|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Aspirasi Hidup Indonesia: Solid Sept24 SSSG; Expect strong 9M24 core profit of 13% yoy, in line with our FY24F (ACES.IJ Rp 890; BUY TP Rp 1,100)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY SMGR's (Hold, TP: Rp4,100) Sales Vol in Sep-24 · SMGR domestic sales Sep-24/9M24: -0.6% mom/-2.7% yoy · SMGR total sales Sep-24/9M24: -3.8% mom/-4.2% yoy

Comments: · SMGR weak vol in Sep-24 was driven by weak export market, while domestic sales was relatively flattish (vs INTP -2.4% mom) with improving bag ratio to total sales by 50 bps mom, and slight market share recovery of 48.5% (+10 bps mom, yet still below its 9M24 avg of 49.5%) · Nevertheless, in 9M24 basis, SMGR sales vol still underperformed (-4.2% yoy) vs INTP ex-Grobogan (+0.1% yoy). Additionally, SMGR's 9M24 sales vol was still below seasonality vs seasonality (68% achievement vs 73% seasonality) · We have HOLD rating for SMGR and expect SMGR to report below consensus earnings for 9M24E period. (Richard Jerry, CFA – BRIDS)

MARKET NEWS |

|

|||||||||||

MACROECONOMY

China Macro Data for Sep-24 (vs. Aug-24/Consensus)

- House Price: -5.7% yoy (vs. 5.3%)

- GDP 3Q24: 4.6% yoy (vs. 4.7%/4.5%)

- Industrial Production: 5.4% yoy (4.5%/4.6%)

- Retail Sales: 3.2% yoy (2.1%/2.5%)

- Unemployment Rate: 5.1% (5.3%/5.3%)

Source: Bloomberg

Prabowo Unveils Cabinet: Sri Mulyani Retains MoF Role

Prabowo has announced his cabinet members. Sri Mulyani Indrawati stays at the MoF helm, while the vice ministers’ post are still filled by Suahasil Nazara and Thomas Djiwandono, with the addition of Anggito Abimanyu. Prabowo appointed a total of 109 people in minister, vice minister, and other equivalent posts. (Kompas)

Sri Mulyani Anticipates 3Q24 GDP Growth Above 5%

Minister of Finance Sri Mulyani expects Indonesia’s GDP growth in 3Q24 to be more than 5%, supported by household consumption, especially from the middle-upper class. The investment growth will be supported by the National Strategic Project (PSN) and IKN development. (Bisnis)

SECTOR

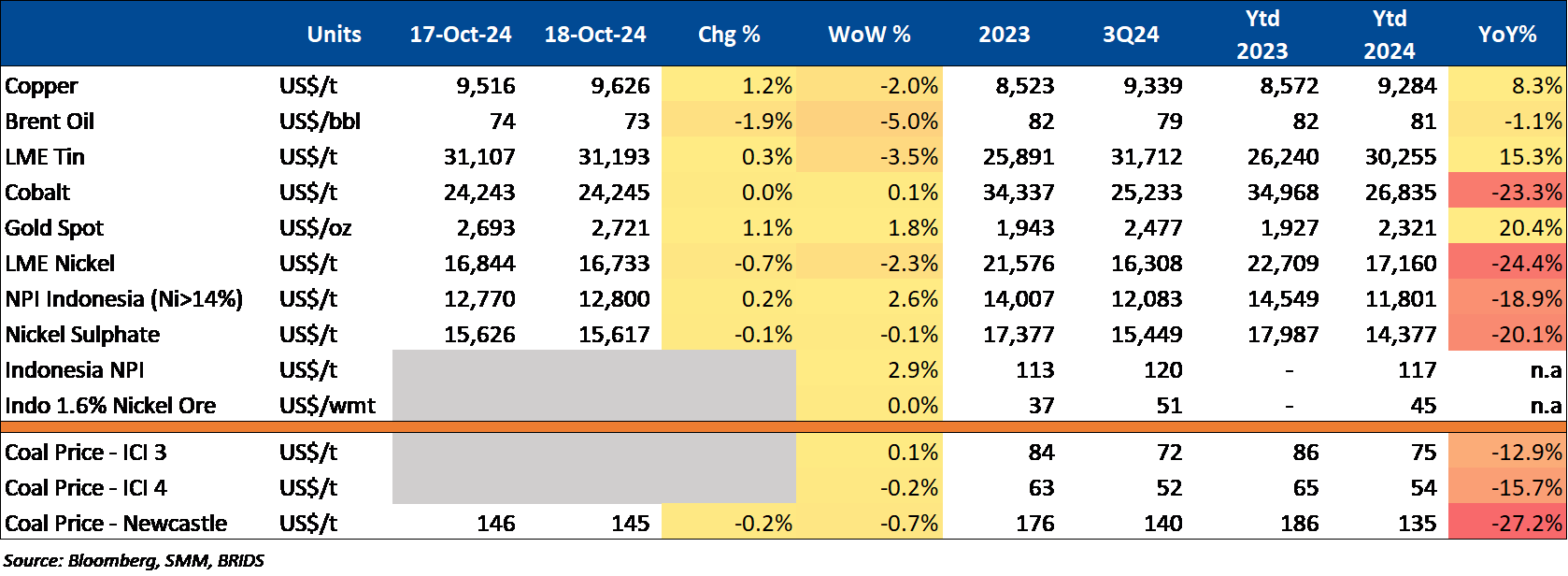

Commodity Price Daily Update Oct 18, 2024

CORPORATE

ADRO Approves Spin-Off of PT Adaro Andalan Indonesia

ADRO held an Extraordinary General Meeting (EGMS) to obtain shareholder approval for the spin-off of its subsidiary, PT Adaro Andalan Indonesia (AAI). The company plans to diversify into non-coal mining, aiming to get 50% of its revenue from non-thermal coal by 2030. The agenda includes selling all shares in PT Adaro Andalan Indonesia, with ADRO committed to supporting Indonesia's goal of reducing greenhouse gas emissions and achieving net-zero by 2060 or earlier. (Bisnis)

MDKA Plans Underground Mining Project at Tembaga Tujuh Bukit, Aiming for 2027 Operations

MDKA is preparing a bankable feasibility study for the underground mining project at Tembaga Tujuh Bukit in Banyuwangi, East Java. The company is optimizing mining and processing to boost long-term revenue and is securing permits, including the Environmental Impact Analysis (AMDAL). Through its subsidiary PT BUMI Suksesindo (BSI), MDKA targets to start underground copper mining in 2027, after open-pit mining ends in 2026. (Bisnis)

PTPP Inaugurates Two Trans Sumatra Toll Projects

PTPP has inaugurated two toll road projects: the Indrapura-Kisaran Section 2 and the Bayung Lencir-Tempino project, both in North Sumatra. The Indrapura-Kisaran road, part of the National Strategic Project (PSN), has a contract value of Rp4.5tr and stretches 47.75km, with a project period from Dec18 to Jan24. The Bayung Lencir-Tempino Section 2, part of the same development package, has a contract value of Rp1.18tr, covering 11.004km, with a construction period from Jun23 to Aug24. (Kontan)