|

FROM EQUITY RESEARCH DESK |

|

||||||||||||||||||||||

|

IDEA OF THE DAY |

|

||||||||||||||||||||||

|

Bank Syariah Indonesia: In-line 1Q24 earnings: strong growth intact, driven by improving asset quality, offsetting lower NIM (BRIS.IJ Rp 2,640; BUY; TP Rp 2,700) · BRIS reported net profit of Rp1.7tr (+17% yoy, +14% qoq; in-line at 26% of FY24F est), supported by positive NII growth and lower provisions. · 1Q24 financing growth of +16% yoy helped the NII growth to remain positive at 3% yoy and qoq, despite a lower NIM caused by higher CoF. · We maintain our FY24F forecasts and valuation and retain our BUY call, noting superior earnings growth vs. its peers as the key catalyst. To see the full version of this report, please click here Bank Mandiri: 1Q24 earnings slight miss on lower NIM and other operating income, offsetting strong loans growth (BMRI.IJ Rp 6,900; BUY; TP Rp 7,400) · BMRI posted muted net profit growth of 1% yoy (22% of our FY24 est) on 36bps lower NIM, lower recoveries and higher G&A exp. · Despite expecting a better NIM, BMRI lowered its FY24 NIM guidance to 5-5.3% (vs. 5.3-5.5% prev.) as it remains cautious on liquidity. · We maintain our Buy rating but with a lower TP of Rp7,400 (from Rp7,600) as we revise down our FY24F NP by 2%. To see the full version of this report, please click here Indosat Ooredoo Hutchison: Inline 1Q24 earnings; well-positioned for more ex-Java monetization and operating leverage upside (ISAT.IJ Rp 11,000; BUY; TP Rp 13,300) · Inline 1Q24 net profit of Rp1.26tr (+339% yoy) on resilient revenue amid seasonality and ongoing ex-Java expansion with a stable EBITDA margin. · IOH is firm on its commitment to scale up ARPU to Rp40k by 2Q24 with Opensignal attesting to its 4G network prowess. · We maintain our BUY rating with an unchanged forecast and TP of Rp13,300 amid the intact growth outlook. To see the full version of this report, please click here To see the full version of this snapshot, please click here

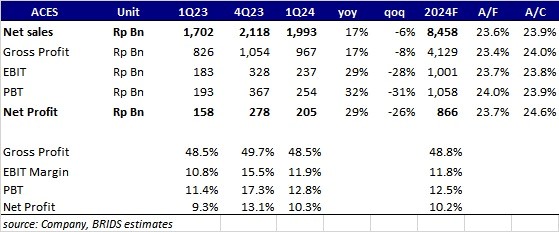

RESEARCH COMMENTARY ACES 1Q24 result: Inline 1Q24 earnings with solid top line

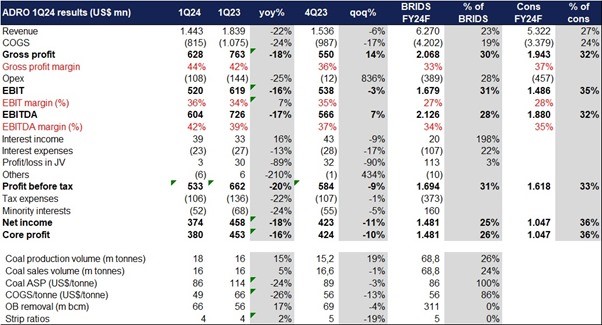

ADRO - inline 1Q24 earnings; strong production and well-managed margin

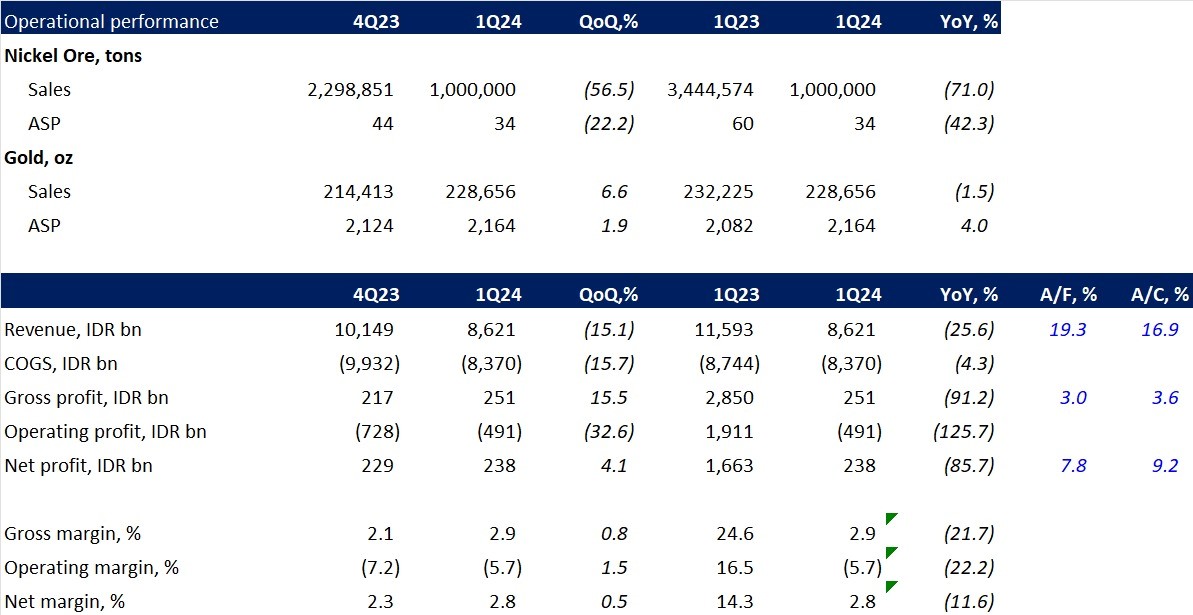

ANTM - 1Q24 Result Highlights; Way below our forecast and the consensus

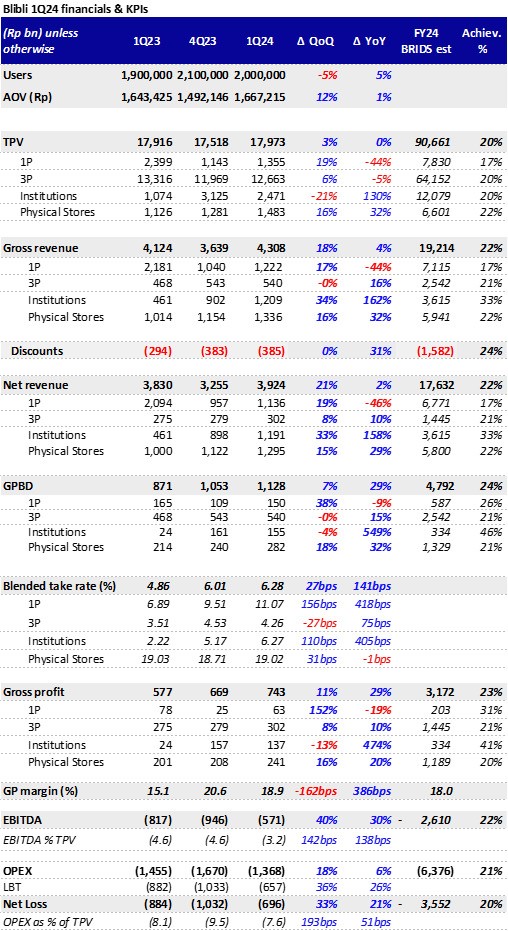

BELI - 1Q24 positive trajectories in the topline, GP and OPEX.

Deep diving into its numbers: • Net revenue came in at Rp3.9tr (+21%qoq, +2%yoy) while GP reached Rp743bn (+11%qoq, +29%yoy). Specifically:

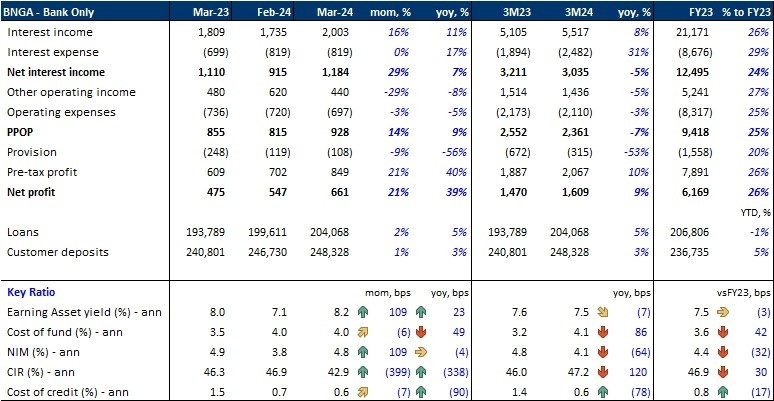

BNGA - Bank Only Mar24 Results

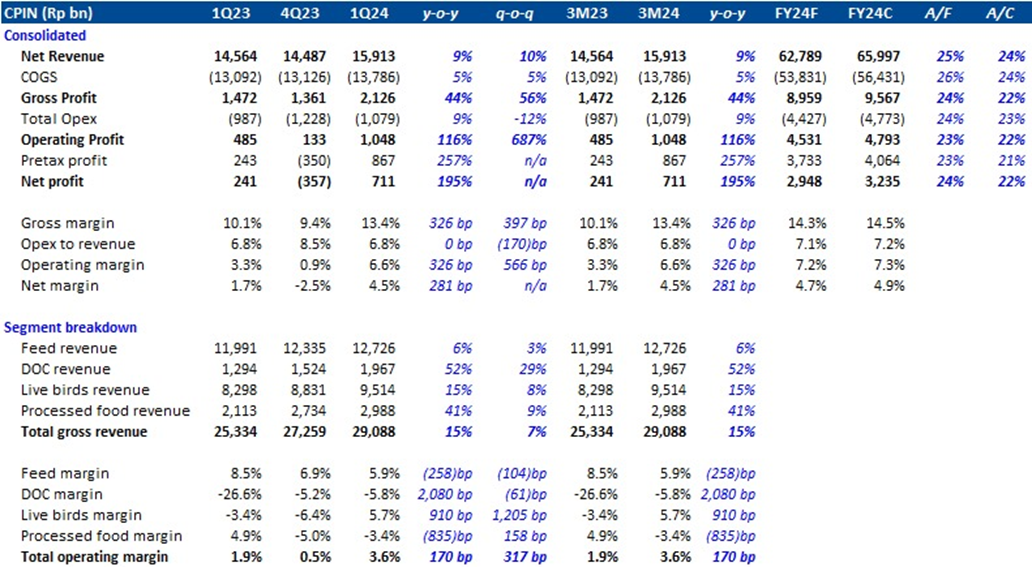

CPIN 1Q24 Results – Inline

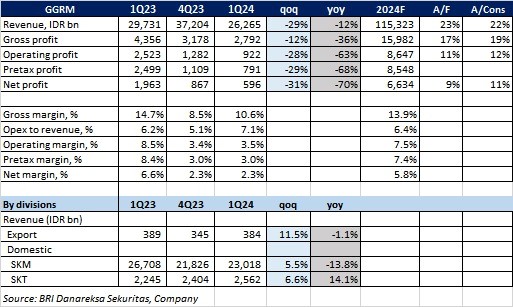

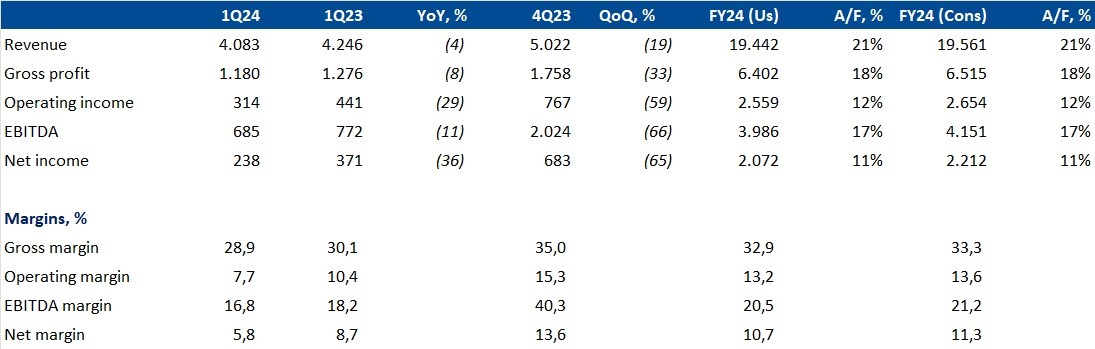

GGRM 1Q24: Below our forecast and consensus estimates

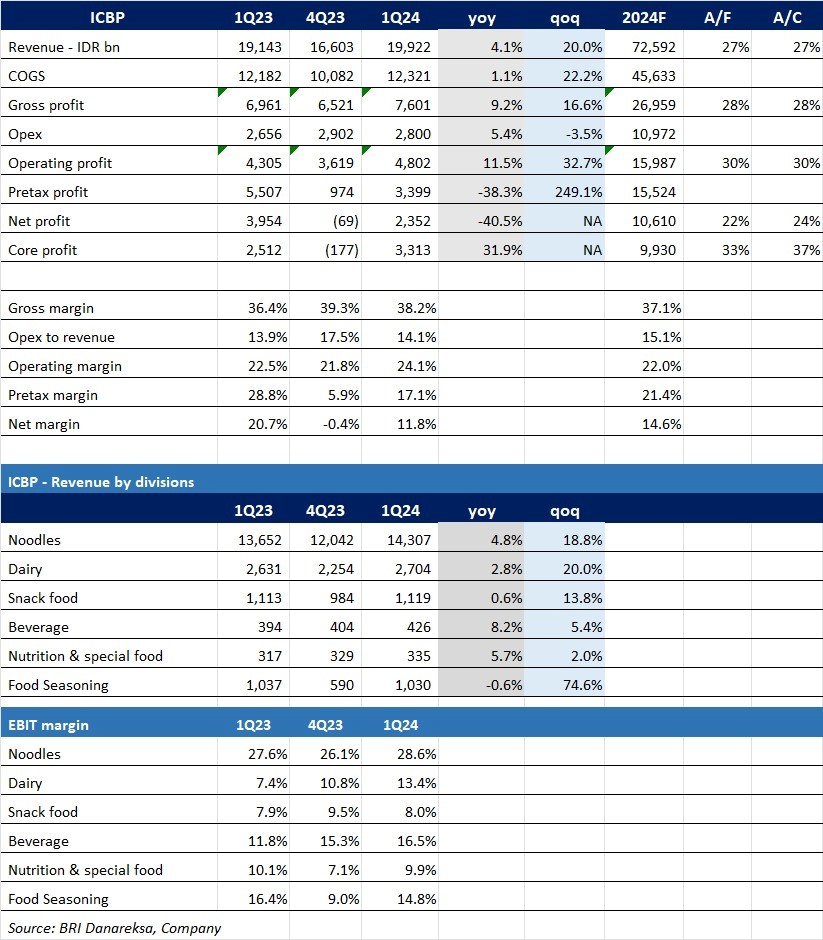

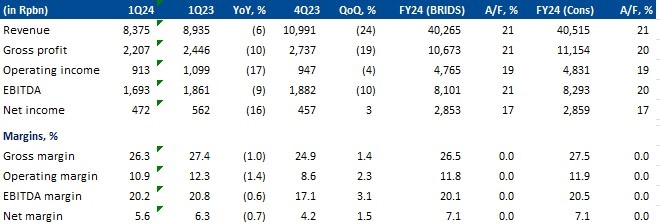

ICBP 1Q24 result: Broadly inline at the operating level, supported by continued high GPM and manageable opex

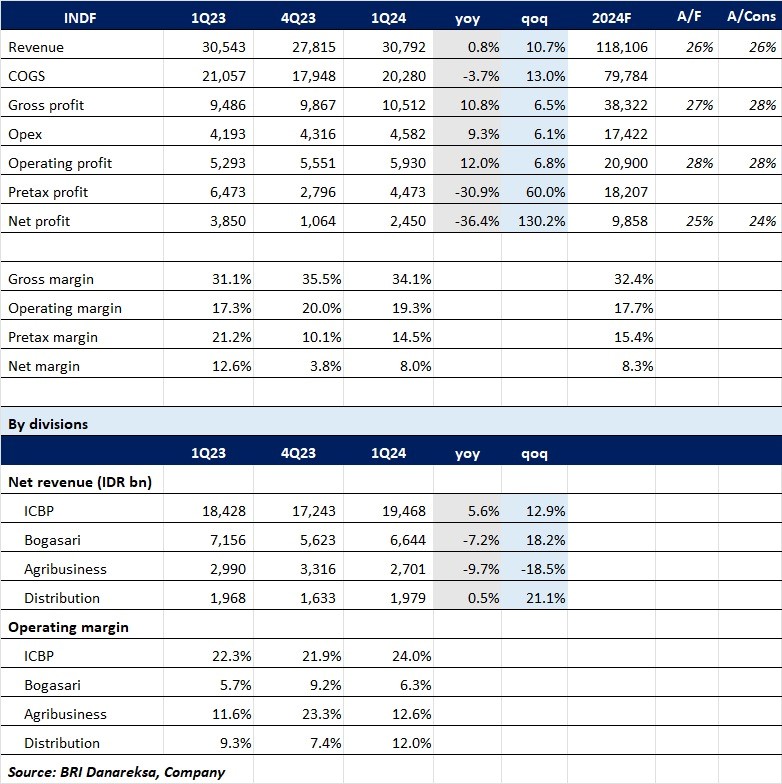

INDF 1Q24 result: Driven by ICBP with high margins, broadly inline

INTP 1Q24 – Missed Estimate due to Higher Opex

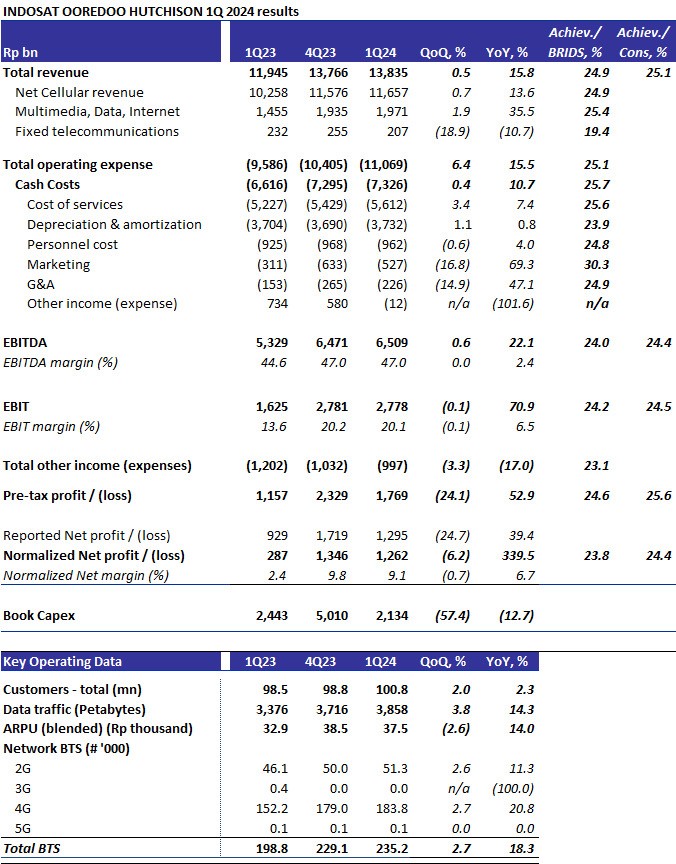

ISAT 1Q24 earnings - Inline IOH delivered core net profit of Rp1.26tr (-6%qoq, +339%yoy) inline, forming 23.8%/24.4% of ours/cons FY est. This reflects:

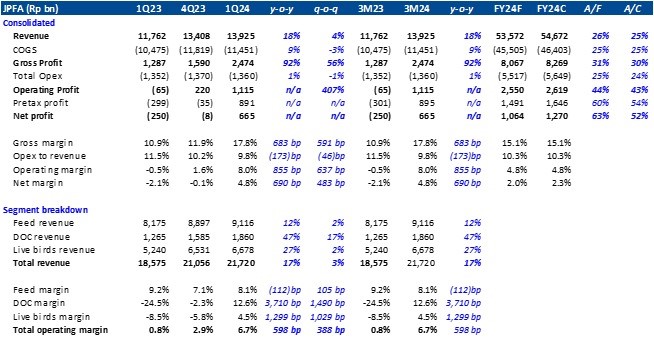

JPFA 1Q24 Results - Above

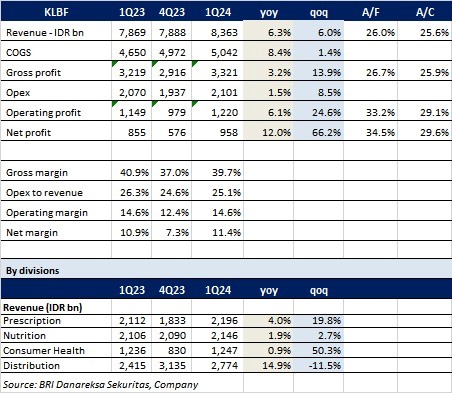

KLBF 1Q24 result: Above our forecast and consensus estimates

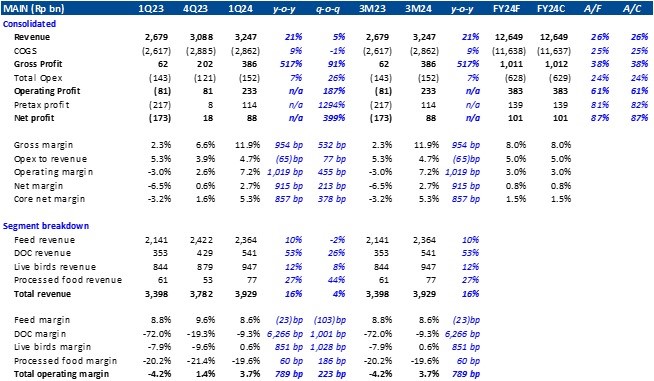

MAIN 1Q24 Results - Above

MEDC - 1Q24 Result Highlights; Inline with ours but below consensus

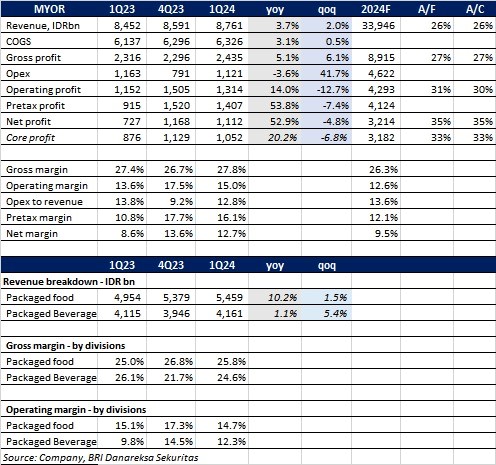

MYOR 1Q24: Above our forecast and consensus estimates, strong gross margins and lower opex

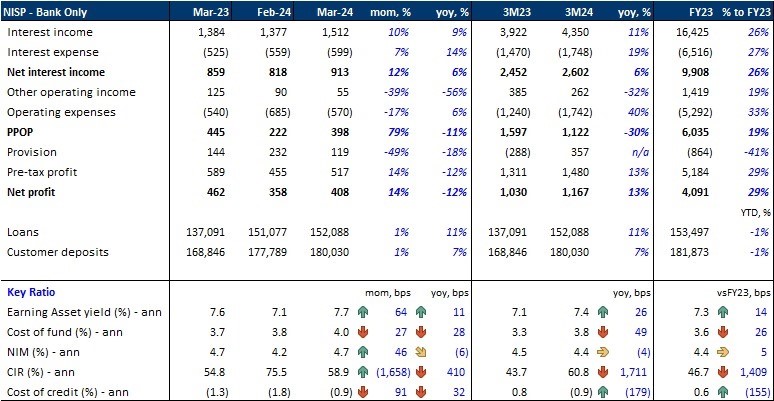

NISP - Bank Only Mar24 Results

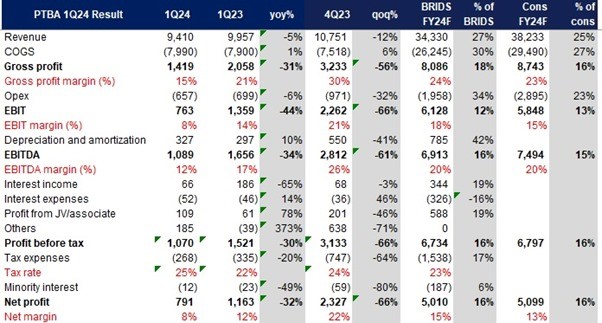

PTBA 1Q24 earnings miss on higher costs

SMGR 1Q24 – Long Holiday Brought Down Cement Sales Volume

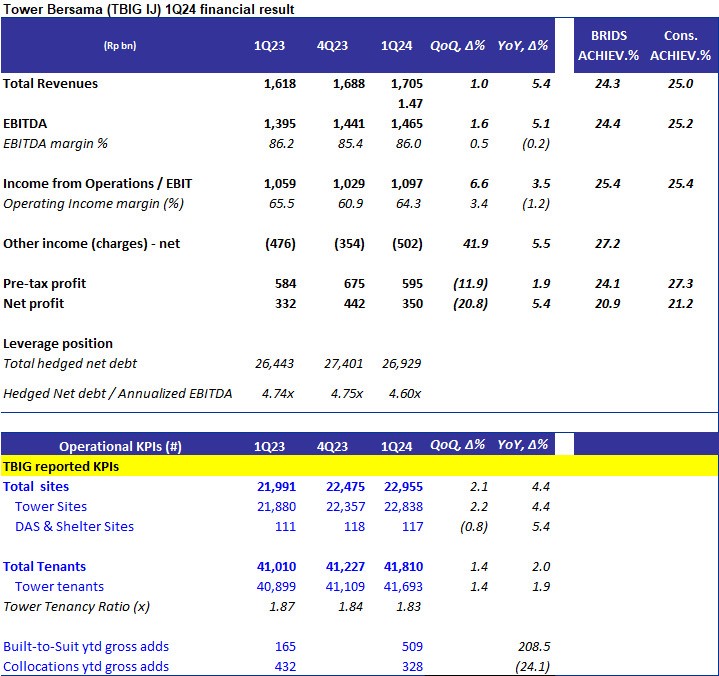

TBIG - Strong 1Q24 results overshadowed by a high 39% effective tax on EBT.

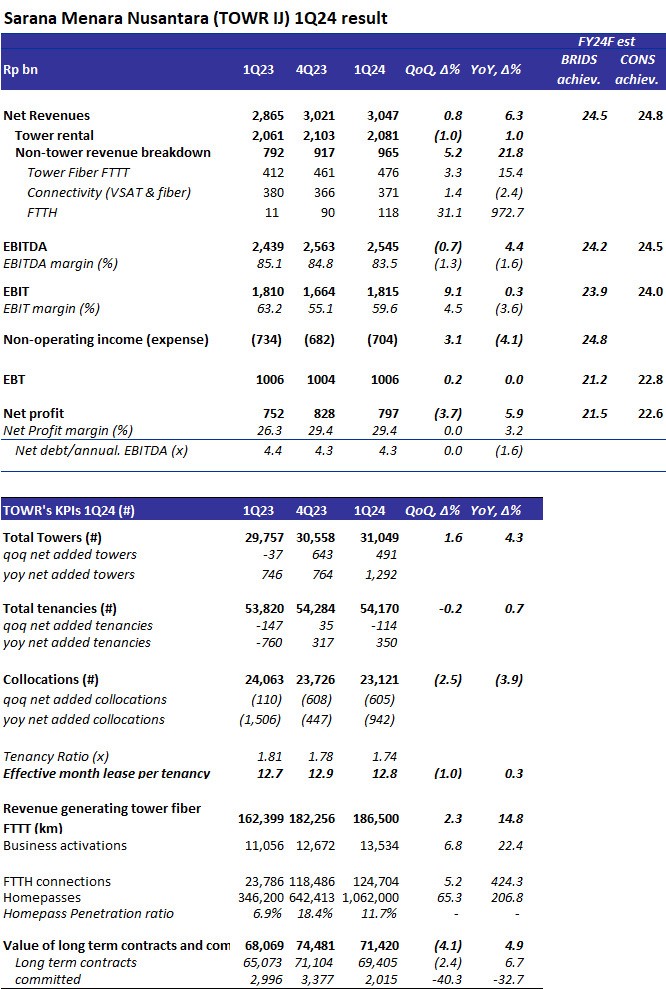

TOWR – Slightly missed, trailing FY24F estimates TOWR delivered NP of Rp797bn (-3.7%qoq, +5.9%yoy) trailing ours/cons FY estimates. This owed to:

MACROECONOMY China’s PMI Rose to 51.4 in Apr24 China's PMI rose to 51.4 in Apr24, a slightly faster expansion rate compared to March's 51.1. Demand improved, resulting in the fastest growth of output since May23. The increasing demand was also reflected by rising backlogs, but managers remain reluctant to increase employment. Input prices rose amid declines in selling prices. (S&P Global).

Eurozone Economy Data Eurozone seemed to escape the recession with the bloc’s GDP up by 0.3% qoq and 0.4% yoy in 1Q24. Both figures are higher than consensus estimates. Inflation for Apr24 also showed progress as headline inflation remained low at 2.4%, matching March's figure, while core inflation slowed to 2.7% (vs. March's 2.9%). Services inflation finally decelerated to 3.7% yoy in Apr24 after being steady at 4% in the previous 5 months. The slower services inflation might support the case for a June rate cut by the ECB. (Bloomberg)

The Fed Left the Rate Unchanged at 5.5% The Fed left the rate unchanged at 5.5% in May’s FOMC. The Fed Chairman Jerome Powel stated that it’s unlikely that the next move would be a rate hike although FOMC members are also getting less confident that inflation could return to 2% any time soon. A less hawkish tone is also implied by the reduction of the balance sheet runoff rate. Beginning in June, The Fed will reduce the pace from US$60bn/month to US$25bn/month. The figure is lower than market expectations of US$30bn and will put less pressure on the UST yield. (CNBC)

CORPORATE ASII to Distribute Dividends of Rp21.01tr ASII agreed to distribute Rp21.01tr or the equivalent of Rp519/share (yield: 10.1%) as dividends from 2023 net profits of Rp33.8tr. For information, an interim dividend of Rp98/share, amounting to Rp3.96tr, was paid on October 31, 2023. Meanwhile, the remaining Rp17.04tr or the equivalent of Rp421/share will be distributed on May 30, 2024. (Kontan)

BBRI Conducted a Share Buyback BBRI has again carried out a share buyback as its share price experienced a significant correction after the publication of the 1Q24 financial report. For information, through the Annual General Meeting of Shareholders (AGMS) on March 13 2023, BBRI obtained shareholder approval to carry out a share buyback of a maximum of Rp1.5tr to be carried out within 18 months after the approval. (Kontan)

BBNI Green Credit Reached Rp67.4tr as of March 2024 BBNI’s green credit distribution has grown at an annual average (CAGR) of 23%, with a value reaching Rp67.4tr at the end of March 2024, compared to the end of December 2020 of Rp29.5tr. Green credit distribution contributed 14.2% to the total wholesale loans, while in December 2020, the portion was only 7.8%. (CNBC) |

|

|

|

||||||||||||||||||||

BRI Danareksa Sekuritas Equity Snapshot - May 02, 2024

Equity Research

02 May 2024