|

FROM EQUITY RESEARCH |

|

||

|

Astra International: Inline FY23 earnings, seasonal weaker auto segment in 4Q23 (ASII.IJ IDR 5.225 HOLD.IJ IDR 5.700) · ASII’s FY23 earnings inline with consensus (below ours), albeit with weaker 4Q23 qoq on auto · We think weaker auto segment’s in 4Q23 revenue may indicate higher discounting, yet we think it was a seasonal trend · ASII proposes dividends of Rp421/share (8% yield), which is historical high, ex-FY22. Maintain Hold rating and TP of Rp 5,700 To see the full version of this report, please click here

To see the full version of this snapshot, please click here

MARKET NEWS |

|

||

MACROECONOMY

US PCE Inflation Rate Slowed to 2.4% in Jan24

The annual PCE inflation rate in the US slowed to 2.4% in January 2024, the lowest since February 2021, from 2.6% in the previous month, and matching market forecasts of 2.4%. The US core PCE price index, the Federal Reserve’s preferred gauge to measure inflation, rose by 2.8% from the previous year in January 2024, the least since March 2021. (Trading Economics)

CORPORATE

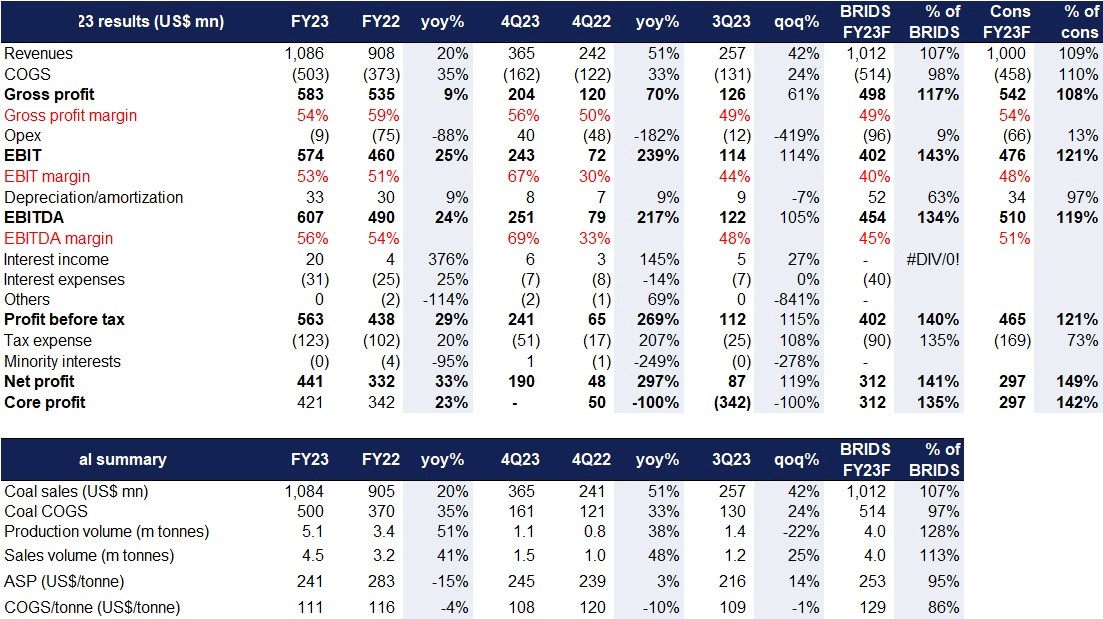

ADMR (Not Rated) 4Q23/ FY23 results: Core profit strong beat from solid 4Q23 operational deliveries

ADMR reported 4Q23 net profit of US$190mn (+119% qoq/ +297% yoy), bringing FY23 net profit to US$441mn (+33% yoy, 49% above cons.).

As previously indicated, 4Q23 net profit included a one-off gain from the reversal of DMO allowance of US$27mn. However, excluding the gain, FY23 core profit still came in at a strong US$421mn (+23% yoy, 42% above consensus est.), reflecting a solid 4Q23 core profit of U$163mn (+225% yoy/ +85% qoq).

The strong 4Q23/ FY23 core profit was supported by:

- Strong coal sales volume of 1.5Mt (+48% yoy/ +25% qoq); FY23: 5.1Mt (+51% yoy, 13% above est.)

- Recovery in 4Q23 ASP to US$245/t (+3% yoy/ +14% qoq); FY23: US$241/t (-15% yoy, 5% below est.).

- Lower cost – 4Q23 COGS/t of US$108/t (-10% yoy/ -1% qoq): FY23: US$111/t (-4% yoy, 14% below est.)

Overall, we see the strong FY23 core earnings as testament to ADMR’s strong operational capabilities to overcome challenging logistics in Barito River, as evidenced by deliveries of above-expected sales volumes. This shall affirm the company’s target to grow its sales volume to 6Mt by FY25 (mgmt’s current FY24 target of 4.9-5.4Mt appear conservative).

BBCA Sets New KPR Bookings Target to Rp44tr

BBCA is targeting a double-digit growth in the KPR segment, with new KPR bookings targeted to reach Rp44tr throughout 2024. The optimism comes from several factors, namely, the high housing backlog as every year the figure reaches 12mn as well as the government's step to issue the government-borne VAT policy (DTP). (Infobank News)

EXCL collaborates with Huawei in Digital AI Business

EXCL and Huawei have signed an MoU to establish strategic cooperation focused on AI-based digital business. This collaboration aims to harness the power of AI technology to accelerate and improve digital business, drive operational excellence, and optimize cloud systems and more effective use of software. This collaboration will also develop opportunities in optimizing cloud systems and using software more effectively. (Suara.com)

HEAL Aims to Increase revenue by 17% in 2024

HEAL targets revenue growth of around 16.8% in 2024. The company plans to inaugurate 5 hospitals this year and currently the number of company hospitals is 47 units. With this addition, HEAL will have 52 hospitals by the end of 2024. On the other hand, the company has also prepared CAPEX for 2024 of Rp2tr and Rp650bn for IKN hospitals. (Bisnis)

ISAT prepares Capex of Rp12tr to work on AI with Nvidia and Huawei

ISAT is preparing a capex of up to Rp12.7tr in 2024. This capex is used to expand reach, increase capacity, and make the network more resilient. ISAT will expand its network to villages outside Java, especially in Eastern Indonesia, such as Maluku and Papua. In addition, ISAT and Huawei signed an MoU for digital development based on AI, industrial applications, ecosystem development, and talent competency development. (Bisnis)

ISAT Collaborate with Tech Mahindra on the ‘Garuda’ Project

ISAT and Tech Mahindra signed an MoU at Mobile World Congress (MWC) 2024 to build 'Garuda', a Large Language Model (LLM) to preserve Bahasa Indonesia, the official and national language of Indonesia and its dialects. Aruda will be built on the principles of Tech Mahindra's indigenous LLM 'Project Indus', a foundational model designed to converse in a multitude of Indic languages and dialects. Garuda will be developed with 16bn original Bahasa tokens, providing 1.2bn parameters to shape the model's understanding of the Bahasa language. (SmartStateIndia)

ITMG Targets Coal Production of 20.2Mt and Budgets Capex of Rp1.5tr in 2024

ITMG targets coal production of up to 20.2Mt in 2024 (16.9Mt Last year). The increase in production is driven by the Graha Panca Karsa (GPK) and Tepian Indah Sukses (TIS) mines, which will start operating in the 2Q24 and will contribute 1.4Mt of production to ITMG's total production. ITMG also targets sales of 24.9 - 25.6Mt, with details of 39% of the coal price having been determined by ITMG, 6% following the coal index price, and the other 55% having not been sold.

In other news, ITMG has also prepared a CAPEX of US$96.5mn for 2024, with an allocation of 68% to coal mines, 11% to TRUST, 9% to greenfields projects, 10% to renewable energy projects, and 2% to other projects. All CAPEX funds come from ITMG cash. (Bisnis)

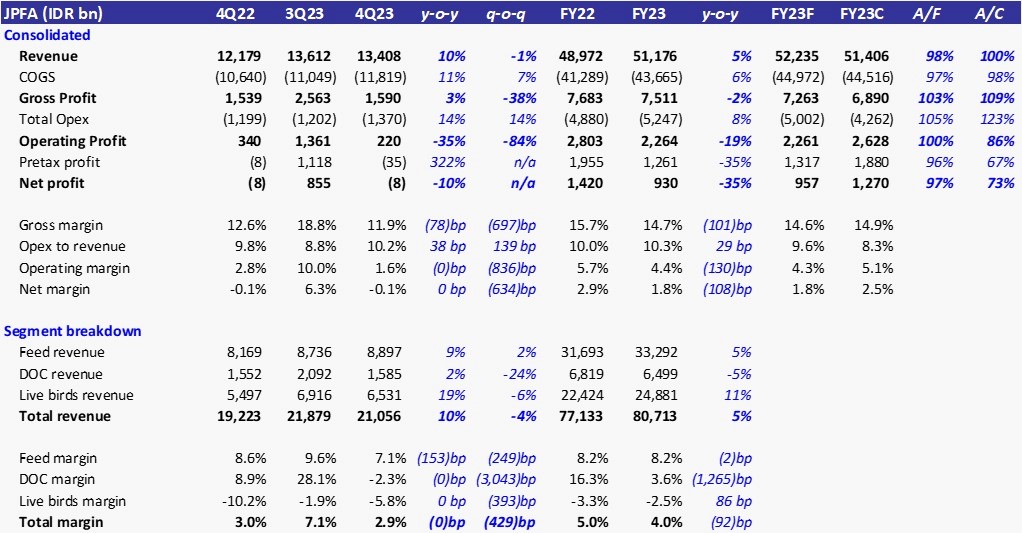

JPFA IJ: 4Q23 Results – inline

- JPFA reported net losses of Rp8bn in 4Q23, flat compared to 4Q22 (similar NPM) and huge turnaround from huge profits of Rp855bn in 3Q23.

- JPFA net profits stood at Rp930bn in FY23 (-35% yoy) which is in-line (97%) with ours but below (73%) of consensus` FY23 estimates. Despite the 5% growth in net revenues, JPFA profitability was eroded by higher COGS(+6%), opex(+8%), and interest expenses(+32%).

- The soft 4Q23 results were due to the huge operating losses in livebird segment at Rp379bn and DOC segment at Rp37bn. Both segments reported operating margin at -5.8% and -2.3% respectively, due to lower ASP caused by weak purchasing power and lack of culling.

- Feed margin declined to 7.1% in 4Q23 (3Q23/4Q22: 9.6/8.6%) as average local corn and SBM prices increased during the quarter.

- Gross revenue in 4Q23 declined by 4% qoq which we believe due to the lower ASP but FY23 revenues still grew by 5% yoy. (Victor Stefano – BRIDS)

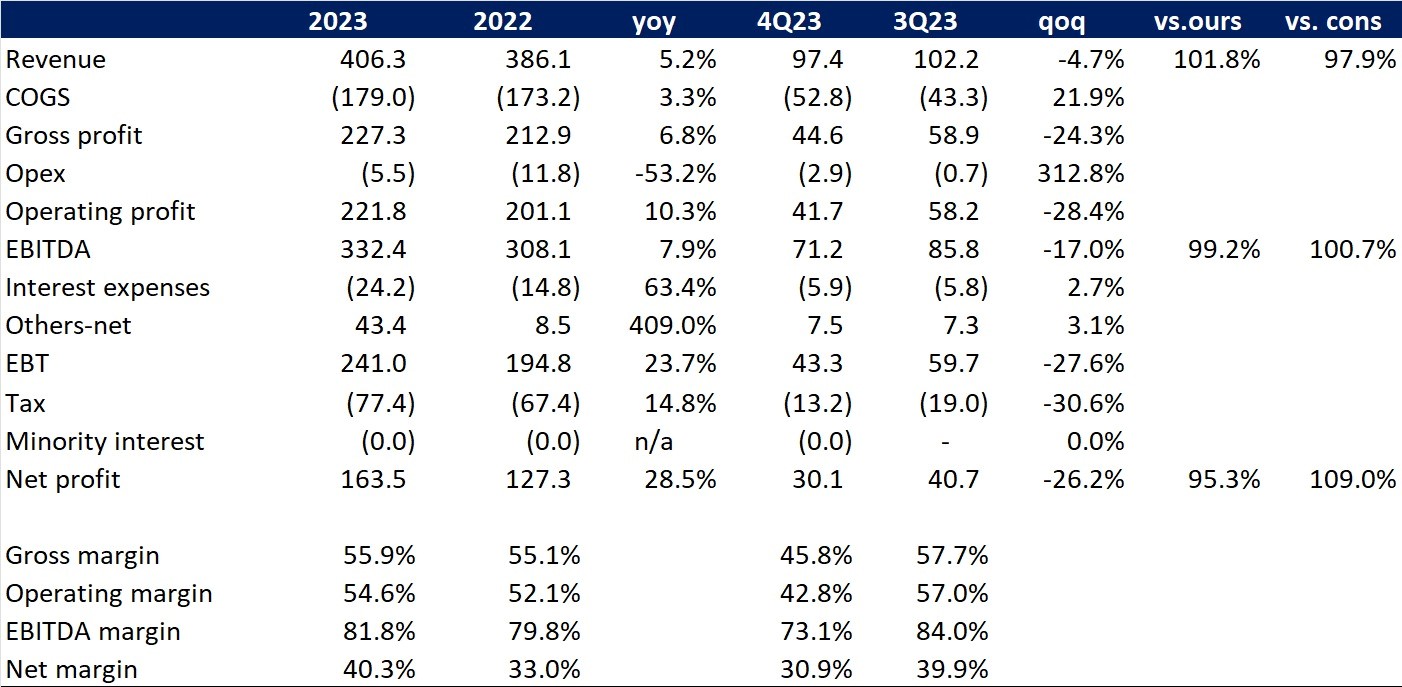

PGEO IJ: Relatively inline with ours but above consensus

- PGEO recorded solid performance in FY23 with earnings recorded at US$163 mn, up 28.5% yoy, which was came in relatively inline with ours (95.3%) but above consensus (109%).

- Revenue was also recorded improved by 5.2% yoy to US$406 mn in FY23 due to improving production performance during this period.

- Margins was slightly expanded across the board in FY23 with gross, EBITDA and net margin hovers at 55.9% (vs. FY22: 55.1%), 81.8% (vs. FY22: 79.8%) and 40.3% (vs. FY22: 33%).

- On quarterly basis, PGEO recorded negative growth for both revenue (-4.7% qoq) and net profit (-26.2%) due to some maintenance in their generation units. (Hasan Barakwan, BRIDS)