|

PT Pertamina Geothermal Energy: Rapid Expansion (PGEO.IJ IDR 1,000 BUY.TP IDR 1,170) PGEO targets to increase the installed capacity that is managed directly to 1 gigawatt (GW), where from 672 MW of installed capacity, PGE will add 340 MW in the next two years. Also, the company believes they could achieve their production in 2023 although they conduct some maintenance this year. Reiterate our Buy call to PGEO with TP of IDR1,170 implied 2023 EV/EBITDA of just 11.3x or 13.2% discount compared to its peers. To see the full version of this report, please click here

To see the full version of this snapshot, please click here

MARKET NEWS |

|

||

MACROECONOMY

Indonesia Trade Balance Reach USD1.31 bn in July 2023

Trade Balance in Jul'23 reach USD1.31 bn, fell from Jun's USD3.45 bn. Import grew significantly in monthly basis, showing improvement in raw & capital goods. Exports in Jul'23 amounted to USD20.88 bn, contracted by 18.03% y-y but slightly grew on a monthly basis at 1.36% m-m. Import in Jul'23 is amounted to USD19.57 bn (-8.32% y-y | +14.10% m-m). (Bank Indonesia)

Comment: Trade surplus reached 39-month streak in July 2023. Despite lower trade balance (the second lowest in 2023), the significant monthly growth in import in encouraging. Increased demand for raw and capital goods shows manufacturing sector is facing or expecting higher sales, in line with rising PMI. The growth of import on consumption (26.87% y-y/31.89% m-m) also supported recent positive retail sales growth in July 2023. Going forward, we expect the surplus trend to continue but keep narrowing. (Economic Research – BRIDS)

Indonesia’s External Debt was Recorded at USD396.3 bn in 2Q23

Indonesia's external debt was recorded at USD396.3 bn at 2Q23, a decrease from USD403.2 bn 1Q23, a contraction of 1.4% YoY, continuing the previous quarter's contraction of 1.9% YoY. The government's external debt was recorded at USD192.5 bn, a drop from USD194.0 bn in the previous quarter, or a 2.8% YoY increase. Private external debt was recorded at USD194.4 bn, down from USD199.7 bn in 1Q2023, with a 5.6% YoY growth contraction (vs 1Q2023: -3.0% YoY). (Kontan)

SECTOR

OTT Content Cencorship

The government is discussing the extent of the regulations for content censorship on Over-The-Top Platforms such as Netflix and HBO GO. The government intends to categorize movie streaming services withing the broadcasting domain in a similar fashion to conventional television broadcasts. Furthermore, the government acknowledges that relying on ITE Law is no longer sufficient for regulating movie streaming services. One of the challenges for this matter involves the determination of whether the film censorship board holds the authority for censorship. (Dinsights)

CORPORATE

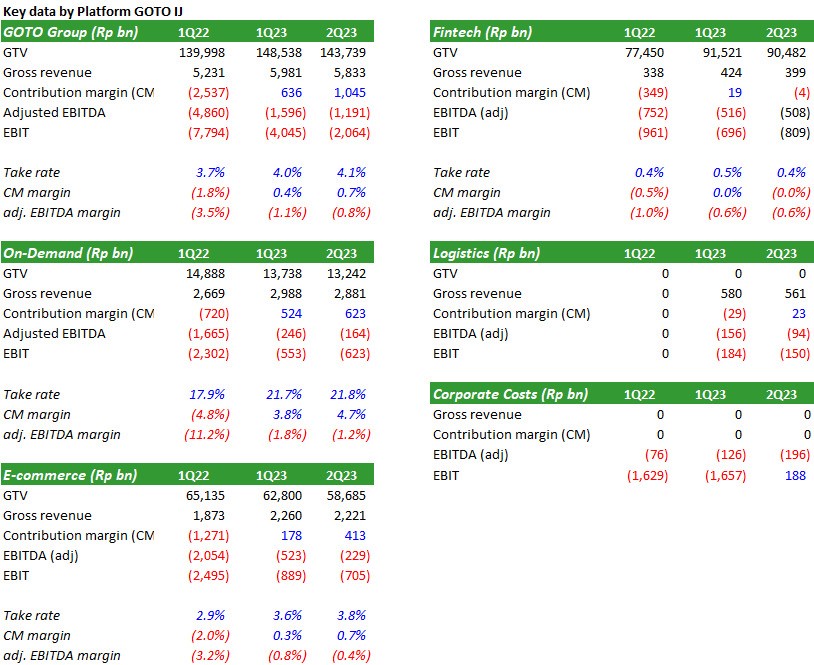

GOTO: 2Q23 Satisfactory result - inline

- 2Q23 Take rate is higher at 4.1% higher than we expected.

- 2Q23 discounts were further improved, lower by 13.8%qoq.

- Despite lower 2Q23 GTV across platforms, net revenue Rp3.55tn improved (+6.6%qoq), inline.

- 2Q23 massive improvement in Contribution margin standing at Rp1.0tn. Consequently 2Q23 adj. EBITDA loss improved by +24.3%qoq. at minus Rp1.2tn. Management is committed to delivering positive EBITDA, but this is not the endgame as per new CEO.

- GOTO updated its guidelines for adjusted EBITDA for 2023 to between minus IDR4.5 tn. and minus IDR3.8 tn. (Niko BRIDS)

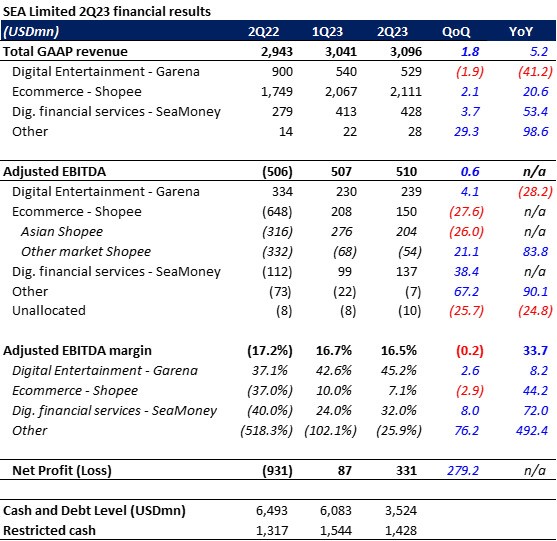

SEA US: 2Q23 optically soft quarter

- 2Q23 SEA group marginal revenue growth, all platforms except for Garena.

- 2Q23 SEA group flattish positive adj. EBITDA USD510 mn. Asian Shopee is down to USD204 mn (-26%qoq). Adj. EBITDA margin slightly lower -20bps qoq.

- 2Q23 net profit improved with the help of other non-operating items mostly.

- The key SEA Ltd management message: Re-accelerate investments in growth. Increase in shipping subsidies. (Niko BRIDS)