%; LT Prospects through End-Users Targeted Product Remain Intact (SMRA.IJ Rp412; BUY TP Rp800)

- Management reiterates its long-term focus on existing projects and recurring assets monetization, also pushes pre-sales from Tangerang.

- Incorporating risks of weaker market demand amid volatility, we trimmed our FY25/26F pre-sales by -11%/-12% to Rp4.05/4.19tr.

- Maintain Buy on SMRA with an unchanged disc.to RNAV-based TP of Rp800; LT prospects lie on its end-users targeted product offerings.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

HMSP (Hold, TP: Rp730) – 1Q25 Sales Volume +0.6% yoy

- In 1Q25, Indonesia reported total cigarette sales volume of 75.9 billion sticks, up 2.6% yoy.

- HMSP’s total sales volume in 1Q25 increased by 0.6% yoy to 20.2 billion sticks, mainly driven by heated tobacco units (HTU), which rose by 15.7% yoy, while conventional cigarette volume grew by 0.4% yoy.

- As a result, HMSP’s market share declined to 26.8% in 1Q25 from 27.4% in 1Q24. However, HTU’s market share increased to 0.4% in 1Q25 from 0.3% in the same period last year.

Comment:

- We believe that sales of cigarette products, especially in the tier-1 category, will remain challenging.

- PMI noted that its sales volume in Indonesia was negatively impacted by an unfavorable cigarette mix, driven by higher demand for below tier-1 cigarettes.

- On a more positive note, sales of HTU continue to grow. Although its contribution is still small, HTU is expected to become a new growth driver for HMSP. (Natalia Sutanto – BRIDS)

MARKET NEWS

MACROECONOMY

Bank Indonesia Held the BI Rate at 5.75%

Bank Indonesia held the BI Rate at 5.75%, focusing on IDR stability amid global uncertainty. BI now sees 2025 loan growth at the lower end of its 11%–13% target, as growth remains below 11% despite ample liquidity and loose lending standards. BI also flagged challenges in raising TPF and expanded intervention to the offshore NDF market after the IDR breached 17,000. Global growth forecasts were cut, and BI now expects a 50 bps Fed rate cut in 2025. Despite unlocking Rp370.6tr via higher KLM incentives, weak credit demand may limit lending. (BI)

US Weighs Tiered Tariff Cuts on China

The U.S. is reported considering a tiered plan to cut tariffs on Chinese imports to 50%–65%, with 35% on non-critical goods and 100% on national security-related items, phased in over five years. Treasury Secretary Scott Bessent stressed the U.S. won’t cut tariffs unilaterally and said a full trade deal could take 2–3 years, tempering earlier market gains. (WSJ, Bloomberg)

SECTOR

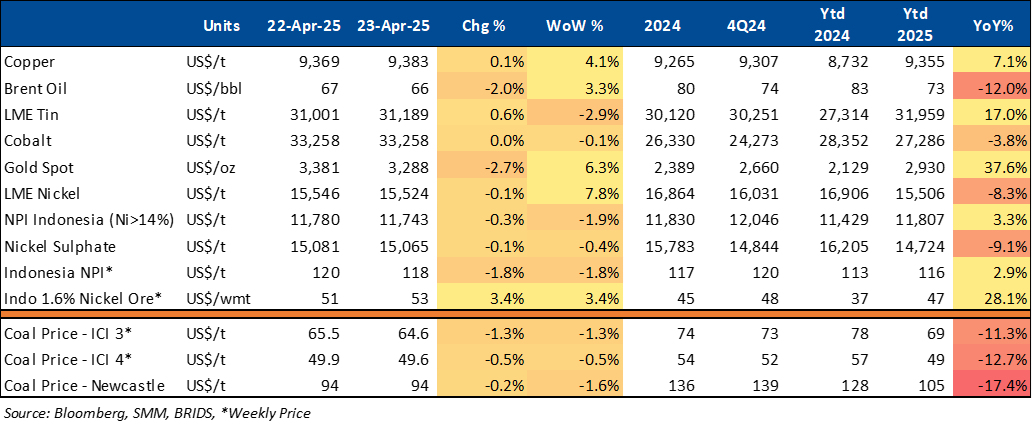

Commodity Price Daily Update Apr 23, 2025

CORPORATE

HEAL Distributes Dividend of Rp10.5 per Share

HEAL has approved a dividend distribution of Rp161bn, equivalent to Rp10.5 per share (yield: 1.0%, payout ratio: 30%). This dividend for the 2024 fiscal year represents a 25.53% increase compared to the previous year. (Bisnis)

Honda Expands EV Lineup and Tech Collaboration in China

Honda launched two new Ye Series EVs—GAC Honda GT and Dongfeng Honda GT—at the Shanghai Auto Show, each featuring distinct designs. The company is partnering with Chinese tech firms like Momenta for AI driver assistance and DeepSeek for in-car AI features via OTA updates. Honda is also working with CATL to develop efficient battery platforms. These efforts support its targets of full EV sales in China by 2035 and carbon neutrality by 2050. (Kontan)

MEDC Revise Buyback Budget to US$25mn

MEDC has revised its share buyback budget from US$50mn (Rp820bn) to US$25mn (Rp408bn). The company plans to repurchase up to 240mn shares, equivalent to 0.95% of its issued and paid-up capital. The buyback proposal will be submitted for approval at the AGM on June 3, 2025, with the execution period set from June 4, 2025, to June 3, 2026. (Investor Daily)

TikTok x Traveloka: Strategic deal brewing?

- ByteDance is in advanced talks to partner with or acquire Traveloka, per DealStreetAsia (Apr 22). What began as hotel and attraction collabs has now evolved into deeper strategic talks—though valuation gaps remain and no formal offer has been made. Traveloka posted a US$7.4mn profit on US$286mn revenue in 2023, with PayLater (TPayLater) growing 88% yoy. The company is IPO-ready and hiring across Asia.

- A deal could supercharge TikTok’s superapp ambitions, integrating Traveloka’s OTA and fintech capabilities into its growing SEA ecosystem—covering travel, food, payments, and experiences adding to Tiktok's fashion, cosmetics and Tokopedia's GMV in SE Asia.

- Traveloka’s PayLater is powered by PT Caturnusa Sejahtera, with support from Bank Jago (credit distribution) and BNI (virtual cards). (Dealstreetasia)

Comment: TikTok still operates in Indonesia via Tokopedia (GOTO holds ~25%), due to 2023 social commerce rules. If TikTok adds Traveloka, it could funnel more lifestyle and fintech use cases through Tokopedia, boosting transaction volumes and expanding GoTo Financial’s reach. In the process, ByteDance could emerge as a true superapp rival to Shopee, Lazada, etc with GOTO playing a key backend enabler role. (Niko Margaronis - BRIDS)

TOWR Distributes Rp800bn in Dividends for FY24

TOWR has approved a total dividend distribution of Rp800bn for the 2024 fiscal year. This includes an interim dividend of Rp300bn or Rp6 per share paid on January 22, 2025, and a final dividend of approximately Rp500bn, translating to Rp9.9 per share (yield: 1.8%), as ratified in its Annual General Meeting of Shareholders (AGMS). (Kontan)

TOWR Secures Shareholders’ Approval for Rights Issue of Up to 15bn Shares

Sarana Menara Nusantara Tbk (TOWR) has received approval from its Extraordinary General Meeting of Shareholders (EGMS) to conduct a rights issue of up to 15bn new shares. While the specific pricing and subscription date have yet to be announced, the company plans to carry out the rights issue in the second quarter of 2025. (Kontan)

UNTR Injects Rp1tr Loan into Subsidiary ACST

UNTR through its subsidiary PT Karya Supra Perkasa, has provided a Rp1tr loan to its construction arm, PT Acset Indonusa Tbk (ACST), to support its working capital needs. According to the company, the loan carries an interest rate of JIBOR +1.03% per annum and will be available from April 21, 2025, until March 21, 2030. (InvestorDaily)