FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

|

Equity Strategy: FY25 Outlook: Attractive valuation emerges as headwind and soft growth outlook are priced in · Despite external headwinds on Rupiah and liquidity, we believe JCI valuation has currently priced in a soft growth outlook for FY25. · Amid resilient economic growth outlook, we forecast FY25 EPS growth of 6.5%, which also transpires into improving market ROE to 19.6%. · We foresee JCI target of 7,850 based on 13x PE; our preferred picks are defensive sectors (i.e, Consumers, Telco) and Rupiah hedge (UNTR). To see the full version of this report, please click here

Telco: OpenSignal 2H24 results: narrowing gaps but overall better network capacities (OVERWEIGHT) · TSEL remains the download speed leader at 26.3 Mbps, narrowing the gap with peers while intensively utilizing its network for FMC synergies. · Hutch3 leads in upload speed at 11 Mbps and leads in gaming, video and voice experiences due to its stronger focus on latency experience. · Maintain Overweight as price hikes, justified by improved networks, shall allow for better monetization on the seasonal 4Q24, 1Q25 demand To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE

To see the full version of this report, please click here

MARKET NEWS |

|

|||||||||||

MACROECONOMY

Bank of England’s Monetary Policy Committee voted 6-3 to hold interest rates at 4.75%

The Bank of England's Monetary Policy Committee voted 6-3 to hold interest rates at 4.75%, but signaled it will keep easing gradually in 2025 as a growing minority of officials set aside evidence of lingering inflation to back an immediate cut in borrowing costs. (Bloomberg)

SECTOR

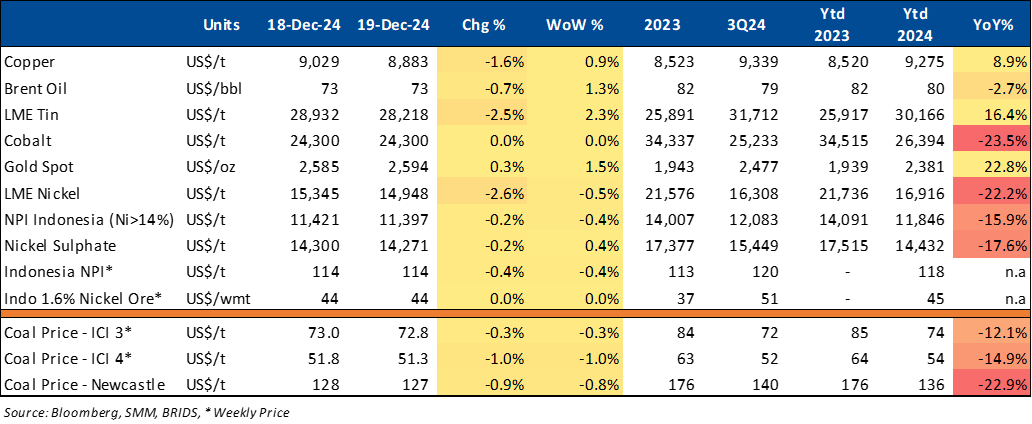

Commodity Price Daily Update Dec 19, 2024

Indonesian Government will Increase CPO Export Levy to 10%

Government will increase CPO export levy to 10% from 7.5% in an effort to implement the B40 Diesel program in January 1st, 2025. (Kontan)

Indonesian Government Plans to Impose Excise Tax on Sweetened Beverages Starting Next Year

The government is reviving the plan to impose excise tax on packaged sweetened beverages (MBDK) and intends for this policy to take effect starting next year. According to the Director of Revenue and Strategic Planning at the Directorate General of Customs and Excise, Ministry of Finance, the government is currently in the process of socializing the MBDK excise tax to companies and associations. He stated that the plan to implement the MBDK excise tax seems likely to be realized, especially as Indonesia's economic condition next year will require increased revenue. (Kontan)

CORPORATE

Honda Launches New e:HEV Technology for Next-Generation Hybrid Vehicles

Honda Motor Co., Ltd has introduced the latest technology for the Honda e:HEV hybrid system, which will be applied to the next generation of hybrid vehicles. This update includes the development of engines, drive units, and the latest control technologies for 1.5-liter and 2.0-liter engines, aimed at improving environmental efficiency while providing an even more enjoyable and high-quality driving experience. (Kontan)

MDIY Targets Management of 1,000 Store Network by 2025

MDIY aims to manage a network of 1,000 stores by 2025 after securing IPO funds amounting to Rp4.15tr. As of 1H24, the company has operated 824 MT DIY stores, all of which are directly managed rather than through a franchise system. According to MDIY, part of the IPO funds will be used for expanding stores to several potential regions. (Bisnis)