Investment Education

- Basic

- Intermediate

- Advance

Trading Mechanism

Equities Trading Mechanism

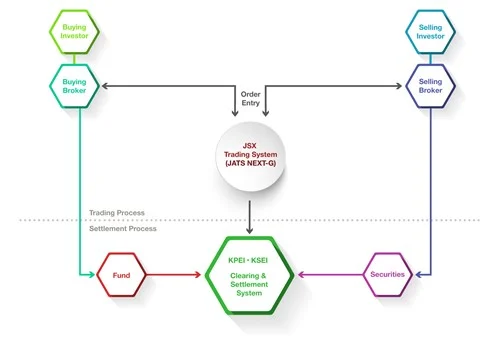

All transactions in the Exchange are processed in a facility called as JATS Next-G. Only the Exchange Members, who also become the members of the Indonesian Clearing and Guarantee Corporation (KPEI), can input the orders into the JATS. The Exchange Members are responsible for every transaction they make in the Exchange.

Trading Process In The Exchange

TRANSACTION

Market Segmentation and Settlement

|

Market Segmentation |

Transaction Settlement |

|

Regular Market |

The second Exchange day after the trade is executed (T+2) |

|

Cash Market |

The same day as the trade (T+0) |

|

Negotiated Market |

Based on the agreement between the Seller and the Buyer |

Pre-Emptive Rights are traded only on the first session of the Cash and Negotiated Market.

Click here for more nformation about trading hour.

Pre-Opening Session

Stock trading at the Regular Market starts with a Pre-opening session. This session allows Exchange Members to input their purchase and sell orders according to the provisions of the stock unit, step value and Auto Rejection limit. The Pre-opening price is formed from the accumulation of the total highest bids and asks matched by the JATS Next-G during the Pre-opening session. All bids and asks that have not been matched during the pre-opening session will be processed in the first session of the trading day, except if the price of the bids and asks has excel the Auto Rejection limit.

Pre-Closing and Post-Trading

At Pre-Closing Session, The Exchange Members input the buying and selling orders. JATS Next-G processes the Pre-Opening price forming and allocates every done transaction. At Post-Trading Session, The Exchange Members input the buying and selling orders and JATS processes the Pre-Closing price forming and allocates every done transaction. JATS Next-G processes the allocates transaction with closing price.

Regular Market and Cash Market

Bids and Asks will be processed by JATS Next-G by considering:

- Price Priority: Higher bids have more priority than lower bids. On the contrary, lower asks have more priority than higher asks.

- Time Priority: If the bids and asks are on the same price, JATS will give priority to the first submitted bids and asks.

Reduction on the number of purchase or sell order processed into the JATS will not cause time priority lose.

Negotiated Market

In Negotiated Market, prices of each security are bargained out between:

- Exchange Members

- Investor and one Exchange Member

- Investor and Exchange Members

The results of the negotiation will be processed through the JATS NEXT-G. The Exchange Members can submit their bids and asks through the ad board, and they can change or cancel them before they are matched with other bids and asks in the JATS NEXT-G. Once they are matched, a transaction is made and will be carried out.

Trading Unit

Stock Trading at Regular and Cash Market must be traded according to stock unit, that is round lot, which 1 lot = 100 shares. Detail information regarding the Price Fraction can be found in the IDX Regulation number II-A Kep-00023/BEI/04-2016.

|

Price Fraction Scale |

Price Fraction |

Maximum Price Movement* |

|

<200,- |

Rp1,- |

Rp10,- |

|

Rp200,- < Rp500,- |

Rp2,- |

Rp20,- |

|

Rp500,- < Rp2.000,- |

Rp5,- |

Rp50,- |

|

Rp2.000,- < Rp5.000,- |

Rp10,- |

Rp100,- |

|

>= Rp5.000,- |

Rp25,- |

Rp250,- |

Stock step value and its maximum price step are valid for one entire trading day and will be adjusted on the next day if its closing price falls on a different price range. The maximum price step should not exceed the percentage of Auto Rejection limit.

Auto Rejection

The buying and selling price orders entered into the JATS NEXT-G have to be in a certain price range. If a Broker inputs a price order above or below the stock's price range, the JATS NEXT-G will automatically reject the price order.

As mentioned in IDX Decree of Director Number Kep-00023/BEI/03-2020, JATS Next-G will automatically do the Auto Rejection to the price orders input into the JATS Next-G at the Regular and Cash Markets if:

|

No |

Reference Price |

Auto Rejection's |

Auto Rejection's |

Volume Order limit |

|

1 |

Rp50,- to Rp200,- |

>35% |

<Rp50,- atau <7% |

> 50.000 lot or 5% of stock's listed shares |

|

2 |

>Rp200,- to Rp5.000,- |

>25% |

<7% |

|

|

3 |

> Rp5.000,- |

>20% |

<7% |

Stock trading as a result of initial public offering is determined to be same with the Auto Rejection percentage as mentioned above.

For Warrant, bids and asks price of warrant will be processed through JATS Next-G with same price or more than the closing price of the underlying stock.

Reference Prices used to limit the highest and lowest offering price toward stocks entered into JATS Next-G at the Regular and Cash Markets are determined by the closing price of the previous closing date (Previous Price) on the Regular Market.

In a case that a Listed Company doing corporate actions, in 2 (two) consecutive Exchange Days after the end of equity trading that has right (cum periode) in Regular Market, the Reference Price used is the Previous Price of each market (Regular or Cash).

Transaction Settlement

Transaction settlements between the sellers and buyers in the Regular and Cash Markets are guaranteed by the KPEI.

- Transactions in Regular Market have to be settled on the third Exchange day after the trade (T+2).

- Transactions in Cash Market have to be settled on the same day as the trade (T+0).

- Settlement process in the Regular and Cash Market is carried out by the KPEI through the Netting process and book-entry on the Exchange Members' accounts in the Indonesian Central Securities Depository (KSEI).

If an Exchange Member fails to fulfill its obligations to deliver the securities as determined, it has to pay an Alternate Cash Settlement (ACS) amounted to 125% (one hundred twenty five percent) of that securities' highest price in:

- The Regular and Cash Market, which deadline of settlement falls on the same date; and

- The first session of the Regular Market at the settlement date.

Negotiated Market

The settlement date in the Negotiation Market is decided based on the agreement between the seller and buyer, and is settled Trade by Trade (without Netting). If the date has not yet been decided, the transaction settlement has to be settled on the third Exchange day after the trade (T+2) at the latest, or on the same day as the transaction (T+0), if the trade took place on the last day of pre-emptive rights trading.

The transaction settlements in Negotiated market sre settled by direct transfer accounts between the buyers and sellers and are not guaranteed by the KPEI.

Transaction Fees

For every transaction, the Exchange Members have to pay fees to the IDX, KPEI and KSEI based on the value of each transaction:

|

|

Regular Market |

Cash Market |

Negotiated Market |

| IDX Transaction Fee |

0.018% |

0.018% |

0.018% |

|

KPEI Clearing Fee |

0.009% |

0.009% |

0.009% |

|

KSEI Settlement Fee |

0.003% |

0.003% |

0.003% |

|

KPEI Guarantee Fee |

0.010% |

0.010% |

- |

|

VAT 11% |

0.0033% |

0.0033% |

0.0033% |

|

Final Withholding Tax 0.1% |

0.100% |

0.100% |

0.100% |

|

Total |

0.1433% (Sell) 0.0433% (Buy) |

0.1433% (Sell) 0.0433% (Bu) |

0.1333% (Sell) 0.0333% (Buy) |

*Paid to the Exchange as compulsory contribution, in accordance to the prevailing provisions.

Transaction Fee above is exclude Exchange Members transaction fee.

Bond and Sukuk Trading Mechanism

Fixed Income Trading System (FITS) is Bonds and Sukuk trading facilities provided by Indonesia Stock Exchange (IDX). Bonds and Sukuk that can be transacted through FITS are Bonds and Sukuk listed on Indonesia Stock Exchange.

Bonds and Sukuk trading mechanism through FITS system is integrated between trading system for clearing and settlement, as in the above chart there are three different mechanisms, such as trading, clearing and settlement.

Bonsd and Sukuk trading activities through FITS system is supported by IDX trading regulations with the approval of Bapepam-LK, one of the clause is regulated about unit of trading (Lot Size), where unit of trading (Lot Size) is 1 Lot equal with value of Five Million Rupiah (1 Lot = 5 Million Rupiah) it’s based in framework of equity investors so that investors can own Bonds or Sukuk issued either by National Private Company or Government.

FITS system is using remote access method from Exchange Members offices, so Exchange Members can give service order (Buy or Sell) to its clients effectively and efficient.

Market Segment

FITS trading system allows member to do Bond transaction in the two trading boards of Indonesia Stock Exchange:- Regular Outright Market is the trading mechanism in which anonymous

continuous auction forms the market price, and the trading method is based on price and time priority. - Negotiated Market is the facility that allows Exchange Member to report the results of its negotiation with other Exchange Member or other party.

| Market Segment | Transaction Settlement |

| Regular Outrigt | 2nd Trading Day after Transaction (T+2) |

| Negotiated | Based on agreement between Selling Exchange Members and Buying Exchange Members |

For Bonds and Sukuk transaction, the Exchange Members have to pay fees to the IDX, KPEI and KSEI based on :

| Market Segment | Nominal Value |

Guarantee Fund | Negotiated Market |

| Transaction Fee, Clearing and Settlement |

≤Rp500.000.000 |

Rp20.000 | Rp35.000 |

|

>Rp500.000.000 – Rp10.000.000.000 |

0,0050% | 0,0075% | |

| >Rp10.000.000.000 | 0,00375% | 0,0050% | |

| VAT 11%* | 11% of the Fee | 11% of the Fee |

*Paid to the Exchange as compulsory contribution, in accordance to the prevailing provisions.

Derivatives Trading Mechanism

Derivatives transactions in the Exchange are processed in a facility called as JATS Next-G. Only the Derivatives Exchange Members can input the orders into the JATS Next-G. The Exchange Members are responsible for every transaction they make in the Exchange.

Trading Process

There is two Derivatives which can be traded in IDX, that is LQ45 Index Futures and Indonesia Government Bond Futures (IGBF). The Exchange Members are responsible for every derivatives transaction they make in the Exchange. Derivatives Transaction in the Exchange are processed in a facility called as JATS Next-G. The trading method is Continous Auction form and the trading method is based on price and time priority. The Exchange Members can submit their bids and asks through the ad board, and they can change or cancel them before they are matched with other bids and asks in the JATS NEXT-G. Once they are matched, a transaction is made and will be carried out.

| Derivatives | Underlying | Contract Period |

| LQ45 Futures | LQ-45 index | 1 month, 2 months, 3 months |

| Indonesia Government Bond Futures (IGBF) | - 5-Year Benchmark Indonesia Government Bond Futures - 10-Year Benchmark Indonesia Government Bond Futures |

3 months in the March quarterly cycle (March, June, September and/or December) |

| IDX30 Futures | IDX30 Index | 1 Month, 2 Months dan 3 Months |

| Basket Bond Futures (BBF) | - Government Bond with maturities of 4 to less than 7 years - Government Bond with maturities of 7 to less than 11 years |

March, June, September, or December |

Liquidity Provider

In Derivatives Trading Mechanism, IDX introduced the new mechanism called Liquidity Provider. Derivatives Exchange Members who also act as Liquidity Provider can submit the quotation (bids and asks) continuously to make Derivatives transaction liquid.

Derivatives Trading

| Derivatives | Multiplier | Tick Size | Initial Margin |

| LQ45 Futures | Rp500.000 | 0.05 Point Index | 4% * index point * Number of Contract * Multiplier |

| Indonesia Government Bond Futures (IGBF) | Rp10.000.000 | 0.01% (1 bp) | - 1% * Contract Size * Number of Contract * Futures Price (5 Year) - 2% * Contract Size * Number of Contract * Futures Price (10 Year) |

| IDX30 Futures | Rp100.000 | 0.1 Point Index | 4% * Index point * Number of contract * Multiplier |

| Basket Bond Futures (BBF) | Rp10.000.000 | 0.01% (1 bp) | - 1% * IGBF Price * Number of Contract * Multiplier (5 Year) - 2% * IGBF Price * Number of Contract * Multiplier (10 Year) |

Auto Rejection

JATS Next-G will automatically do the Auto Rejection to the derivatives' price orders input into the JATS Next-G if:

| Derivatives | Tick Size | Auto Rejection |

| LQ45 Futures | 0,05 (1bp) | 10% |

| Indonesia Government Bond Futures (IGBF) | 0.01 (1 bp) | 300bp from reff price |

| IDX30 Futures | 0,1 Point Index | 10% |

| Basket Bond Futures (BBF) | 1 bp (0,01%) | 600 bp |

Transaction Settlement

Settlement of Derivative Products is carried out by the KPEI through the Netting process and held with this provision:

| Derivatives | Transaction Settlement |

| LQ45 Futures | 1st Trading Day After Transaction (T+1) |

| Indonesia Government Bond Futures (IGBF) | |

| IDX30 Futures | |

| Basket Bond Futures (BBF) |

Click here for more information about Trading hours.

Derivatives Transation Fees

For derivatives transaction, the Exchange Members have to pay fees based on:

| LQ-45 Futures | IDX30 Futures | KB SUN & KBSSUN |

|

| Transaction Fee (exclude Clearing and Settlement) | Rp5.000,-/transaction | Rp3.000,-/transaction | Rp10.000,-/contract |

| VAT 11%* | 11% from fees | 11% from fees | 11% from fees |

*Paid to the Exchange as compulsory contribution, in accordance to the prevailing provisions.

TRADING HOURS

Regarding Decree of the Board of Directors of Indonesia Stock Exchange Number: Kep-00031/BEI/03-2020 concerning “Changes to Trading Hours on Stock Exchange, and Number: Kep-00061/BEI/07-2021 concerning “Regulation Number II-A concerning The Trading of Equity Securities”, Indonesia Stock Exchange (IDX) stipulates changes in Exchange trading hours to be as follows:

Securities trading in the Regular, Cash and Negotiated Market are carried out during the trading hours on every Exchange Day based on the JATS timer.

Trading Hours in the Regular Market

| Day | 1st Session | 2nd Session |

|---|---|---|

| Monday – Friday | 09:00:00-11:30:00 | 13:30:00-14:49:59 |

Trading Hours of the Cash Market

| Day | Time |

|---|---|

| Monday – Friday | 09:00:00-11:30:00 |

Trading Hours of Negotiated Market

| Day | 1st Session | 2nd Session |

|---|---|---|

| Monday – Friday | 09:00:00-11:30:00 | 13:30:00-15:30:00 |

There is Pre-Opening, Pre-Closing and Post-Trading session in the Regular Market with the following schedule:

-

Pre-Opening Session:

Time Agenda 08:45:00 - 08:59:00 The Exchange Members input the buying and selling orders. 08:59:01 - 08:59:59 JATS processes the pre-opening price forming and allocates every done transaction. -

Pre-Closing

Time Agenda 14:50:00 - 14:58:00 The Exchange Members input the buying and selling orders without the bid-ask information displayed. 14:58:01 - 15:00:00 Random closing time 15:00:01 - 15:00:59 JATS processes the pre-closing price and allocates every done transaction based on price and time priority.

-

Post-Trading Session

Time Agenda 15:01:00 - 15:15:00 The Exchange Members input the buying and selling orders besed on the pre-closing price, and JATS will match this buying and selling orders based on price and time priority.

Trading Hours of Derivatives - Futures

Monday to Friday

- Session I starts from 08:45 to 11:30, JATS time

- Session II starts from 13:30 to 15:15, JATS time

Trading Hours of Derivatives - Option

Monday to Friday

- Session I starts from 09:30 to 11:30, JOTS time

- Session II starts from 13:30 to 15:00, JOTS time

Debt and Sukuk Securities Trading Hour on Fixed Income Trading System (FITS)

Monday to Friday

- Session I starts from 09:00 to 11:30, FITS time

- Session II starts from 13:30 to 15:00, FITS time

Debt and Sukuk Securities Trading Hour on Alternative Market Trading System (SPPA)

Monday to Friday

Starts from 09:00 to 15:00, SPPA Time

Securities Transaction Reporting Hour on Trade Repository Reporting System (PLTE)

Monday to Friday

Starts from 09:30 to 15:30, PLTE time

Source: Website Bursa Efek Indonesia, https://www.idx.co.id/en/products/trading-hours-and-mechanism/